Is Now the Time to Upgrade Your EM Manager?

Markets have been extremely difficult this year across assets. Some investment professionals see environments like this as a crucial time to stand out for current clients and develop new relationships. Bear markets can present an opportunity to demonstrate expertise and take deliberate action—to harvest tax losses, enhance diversification, swap and upgrade managers, segment near-term income needs, and consider the medium-term return outlook.

Overcoming the Home Equity Bias

Emerging markets can and likely need to be a part of a two- to five-year allocation for investors seeking capital appreciation and total return potential. While home equity bias may have worked to portfolios’ advantages in the recent past, many capital market assumptions call for non-US equities, including emerging markets to outperform the US in the next 10 years.

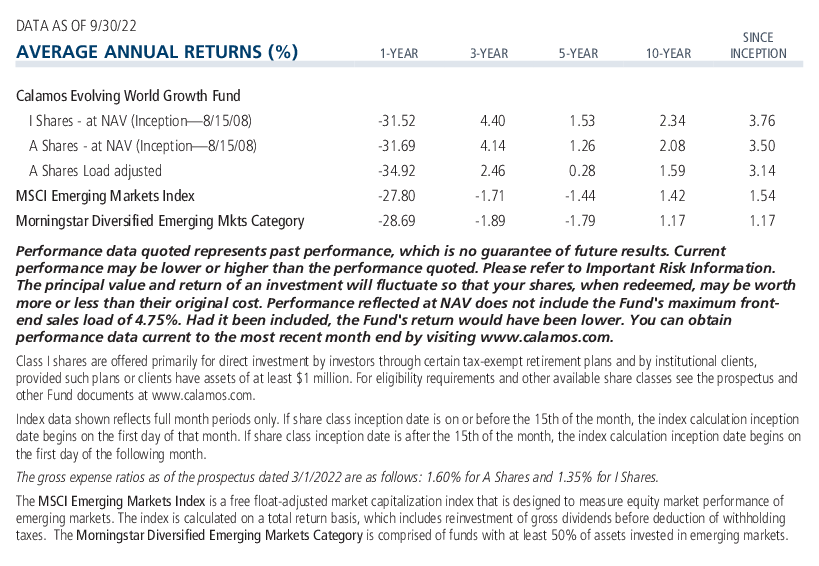

This is not the Calamos Global and International Team’s first rodeo, or Fed hiking cycle for that matter. Since 2008, Calamos Evolving World Growth Fund (CNWIX) has applied a risk-managed approach to emerging markets, having generated returns above the emerging markets benchmark and peer category average, and reduced risk in the process.

The fund’s performance during the multi-year Covid pandemic cycle is the latest illustration of our dynamic, active approach. This is a period that confronted managers with a rapid drawdown in 2020, the recovery rally, technological disruption, geopolitical conflict, higher inflation and tighter monetary policy.

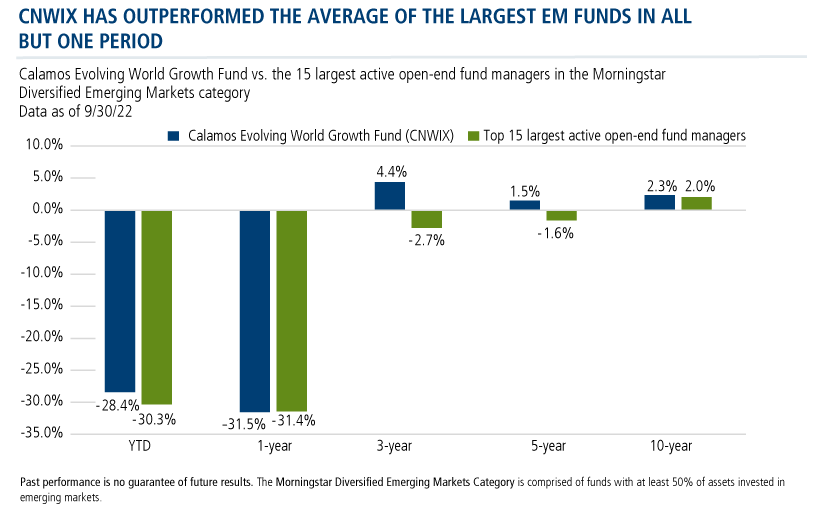

We analyzed how many of the largest and widely held active emerging markets funds met this test. Here’s a summary of our findings—note how CNWIX distanced itself from this group over this period of sea change and beyond.

Calamos Evolving World Growth Fund (CNWIX)

Morningstar Overall RatingTM Among 718 Diversified Emerging Mkts funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 4 stars for 10 years out of 718, 646 and 423 Diversified Emerging Mkts Funds, respectively, for the period ended 6/30/2024.

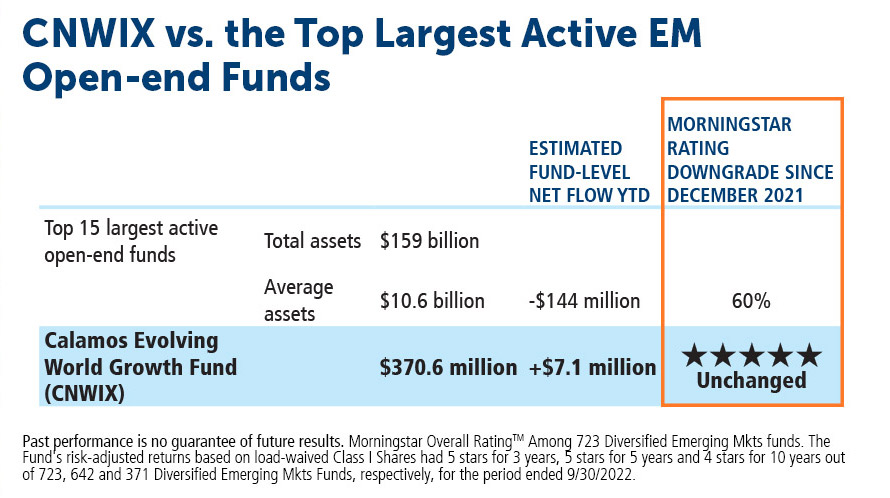

- This set of the 15 largest active open-end fund managers represents approximately $159 billion of assets across, with average assets over $10 billion.

- The average fund experienced more than $140 million in net outflows YTD through September 30.

- Six out of 10 EM funds have experienced a Morningstar Rating downgrade in response to a weakening risk-adjusted performance trend.

- CNWIX outperformed nearly all these funds over time, showing its ability to deliver over market cycles for clients. Namely, the fund leads on a multi-period review: Relative to the average largest active open-end fund managers, CNWIX outperforms YTD and trailing 3-, 5-, and 10-year periods.

The CNWIX Difference

CNWIX’s differentiated performance is the direct result of its differentiated approach:

- Focusing on higher-quality companies with compelling growth characteristics.

- Conducting research across the capital structure and utilizes Calamos’ experience in convertible securities to dynamically manage the risk profile, seeking to improve skew and provide asymmetric returns.

- Identifying durable secular themes that provide a tailwind for sustainable growth and a franchise premium.

- Actively incorporating ESG research into company analysis, team discussion and risk management. Emphasizing investment in economies enacting structural reforms and improving economic freedoms.

The fund has delivered:

- Compelling performance during the volatile and highly rotational market cycle of the last two years.

- Strong rankings within its Morningstar category, and a 5-star Overall Morningstar Rating.

- Since inception outperformance versus the MSCI Emerging Market Index, with lower beta, standard deviation and downside semivariance.

- Lower volatility than index since inception.

For more information on CNWIX as well as some ideas on harvesting tax losses, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Morningstar Diversified Emerging Markets Category is comprised of funds with at least 50% of assets invested in emerging markets.

Morningstar RatingsTM are based on risk-adjusted returns and are through 9/30/22 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc.

820307 1022

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on October 31, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.