Today's Trading Opportunity: Hedged Equity for a Market Crash or a Market Rally

Anna Narem

VP, Director of Product Management

Calamos Hedged Equity Fund (CIHEX) is an active hedged equity fund often considered alongside more systematic or defined outcome peers. Defined outcome products are designed to capture a certain amount of downside or upside each quarter, depending on where the market moves. However, turbulent markets reveal the limitations of such funds.

The market has been down all year, and many expect high volatility to persist over the short to medium term. CIHEX’s active approach provides an opportunity to capitalize on and shield against that volatility. And when the market turns? While defined outcome products are limited by how much ground they can make up after sustained losses, there are no limits on CIHEX’s ability to capture potential upside.

The Drawbacks of Defined Outcome Funds

In fact, there are drawbacks of defined or fixed outcome funds in both up and down market scenarios. When the fund experiences multiple quarters to the downside, successive losses add up. Another disadvantage: the fund provides less hedge against large drawdowns.

Conversely, the upside of defined outcomes is also locked in, and defined outcome products are capped or limited in how much upside they can achieve each quarter. Furthermore, defined outcome products have designated reset dates, which can be a roll of the dice depending on when and how the market moves.

“CIHEX is uncapped—the fund can participate fully in the upside of a market rally, regardless of how high it goes. Isn’t that what your client would expect?”

Here’s why we believe active management is the better approach: CIHEX is uncapped—the fund can participate fully in the upside of a market rally, regardless of how high it goes. Isn’t that what your client would expect? Also, rebalancing risk is mitigated as the fund has no systematic “reset” date and can adjust the portfolio daily.

There is a divergence in performance between CIHEX and a static peer that locks in positions. Such divergence is due to the uncapped nature of CIHEX and its ability to adjust in unpredictable market conditions. The fund is nimble in a way that a static fund can’t be.

We can illustrate the divergence using a stress test scenario that can be used only with investment professionals. To see, please log in to the Investment Professionals-only area of Calamos.com or reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

The Opportunity

Many products are down year-to-date, and there are ample opportunities to harvest losses and move into a comparable product that could be more tactically advantageous. This provides a great trade opportunity to reset the clock and move into an active fund with similar downside mitigation in the event of a market crash—but with more room to run on the upside. Recovery in a defined outcome fund is metered, remember. Once the fund’s upside is hit for the quarter, investors in the product must wait until the quarter rolls over for additional gains.

CIHEX provides active management and uncapped upside in a risk-managed product at a time when many clients are looking for a bit of buffer but need to make up lost ground. The fund offers an advantage over defined outcome products that are characterized by their limitations: a narrow ability to maneuver after successive down quarters and an upside that’s capped.

For more information on CIHEX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

S&P 500 Index is generally considered representative of the US stock market.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The Morningstar Options Trading Category is comprised of funds that use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others.

Morningstar RatingsTM are based on risk-adjusted returns and are through 9/30/22 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc.

820293 1022

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

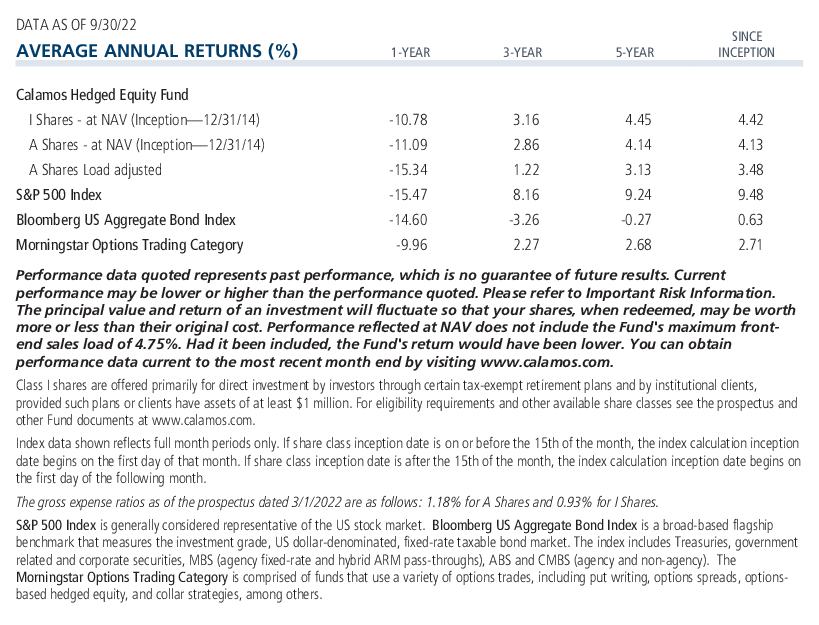

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on October 17, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.