Investment Team Voices Home Page

Investment Team Voices Home Page

There’s Opportunity in Every Market—Even the Most Uncertain Ones

John P. Calamos, Sr.

These are confusing times for investors. There are a lot of big questions and not much clarity: How much further will the Fed raise rates? Will the stock market sustain its rally or fall back into bear market territory? Will the US enter a recession soon, or has it already?

The past few weeks have brought welcome signs that things could be getting better: Gas prices have fallen, inflation seems to have peaked, and in this most recent cycle of earnings announcements, companies have posted strong results that surprised on the upside. On the other hand, there’s been less upbeat news: CEO confidence measures and housing data are pointing in a disheartening direction, and some well-publicized reports of layoffs. The stock markets are choppy, ending many days with sharp declines.

I have both good news and bad news for investors. Let’s get the bad news out of the way first—the uncertainty isn’t going to go away. In fact, markets may get more turbulent as midterm election anxiety and fiscal policy unknowns add to geopolitical concerns, most notably surrounding Russia’s invasion of Ukraine and China’s strategic aspirations. Given this environment, investors should be prepared for the market to trade in a saw-toothed fashion, with massive moves and broad trading ranges, not just this year but beyond.

Now, for the good news: There is opportunity in all markets. Building wealth doesn’t require a perfect economic backdrop. If it did, no one would ever make money.

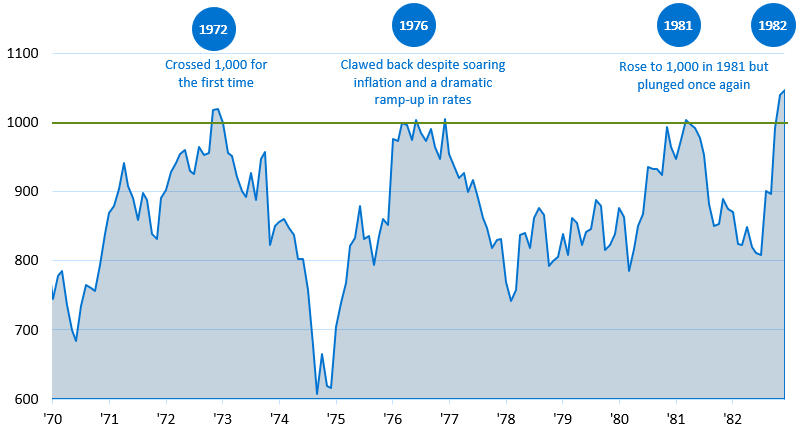

What we are seeing today reminds me of the 1970s, early in my investment career. Markets were extremely volatile, as the chart below shows. In 1972, the Dow Jones Industrial Average—then the bellwether measure of the market—crossed a massive milestone: 1,000. Unfortunately, the advance was short lived, and the next years brought dramatic saw-toothed markets as investors grappled with inflation and a Fed funds rate both in the double digits. Like the Greek mythological character of Sisyphus who was condemned to roll a boulder up a mountain only to have it roll back down once he reached the top, the Dow struggled for years, crossing the 1,000 mark in 1976 and 1981 but sliding precipitously thereafter. It wasn’t until 10 years later that the Dow finally took off, supported by the tailwinds of favorable policy.

The DJIA crossed the 1,000 mark in 1972, 1976, 1981 and 1982. There were still many opportunities to build wealth with a long-term approach and active management.

Past performance is no guarantee of future results. Source. Bloomberg.

As difficult as those years were for the markets overall, I still found ways to build wealth for my clients. Looking back, I’d cite two main reasons, both of which I believe are just as relevant to navigating conditions today. The first was active management driven by individual security selection. The second was the use of alternative investment strategies as part of diversified asset allocation strategies.

The importance of active management. After a brutal start to 2022, the US stock market has gained back about half the ground it lost. The recovery hasn’t been synchronized, however. Many stocks are overpriced, while others are not. Some have been punished too severely by market participants, and some have likely been given more credit than they are due.

During the first half of 2022, markets were primarily moving based on macro forces, such as market participants’ interpretation of Fed comments or inflation data. And make no mistake—macro influences will still exert a powerful influence on the markets from day to day. However, we are seeing signs that investors seem to be paying more attention to company-specific fundamentals. For active managers like us, this provides opportunities for our teams to add value through proprietary research and individual security selection.

Small-cap growth stocks are one area where we’re seeing an encouraging change in the tide. Small caps faced bruising headwinds earlier this year, but these were due more to sentiment and macro factors than fundamentals. This has led to significant valuation discounts and provides a rich hunting ground for Calamos Timpani Small Cap Growth Fund.

The opportunity of alternatives. In the 1970s, both stocks and bonds were coming under pressure. Many investors felt there was nowhere to turn. But there was—we just had to look in less-familiar places for alternatives. For me, this led me to diversifying my clients’ asset allocations into convertible securities, which were essentially an alternative asset class. This was years before the emergence of the popular convertible indexes we have today, and I worked to develop proprietary valuation models. What I found was that convertibles offered a less-travelled path but one that led to attractive risk-adjusted returns.

Today, I believe the merits of alternatives are as strong as ever and that one of the wisest actions an investor can take is to consider establishing or increasing allocations to liquid alternative strategies. By providing access to more sophisticated strategies than those available to traditional mutual funds, liquid alternatives provide an excellent way to enhance risk management or to boost return prospects. They can be used to address a variety of asset allocation challenges, on either the equity or fixed income side of an asset allocation. For example, funds such as Calamos Phineus Long/Short Equity Fund and Calamos Hedged Equity Fund employ a breadth of techniques to potentially profit from both equity market upside and downside. For fixed income allocation, Calamos Market Neutral Income Fund offers a time-tested approach to seeking steady performance and income without the level of interest rate risk associated with traditional bonds.

Meanwhile, convertible securities continue to provide an alternative to traditional stock and fixed income allocations. As we discussed in a recent paper (“Convertible Securities: Market Review and Outlook”), an interesting landscape has emerged, creating opportunities for our bottom-up approach. Thanks to their embedded options, convertibles offer attractive risk-managed access to small and mid-cap growth companies, with potentially less downside than investing in the common stocks of the issuers. Convertible issuers frequently have no other debt in their capital structure and well-capitalized balance sheets. Additionally, convertibles tend to have shorter durations than traditional bonds, which is an appealing feature in this rising rate environment. Actively managing convertible securities, as we do in Calamos Convertible Fund, gives us an opportunity to mix convertible securities with attractive yields to maturity with convertible securities that have measured equity sensitivity.

Conclusion

A good rule to follow, especially in the current market environment, is to think longer term. Don’t allow the short-term headlines—which are causing a lot of volatility—to introduce panic into your investment decisions.

Throughout my 50 years as an investor, there’s never been a day that the market hasn’t faced unknowns and what ifs. However, if you take a disciplined approach and don’t get caught up in the short-term noise, you don’t need certainty about the markets and the economy to achieve your long-term financial goals.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The Dow Jones Industrial Average tracks the performance of 30 large US companies.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks. As of March 1, Calamos Hedged Equity Income Fund's name has been changed to Calamos Hedged Equity Fund.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

Asset allocation and diversification do not guarantee a profit or protect against a loss.

18991 0822 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.