Investment Team Voices Home Page

Investment Team Voices Home Page

We’re Finding Much to Like in Japan: Calamos Global Opportunities Fund

Calamos Global Opportunities Fund (CGCIX)

Morningstar Overall RatingTM Among 338 Global Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 338, 320 and 240 Global Allocation Funds, respectively, for the period ended 6/30/2024.

Japanese companies currently represent one of the top allocations in Calamos Global Opportunities Fund (CGCIX), thanks to favorable macro and market tailwinds and bottom-up company fundamentals. Our team’s constructive outlook on Japan reflects a variety of factors, including:

- Improving wages and consumer confidence

- More capital-friendly corporate behavior

- Attractive valuations, renewed capital flows and rising earnings revisions

Japan’s Nikkei Index recently set new multi-decade highs buoyed by key developments in the macro environment and bottom-up investment backdrop. From an economic perspective, Japan is exiting a decades-long period of deflation and ushering in higher nominal growth across its economy. Rising wages and more upbeat consumer confidence reflect these positive changes.

Japanese Equities: Strong gains after difficult decades

Nikkei 225 Index

Past performance is no guarantee of future results. Source: Macrobond.

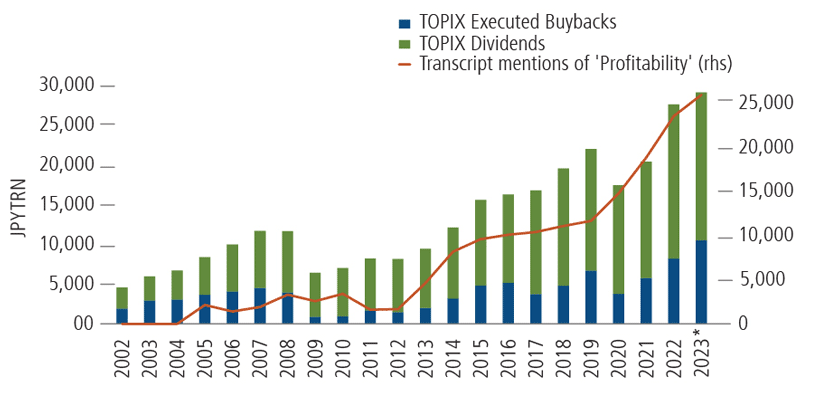

From a company perspective, the times are also changing. More capital-friendly corporate behavior—e.g., a greater emphasis on improving returns on equity and managing for shareholder returns—illustrates key changes in perspective. Dividends and buybacks are on the rise. This shift is driving widespread strength across the Japanese equity market.

Japan’s corporate management teams: Pivoting to profitability and shareholder returns

Past performance is no guarantee of future results. The Tokyo Stock Price Index (TOPIX) is a measure of the large-cap Japanese stock market. Source: Morgan Stanley, “Global Strategy Mid-Year Outlook, Crunch Time” June 4, 2023, using TSE, Nikkei NEEDS, AlphaSense, Morgan Stanley Research; Note: Data as of May 24, 2023. 2023 data are annualized.

For many years, Japan equities traded at a discount versus global peers like US equities but lacked sufficient catalysts to unlock this valuation upside. Higher nominal growth, more flexibility in Japan’s yield curve control, and renewed interest from both foreign and domestic investors are driving capital flows and higher share prices this year.

How We’re Capitalizing on Japan’s Improved Equity Environment

We believe these favorable trends in Japan can be sustained and provide wind in the sails for many companies. Market reforms, reflation, and reopening should continue to support better Japanese equity performance, in our view. But company fundamentals and bottom-up research also matter, and it’s here that we believe our team adds significant value.

Calamos Global Opportunities Fund’s holdings in Japan include high-quality multinationals that we believe are some of the better companies globally but have historically traded at a “Japan-market” discount. We also maintain positions in companies more directly exposed to the post-Covid reopening and to companies whose balance sheets and valuations make them more likely to experience a boost from market reforms or reflation. From an industry standpoint, our holdings span construction equipment, airlines, semiconductors, and manufacturing automation systems.

Also, our positioning in Japan reflects an important differentiator in our approach: a broad investment universe that includes convertible securities as well as equities. Convertible securities offer us opportunities to manage risk and reward in ways that stocks alone do not. Japanese companies have long accessed the capital markets by issuing convertibles, and we’ve found several holdings that meet our criteria.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Indexes are unmanaged, not available for direct investment and do not include fees and expenses. The Nikkei 225 Stock Average is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

Morningstar Global Allocation Category funds seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. While these portfolios do explore the whole world, most of them focus on the US, Canada, Japan, and the larger markets in Europe. It is rare for such portfolios to invest more than 10% of their assets in emerging markets.

Morningstar RatingsTM are based on risk-adjusted returns and are through 7/31/23 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2023 Morningstar, Inc.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

822145 0823

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.