Investment Team Voices Home Page

Investment Team Voices Home Page

China’s Consumer Recovery: Lessons from the Tortoise and the Hare?

Paul Ryndak, CFA

As investors, we are always evaluating data and looking for changing trends that will help us make better investment decisions. All over the world, the Covid-19 pandemic has caused significant changes to consumer behavior, and we believe many of these changes will endure and build momentum in a post-Covid world. In this post, we discuss the changing dynamics of Chinese consumer activity due to Covid-19 and the longer-term investment implications.

Across the Calamos global and international portfolios, we seek out companies that can benefit from their exposure to secular and cyclical growth themes. Secular themes—for example, shifts to cloud-based computing, ecommerce and digital payments—provide long-term tailwinds to demand. Many of these themes accelerated during Covid lockdowns as behaviors changed: employees began working from home, and people increased their online shopping and entertainment consumption. (See our post, “Accelerated Disruption Fuels Global Growth Opportunities” for more.) Households also adjusted spending and savings habits.

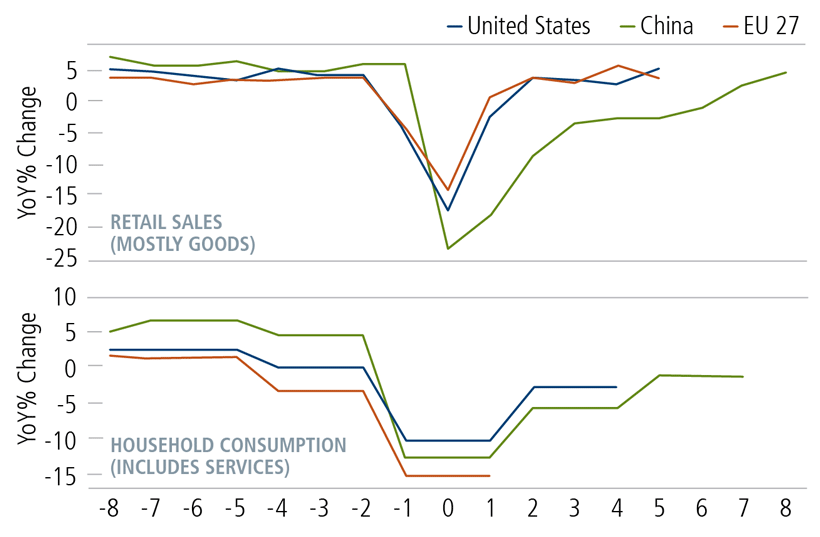

While there have been similarities among countries, there are also country-specific nuances that are key to understanding the investment opportunities on a going-forward basis. Just as the health and economic impacts of Covid-19 have varied greatly among countries, consumer recoveries are also proceeding differently. For example, not only was China the first of the major economies to shut down and the first to recover, the recovery of its consumer sector has also followed a trajectory that differs from what we’ve seen in the U.S. and Europe so far.

Impact of Covid-19 on Households in China: Demographic Backdrop

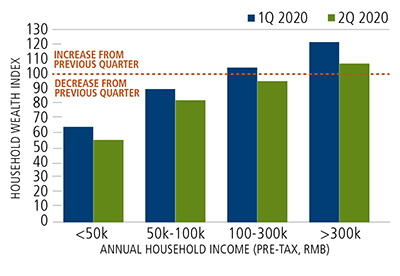

As shown in the charts below, shutdowns exacted the most severe toll on China’s lower-income households, due to losses of wages and self-employment income. Even as the economy has reopened, these lower-income households have continued to save more as a precaution against further shutdowns. Higher-earning households cut back consumption and increased their savings as well but did not see significant declines in income, which has supported a relatively higher level of pent-up demand from this demographic.

Change in household wealth, by income group

Urban and rural households, per capita basis

Source: Gavekal Dragonomics, Ernan Cui, “How Covid-19 Changed Chinese Consumers,” November 2020, using CHFS and Ant Group Research, Gavekal Dragonomics/Macrobond (change in household wealth) and Gavekal Dragonomics/Macrobond (household savings).

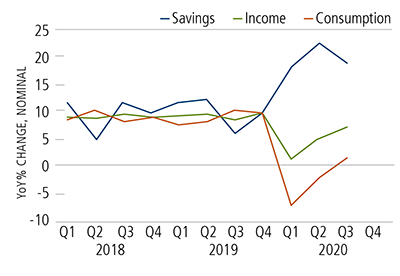

Across China, unemployment rates have returned to pre-pandemic levels, and household incomes continue to recover. Although China’s “first-in, first-out” experience of Covid allowed it to begin an economic recovery ahead of Europe and the U.S., the retail spending recovery in China has been more gradual, taking a U-shaped path that contrasts with the V-shaped path seen in Europe and the U.S. Importantly, however, this U-shaped path has been sustained, even as the recovery in the U.S. and Europe has flattened to a degree, as shown below.

Real growth, 8 months before and after point of deepest lockdown

Source: Gavekal Dragonomics, Ernan Cui, “How Covid-19 Changed Chinese Consumers,” November 2020, using CEIC, Gavekal Dragonomics/Macrobond.

There are a few reasons that likely explain the slower consumption recovery in China:

- Chinese households continued to save even as the economy reopened in preparation for potential future impacts from Covid.

- China doesn’t have the same kind of social safety nets for individuals that are offered in many more-developed countries. In the U.S. and Europe, governments provided fiscal support to consumers through stimulus checks or unemployment benefits, which supported spending.

- Public health restrictions have remained quite tight in China, which has likely restrained spending in many areas.

A closer look at how demand trends are playing out in China

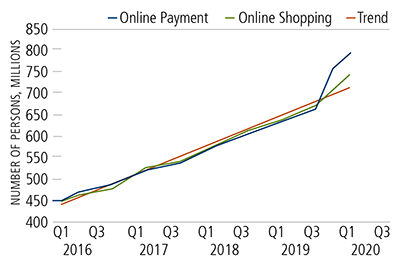

As the pandemic has eased in China, we have seen a fast recovery and growth in many discretionary purchases, with particularly healthy pent-up demand coming from higher-earning households. Auto purchases have been notably strong, likely bolstered by a desire to avoid ridesharing or public transportation due to health concerns. Online shopping and online payment services have seen a large surge in demand as well. While this is a trend that existed before, it clearly accelerated in 2020, especially for online payments. (For more, see our post “Central Banks’ Digital Currency Aspirations Provide Tailwinds to Current Leaders in the Global Payments Ecosystem.”)

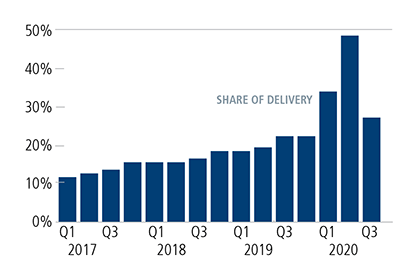

In addition, China’s consumers increasingly have turned to delivery services, especially food delivery, which spiked in the second and third quarters of 2020. This creates a window of opportunity for companies that have the expertise required to retain customers as the pandemic eases. In our global and international portfolios, we’ve found opportunities to invest in companies with strong local presence and brands, and a demonstrated ability to execute on delivery-based models.

Users of online shopping and online payment services

KFC and Pizza Hut, delivery as a % of total sales

Source: Gavekal Dragonomics, Ernan Cui, “How Covid-19 Changed Chinese Consumers,” November 2020 using CNNIC, Gavekal Dragonomics/Macrobond (online shopping and payments) and Yum China, Gavekal Dragonomics/Macrobond.

Furthermore, the share of rural residents in China using the internet increased 10 percentage points to 52% in the second quarter of 2020—an increase that is as large as the previous five years combined. In a country where approximately 550 million people live in rural areas, this ramp-up in internet penetration is a powerful tailwind for the futher adoption of online spending.

Conclusion

The consumer recovery we have seen in China provides many attractive investment opportunities for our portfolios, including in areas that have benefited from accelerated disruption, such as online services—most notably online shopping and payments. The recovery in Chinese consumer spending may not have been as dramatic as in the U.S. and Europe, but it has been reslient, and we believe the increased internet use in rural China represents a demographic shift with far-reaching implications for sustained demand.

For more on our views, see our team’s blog posts.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18854 1220 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.