Investment Team Voices Home Page

Investment Team Voices Home Page

Accelerated Disruption Fuels Global Growth Opportunities

Calamos Global Team

We are living in interesting and turbulent times. The human impact of COVID-19 globally is tragic, and the resulting economic disruption is causing great hardship for many. The monetary and fiscal policy responses globally to address the economic dislocation broadly have been unprecedented.

From a business standpoint, there are industries, notably in the travel, hospitality and aviation spaces to name a few, that were generally healthy going into the crisis but have been severely disrupted by it. But some businesses were already vulnerable to and experiencing disruption at the hands of secular forces in place before the pandemic.

Taking a step back, secular themes are long-term trends that can drive growth for years, even decades, within or across industries or sectors. Companies with secular forces at their backs are better positioned and have a greater capacity to grow in both favorable and unfavorable economic climates. Meanwhile, businesses less favorably exposed to a secular theme are likely to have more limited growth opportunities and face persistent challenges, particularly during periods of broader economic weakness.

The common thread or “north star” across many growth themes is productivity enhancement in our daily lives: working, learning, shopping, socializing, entertaining. Investing behind the drivers of disruption and beneficiaries of disruption while avoiding the losers is an important part of how we build the Calamos global and international portfolios.

When we look across the vector of secular forces already in place for the last decade, it has been striking to see how much the gap has widened between winners and losers in the span of just a few months. Indeed, this shock across the global economy is accelerating the disruption we were seeing before the crisis.

- Computing shifting to the cloud: This trend has been well established as people and businesses have sought access to information anywhere, anytime, and on more and more devices. As people stay at home for work, school, and play, this trend has greatly accelerated and is likely to persist after the pandemic abates. Beneficiaries include the software platforms that improve productivity and enable us to do our jobs, learn, shop, and socialize from home. Cloud services companies that provide the computing power needed for all this at scale and some of the technology hardware that facilitates cloud computing are also advantageously positioned, in our view. The shift from on-premise computing to the cloud has developed most quickly in the West, but opportunities are now emerging across similar parts of the value chain in China.

- Commerce shifts from brick and mortar to digital: This trend has also been well established over the years to address consumer’s preferences for an omnichannel experience. During the past several months, having the ability as a customer to purchase and as a business to fulfill items away from physical locations has become a necessity.

- Payments: Innovative companies that enable merchants to move online and those that are driving ecommerce and digital transactions will continue to benefit. The gradual move to digital and electronic transactions will accelerate in an environment of social distancing and as we spend more time at home. (For more, read our post: Opportunities in Disruption: Finding Growth Opportunities in the Payments Ecosystem.)

- Bioprocessing: We see compelling opportunities for companies that supply tools to drug and biotechnology companies as well as for those that manufacture drugs and vaccines. They are not tied to the success of any one company, but benefit broadly from the development activity for treatments and vaccines. (For more, read our post: Global Growth Themes: The Opportunity of Bioprocessing.)

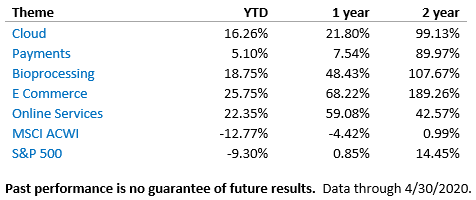

The chart below illustrates the potential impact of thematic tailwinds, using baskets of stocks tied to each theme.* Each has strongly outperformed the MSCI ACWI and S&P 500 Index for the year-to-date period, as well as for the trailing one-year and 2-year periods.

Conclusion

The extent and duration of the damage from shuttering economic activity in response to the pandemic is difficult to estimate, particularly given it is still uncertain when or how things will begin to normalize. Financial market volatility will likely remain elevated. Identifying and investing along strong growth themes has been helpful to portfolio performance this year as well as over the long term. We expect that will continue.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

*Baskets shown are equal weighted average returns, all periods are through 4/30/20. Companies included within each basket are as follows. Cloud: CRM, 268 HK, COUP, NOW, WDAY, MSFT; Payments: V, MA, ADYEN NA, PYPL, SQ; Bioprocessing: LONN SW, DHR, 2269 HK, RGEN; ecommerce: AMZN, SE, SHOP, BABA, MELI; Online Services: 1044 HK, NTES, 035720 KS, 035420 KS, EDU, 1833 HK.

The S&P 500 is considered generally representative of the U.S. equity market, and the MSCI All Country World Index is considered representative of global equities. Indexes are unmanaged, do not include fees or expenses, and are not available for direct investment.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

18795 0520 O

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.