Investment Team Voices Home Page

Investment Team Voices Home Page

Defining Great Companies: A Conversation with the Calamos Sustainable Equities Team

Beth Williamson Vice President, Head of Sustainable Equity Research and Associate Portfolio Manager

With experience that dates to the 1990s, the Calamos Sustainable Equity Team brings pioneering expertise to Calamos Antetokounmpo Global Sustainable Equities ETF (SROI), an ETF designed to serve as a core allocation to quality growth companies. We asked the team to explain what they look for and why they believe their approach gives a more complete picture of a company’s ability to build shareholder value.

“Companies that can sustain long-term success share defining characteristics. In our experience, these characteristics apply for global market leaders and smaller regional players with a new or better products.

- A history of innovation and competitiveness

- Products and services that meet important, widely held needs

- Market leadership and the ability to maintain their edge

- Strong business fundamentals relative to their industry

- A record of mitigating environmental risk and managing within ecological limits

- Ethical management, reflected in corporate behavior

We believe that valuation is an important aspect of security selection, and we analyze a company’s stock price relative to its history, the market and its peers in our effort to avoid overpaying for excellent companies.”

-- Tony Tursich, Jim Madden and Beth Williamson

Q. What types of companies make great investments?

A. Our philosophy has always been to invest in quality companies, with our definition of quality consisting of two dimensions. First, a company must have quality financial fundamentals, such strong ROIC (return on invested capital), margins, and cash flows. But we believe it’s important to look deeper, which is why we also require the companies we invest in to have quality non-financial fundamentals.

Q. How does sustainability fit into this?

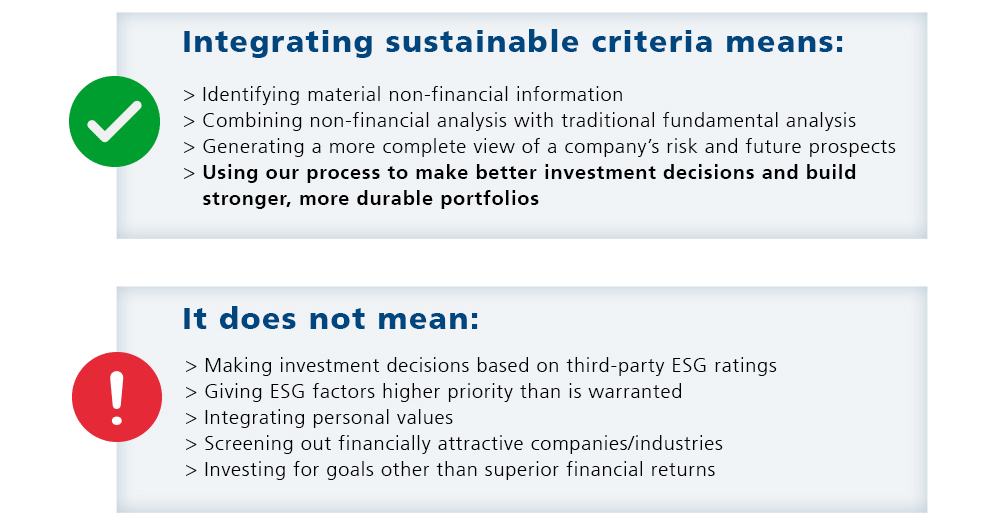

A. Sustainability factors—such as governance, ecological impact, and improving human development—are examples of non-financial criteria. They give us another vantage point for understanding the opportunities and the risks that companies may have. We believe that having more information and using that information to make investment decisions is a better way to invest for the long term.

Around the world, there’s a growing interest in building a more sustainable world and improving conditions for humankind. We believe that companies that are providing innovations that are aligned with these priorities are positioned to capture tailwinds, in terms of increasing profitability and market share and avoiding risks. SROI and the other portfolios our team manages invest in companies that develop goods and services that offer other businesses the opportunity to lower their bottom line or produce new in-demand technologies or services. This includes a wide variety of companies—from those at the forefront of the circular economy to a chip manufacturer that’s capitalizing on global demand for electric vehicles.

Q. Give us an example of a company that checks all the boxes for you.

A. One company that we’re really excited about is Darling Ingredients, headquartered in Texas. Many of its innovations focus on recovering and collecting cooking oil and animal fats and repurposing them into feed and fuel ingredients. Darling also has formed a joint venture with Valero, establishing Diamond Green Disel, the largest producer of renewable diesel in North America. From a traditional financial perspective, Darling offers dominant market share, vertical integration and increasing margins. On top of this, we see a company that’s been an early participant in the circular economy, providing sustainable food solutions and monetizing materials that would otherwise be wasted.

Q. Walk us through a key theme that you see driving opportunity and how SROI participates.

A. There are tremendous opportunities in the energy transition. (See our blog post “We are Bullish on Energy” for more.) Drive across the country and you’ll see firsthand the increased use of wind and solar to power America’s farms and cities. Quanta Services, also headquartered in Texas, fits right into this. Quanta is a specialty contractor focused on the design, installation and maintenance of energy infrastructure. It’s a leader in electric power and is at the forefront of delivering more resilient power grids. We’re seeing terrific organic growth as well as some key strategic acquisitions. We also love the way the company invests in human capital—earning numerous awards for worker satisfaction and safety.

Q. A tremendous amount of investor focus has been given to the “Magnificent Seven” mega caps. What are your thoughts on these sorts of companies?

A. Not all of the Magnificent 7 meet the criteria to fit into our universe, but as quality growth investors, we’ve found a lot to like in several of these companies. For example, Alphabet is dominant because it can execute, innovate, and manage risks. It has strong financial characteristics and capable management teams. Alphabet holds a dominant position in search and advertising, is consistently seeking new approaches and new markets, and is also a leader in reducing its environmental impacts.

Q. Let’s take on the 1000-pound gorilla in the room—politics. How do politics influence your investment approach?

A. That’s an easy one—they don’t. We’re fiduciaries of our investors’ capital and we don’t bring our politics into our investment decisions. Our focus is on creating a portfolio of companies with above-average growth potential and less exposure to the risks that can derail and distract businesses from building shareholder value.

Our goal: Use sustainable criteria to make better investment decisions

About Calamos Sustainable Equity Team

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equities suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free funds in the United States. Prior to Calamos Investments, Jim, Tony, and Beth were portfolio managers for the Trillium ESG Global Equity Fund Retail (PORTX).

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

As of March 3, 2024, the largest holdings in SROI were as follows: Microsoft Corp, 4.52%: Alphabet Inc-Class A, 3.69%; Taiwan Semiconductor, SP ADR, 3.60%; Apple, Inc., 3.21%; Nvidia Corp, 1.99%; Novo Nordisk A/S-B; 1.88%; SAP SE, 1.78%; Vjsa Inc-Cass A Shares, 1.73%; Applied Materials, Inc, 1.65%; Costco Wholesale Corp, 1.35%. Darling Ingredients Inc. represented a weight of 0.99%, and Quanta Services Inc represented 0.95%. View current holdings here.

ROIC (return on invested capital) measures how effectively a company uses the money invested in its operations, calculated as a company's net income minus any dividends divided by the company's total capital.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

ESG Investing Risks: When the investment process considers environmental, social and governance factors, the adviser may choose to avoid investments that might otherwise be considered, or sell investments due to changes in ESG risk factors as part of the overall investment decision process. The use of environmental, social and governance factors may impact investment exposure to issuers, industries, sectors, and countries, which may impact a portfolio’s relative performance.

The principal risks of investing in the Calamos Antetokounmpo Global Sustainable Equities ETF include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC ("CGAM"), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund's adviser ("Adviser"). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo.

Mr. Antetokounmpo serves on the Adviser's Board of Directors and has indirect control of half of the Adviser's Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund's investments, and neither Original C nor Mr. Antetokounmpo shall provide any "investment advice" to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then "Antetokounmpo" will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

Giannis Sina Ugo Antetokounmpo is the majority shareholder of Original C, with a 68% ownership interest.

The Adviser is jointly owned and controlled by Calamos Advisors LLC and, indirectly, by Mr. Antetokounmpo, a well-known professional athlete. Unanticipated events, including, without limitation, death, adverse reputational events or business disputes, could result in Mr. Antetokounmpo no longer being associated or involved with the Adviser. Any such event could adversely impact the Fund and result in shareholders experiencing substantial losses.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.