Investment Team Voices Home Page

Investment Team Voices Home Page

The Fed Pause: A Key Catalyst for Global Equity Markets

Calamos Global Opportunities Fund (CGCIX)

Morningstar Overall RatingTM Among 338 Global Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 338, 320 and 240 Global Allocation Funds, respectively, for the period ended 6/30/2024.

We see an improving backdrop for Calamos Global Opportunities Fund (CGCIX), supported by improving macro data and company fundamentals.

- A Fed pause and weakening dollar, which have historically set the stage for strength in non-US equities.

- Low equity valuations, both relative to the US and to historical levels.

- Favorable trends in global earnings revisions and earnings growth.

- Attractive issuance in global convertible securities.

After staring down weaker global growth, aggressive policy tightening, a strong dollar and increased geopolitical tension, global equity markets look to be positioned for brighter days ahead. Since the end of October, we’ve seen the performance of US and non-US markets begin to converge as investors shift their focus from a higher-for-longer rate scenario to contemplating the Fed pause.

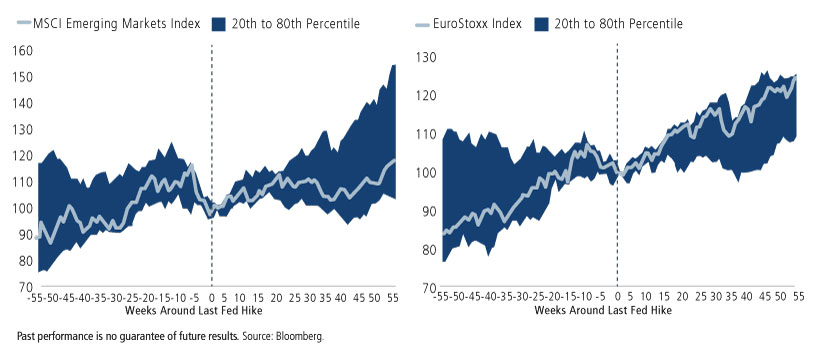

The end of a Fed tightening regime has been a key turning point for non-US equities

Over the past 30 years, international equity markets have enjoyed a boost when the Federal Reserve has paused rate increases. The chart below shows the decidedly positive performance of emerging market equities and European equities leading into and in the months following Fed pauses.

Median moves around end of Fed tightening cycle, going back to 1989

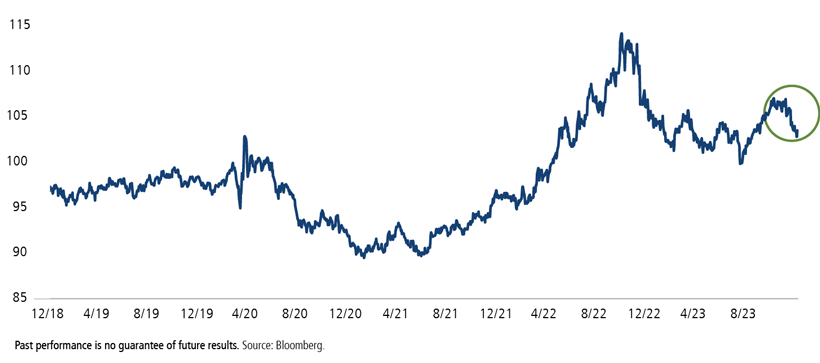

As the Fed has become less hawkish, the dollar has trended down

A weaker dollar has also been a tailwind for overseas markets. For most of the past two years, global markets have struggled amid waves of investor anxiety about global growth and interest rates, which were reflected in a strong dollar. As the chart below shows, the dollar went through a period of massive upside in 2021 and 2022. And, from July through October of this year, the dollar staged a major rally in a risk-off environment. However, in the wake of the Fed pause and lower real yields, we've seen the dollar stabilize and depreciate versus many foreign currencies. This move has contributed to a more hospitable environment in the global capital markets, with non-US markets, including emerging markets and European equities, benefiting.

US Dollar Index

Improving Global Fundamentals

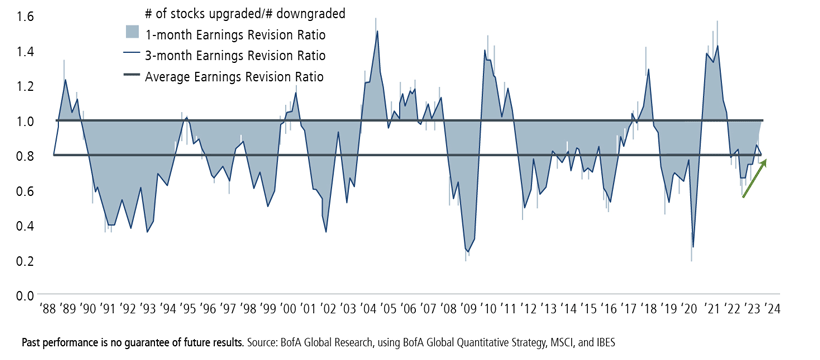

In addition to a better macro landscape, we also want to see companies performing better. During the Covid cycle, earnings were all over the map. Companies in Europe and other more trade-oriented economies struggled more than those in the United States. More recently, we’re seeing indications that the skies are brightening for companies around the world, including in Japan and Europe—two regions well represented in Calamos Global Opportunities Fund. (See our post, “We’re Finding Much to Like in Japan.”)

Global Earnings Revisions: Moving in an Encouraging Direction

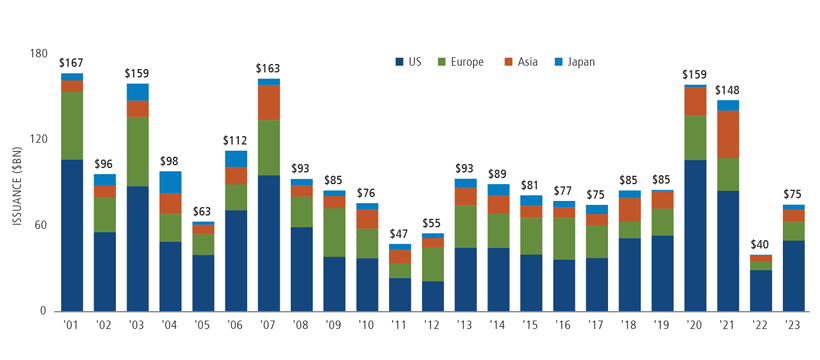

Convertible Securities: A potential advantage for Calamos Global Opportunities Fund

Calamos Global Opportunities Fund’s investment universe includes convertible securities, which we believe is a key differentiator. Convertible securities blend characteristics of stocks and traditional fixed income securities, giving our team additional levers for accessing well-priced growth and favorable risk/reward skew. Global convertible issuance has been healthy this year, and we believe this trend should continue in 2024, as companies seek growth capital at lower borrowing costs.

Global Convertible Issuance

As of November 30, 2023. Source: BofA Global Research.

Conclusion

We believe lower inflation and less hawkish central banks, a pickup in growth and higher earnings revisions, and the potential for a stable-to-declining dollar have re-energized the backdrop for global equities and provide strengthening tailwinds for our global strategies, including Calamos Global Opportunities Fund.

Our team manages Calamos Global Opportunities Fund with the goal of providing lower-volatility equity exposure by striking favorable risk/reward skew with more upside than downside over full market cycles. We are pleased to see a growing set of advantaged companies emerge—businesses with rising cash flows and solid balance sheets. The fund continues to emphasize companies that can thrive during all phases of the economic cycle, such as those benefiting from thematic shifts and disruption. From a sector standpoint, we’re finding attractive opportunities in technology, industrials, health care and energy. We’re also finding attractive potential across the capitalization spectrum, including select smaller caps.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information: An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

Morningstar RatingsTM are based on risk-adjusted returns and are through 11/30/23 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2023 Morningstar, Inc.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

822284 1123

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.