Investment Team Voices Home Page

Investment Team Voices Home Page

Upcoming Maturity “Wall” May Signal Higher Convertible Bond Issuance

Convertible Bonds – Potentially Attractive Alternative for Issuers of Corporate Debt

Over the last 16 months the central bank has raised the fed funds rate by more than 5% - the swiftest and most severe set of hikes in recent history. The not-so-distant memory of a 0% fed funds rate was ripped off like a band-aid in an effort to curb 40-year high post-COVID inflation. The ramifications of which are still playing out today, causing much of the economy to sit in a holding pattern, waiting to see if the anticipated recession comes, or if a soft landing is achieved. Until then, rising rates have increased borrowing costs for everyone. This is especially true for companies looking to raise capital or refinance debt. It’s against this backdrop that we have seen a renewed appetite for convertible bonds, both from issuers, who use convertibles to obtain a lower cost of financing, as well as from financial advisors, as they set up clients to participate in the increased coupons offered bonds, without completely sitting on the sidelines of the equity market. This is summarized in an often-quoted convertible adage that may resonate with investors now more than ever, which is, “Paid to wait. Poised to Rally.”

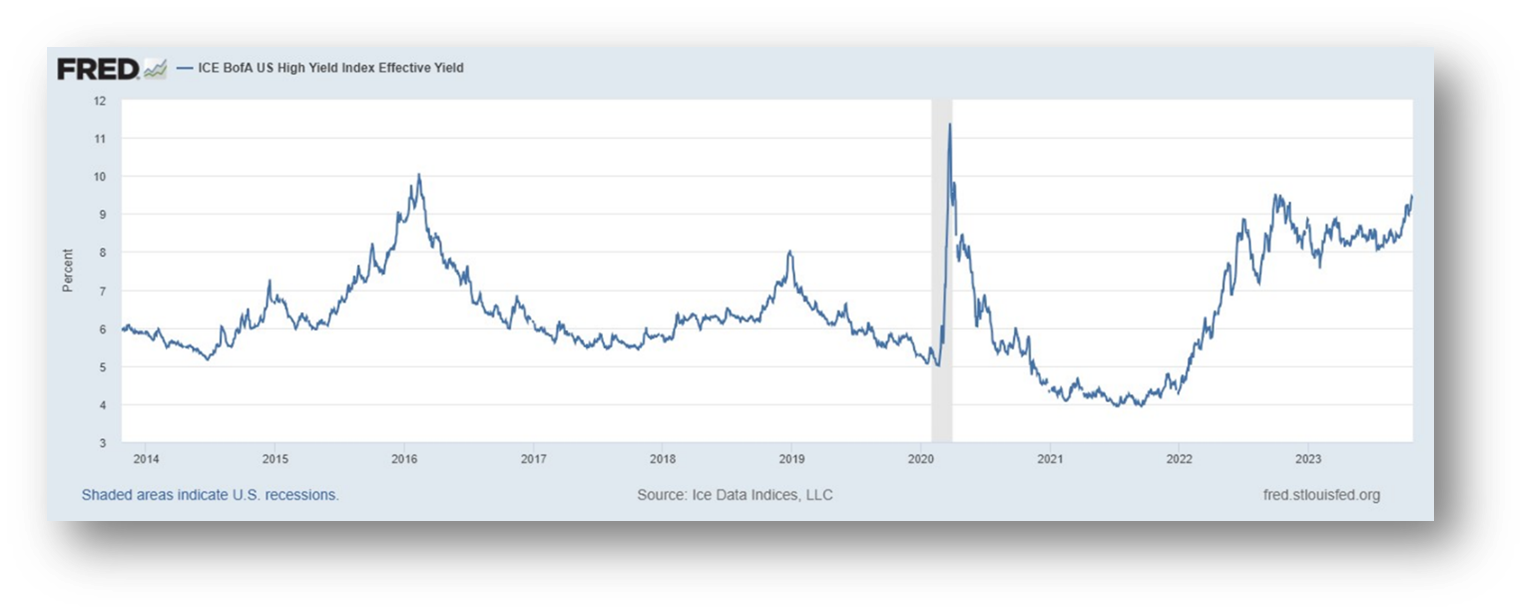

Pending Maturity Wall

For companies using the corporate debt markets to raise capital, the recent rate hikes have meant severe increases in the cost of obtaining capital. For example, in Q1 2022 a BB rated issuer could issue corporate bonds and pay around 3.5% - 4.0% in interest. Today (4Q23) that rate has climbed to nearly 8%. This severe move has caused much of the investment grade and high yield corporate debt markets to hit the pause button in 2022, as many assumed rates would retreat, and they would once again be able to obtain a favorable cost of financing… or at least lower than current rates.

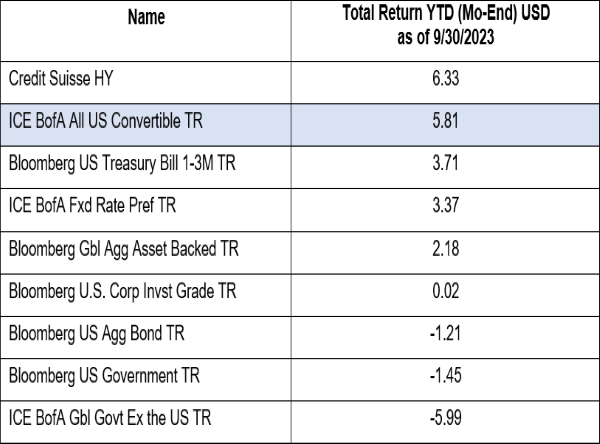

As of 9/30/2023. Past performance is no guarantee of future results. Indexes are unmanaged, do not reflect the deduction of fees and expenses, and are not available for direct investment.

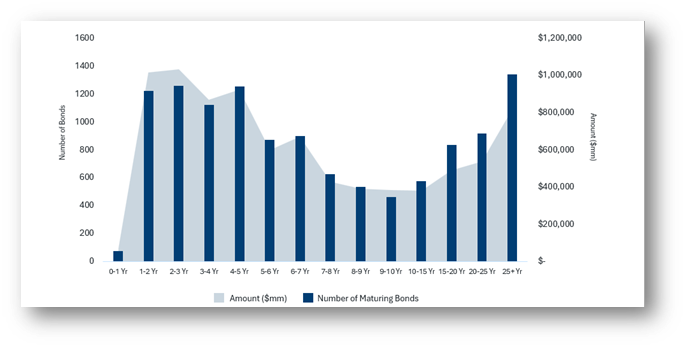

Today, the waiting game may not be working, as corporations are faced with a “higher for longer” rate environment. We can see the impact of this holding pattern in the data. As illustrated below, a massive “maturity wall” has built up in the corporate debt market. Over the next 4-5 years, nearly $4t in corporate bonds will be coming due—a large majority of which will need to be financed at much higher rates, or corporations will be forced to look for alternative means of raising capital.

Source: ICE BofA US Corporate Index and ICE BofA High Yield Index, as of 10/19/23. ICE BofA US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued and settled in the US domestic market. ICE BofA High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued and settled in the US domestic market It is not possible to invest directly in an index. Past performance is not indicative of future results.

This has set the stage for the convertible debt market to be a popular alternative means of financing for corporations, as issuers look to take advantage of the lower cost of capital (e.g., 3-4%) as well as new accounting treatment that improves transparency and overall cost of issuance. As the nation’s largest manager of convertible bonds, we have seen early evidence of this.

In the past, issuance has come from small and mid-cap companies that were largely unrated and didn’t have access to straight debt capital. In 2023, 65% of issuers have had a credit rating… so what this may be signaling is that companies are in fact choosing to use the convertibles markets to raise capital.

Just how soon will this “Great Refinancing” begin? It’s difficult to predict… but with trillions maturing soon and most potential issuers in quiet periods during the first month of every quarter because of pending earnings releases, the next leg up in convertible issuance looks to likely be a 2024-2025 story.

What are Convertible Bonds?

Convertible bonds are essentially corporate bonds with an option to be converted into stock in the future.

Over the past 15 years the convertible bond market has often been viewed as a “niche” asset class, or one best used by institutions for relative arbitrage purposes, as many investment grade and high yield corporations were able to obtain extremely favorable financing from the straight corporate bond markets. In fact, over this same timeframe, the corporate bond market nearly doubled in size, while the convertibles market remained largely unscaled (save a window of opportunity during COVID).

The benefits for issuers of this “bond + option” combo is generally improved financing costs (via a lower rate and improved accounting treatment), in exchange for the future liability of issuing additional shares of stock to convertible bond holders. For investors, this equates to equity upside participation, with a built-in bond floor, and income along the way. As such, many financial advisors and investors look to the convertible markets as a defensive and income-enhanced alternative to owning the equity markets outright.

Performance of Convertible Bonds

Due to the embedded potential equity participation, convertibles tend to hold up well during inflationary and volatile markets. Year-to-date, convertibles have been a top performing fixed income asset class.

New Rate Regime Equates to New Tools for Market Participants

As the pending maturity wall in investment grade and high yield bonds draws near, corporations may choose to look for alternative means of funding. We’re encouraging clients to keep an eye on both interest rates as well as convertible bond issuance. If rates do in fact remain higher-for-longer, our view is we will likely see a resurgence in the use of convertible bonds by both issuers and investors, spurring a deeper pool of convertibles, and potential investment opportunities along the way.

About the Author - Matt Kaufman | Calamos Investments

SVP, Head of ETFs

Matt Kaufman serves as SVP, Head of ETFs at Calamos Investments, where he leads the firm’s ETF business.

Matt joined Calamos Investments in 2023 as an accomplished financial services executive with more than 20 years of experience serving the asset management and insurance industries across North America, Europe, and Asia. Matt has designed, led, and helped build hundreds of exchange-traded funds (ETFs), unit investment trusts (UITs), indexes, variable insurance trust funds, registered index-linked annuities, fixed annuities, and closed-end funds. He is also a sought-after source by leading financial publications and is a frequent speaker at industry conferences and events.

Prior to Calamos, Matt spent more than a decade at Milliman, Inc., where he served as President of the firm’s broker/dealer (Milliman Investment Management Services LLC) and as a principal of the firm’s $170b RIA (Milliman Financial Risk Management LLC). Matt also draws from his prior experience at PowerShares ETFs, where he helped the firm grow during the formative years of the ETF ecosystem.

Matt earned a B.A. in Public Administration and Economics from Cedarville University and maintains Certified ETF Advisor (CETF®) and Professional Certified Marketer® designations through The ETF Institute and American Marketing Association, respectively. He also holds FINRA Series 7, 63, and 24 and CFTC Series 3 licenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Convertible Securities Risk–The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline.

822249 1123

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.