Investment Team Voices Home Page

Investment Team Voices Home Page

The Fed’s Dovish Pivot: A Catalyst for Sustained Small Cap Strength

Brandon Nelson, CFA

Summary Points:

- Small caps came roaring back in the fourth quarter, outpacing the strong returns of large caps.

- We believe the Fed’s dovish pivot has far-reaching favorable implications for small caps.

- Other factors that could propel small caps include attractive valuations, presidential cycle tailwinds, the potential for increased merger activity and large amounts of cash on the sideline.

- We emphasize stocks of companies with above-average growth prospects, and we believe this will serve the funds well in 2024.

Reversing the third quarter’s weakness, stocks surged in the fourth quarter. Small caps came back with a vengeance, with the Russell 2000 Index’s gain of 14% surpassing the S&P 500 Index’s 12% return. Overall equity performance continued to be tightly linked to 10-year US Treasury bond yields. When yields rose in October, stocks fell sharply. Yields collapsed in November and December, and stocks rallied.

Federal Reserve Chairman Powell’s dovish pivot was one of the most important catalysts during the quarter. On December 13, he made public comments that suggested the Fed had interest rate cuts on its mind, saying cuts were “a topic of discussion [among Federal Reserve members].” Compare that to the public comments he made only a few days earlier on December 1: “It would be premature to speculate on when policy might ease.” This reframing was a true pivot.

The implications of this pivot in rhetoric are potentially extremely bullish for stocks overall and especially for small cap stocks. Think back to November 2021 when Powell made hawkish comments for the first time, telegraphing higher federal funds rates down the road. Stocks took notice and sold off sharply for the next several months, even before the first actual Fed funds rate hike in mid-March 2022. Small cap stocks were hit especially hard during this time and are still in recovery mode, unlike large caps, which fell less and rallied more off the overall market bottom.

The mid-December dovish pivot seems to have marked the inverse of the November 2021 pivot. Thus, logic would suggest small caps could disproportionately benefit from this pivot, especially given how attractive valuations have become relative to large caps in recent years. (Valuations of small caps versus large caps ended the year in the 10th percentile, according to Jefferies.)

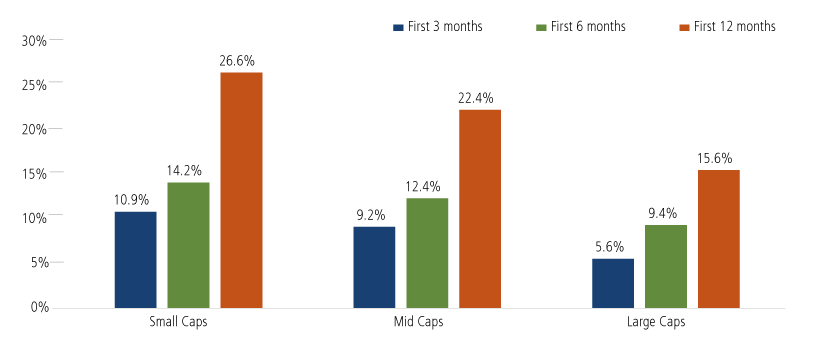

Things can always change, but it seems likely to us that the Fed will be cutting interest rates in 2024. Historically speaking, stocks tend to perform very well after the first rate cut, especially small cap stocks.

Rate Cuts Have Tended to Give the Biggest Boost to Small Caps

Past performance is no guarantee of future results. Source: Jefferies using Federal Reserve Board, Haver Analytics, Center for Research in Securities Prices (CRSP®), and the University of Chicago Booth School of Business. Note: used fed funds rate from 1954 until 1963, then used the discount rate from 1963 until 1994 and the fed funds rate after that. Market caps defined by CRSP based on placing market caps into deciles. Deciles 1 and 2 are large and 6 through 8 are small.

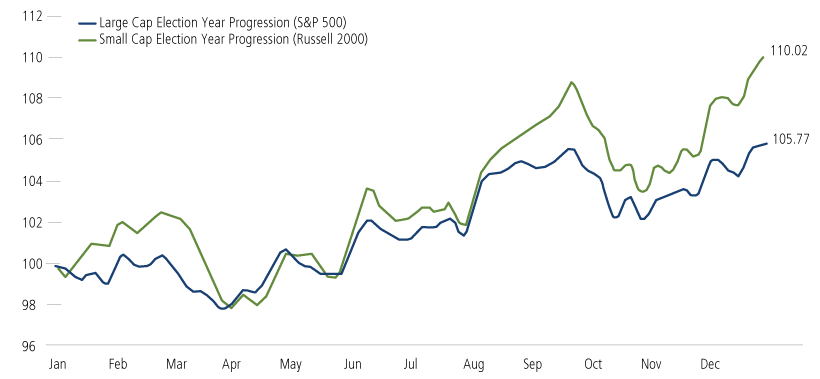

Thus, the set-up for small caps seems extremely favorable, in our view. For several years, small caps have looked cheap. But with the Fed changing its tune, there is now a specific catalyst that has created urgency to invest in small caps. Combine this urgency with unusually high levels of cash on the sidelines (buying power), a robust M&A environment (where takeover premiums are likely), and presidential cycle tailwinds (the fourth year of a presidential term is usually relatively strong), and the outlook gets even better.

Historically, Stocks Have Done Fine in Election Years, Especially Small Caps

Past performance is no guarantee of future results. Source: Piper Sandler Technical Research/Bloomberg.

We believe Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) are well positioned. Both funds are tilted toward stocks that we believe offer above-average growth prospects and very visible fundamental strength. Stocks with these characteristics sometimes lag at critical market turning points but tend to play catch-up as new stock market upcycles mature. We see this scenario playing out once again and thus have high hopes for absolute and relative-to-benchmark returns for both funds in 2024.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of the potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

024001g 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.