Fixed Income PMs on Positioning for a Generational Shift: High (But Moderating) Inflation

In the economic battle between growth and softening, inflation is now the center of attention for the first time in a generation. This challenge—including the monetary and fiscal measures being deployed to knock inflation back down to size—was the focus of the call held Feb. 15 with the Calamos Fixed Income Funds portfolio management team (listen to the call in its entirety here). Speakers included Co-CIO, Head of Fixed Income Strategies and Senior Co-Portfolio Manager Matt Freund, Co-Portfolio Manager Chuck Carmody and Co-Portfolio Manager Christian Brobst.

Freund set the stage by explaining that markets are struggling to comprehend the classic dilemma of a strong-but-softening economy. “So, we think the most important thing to focus on is the change in magnitude of each of these trends colliding with one another. When you look around the world today, it’s really a global phenomenon. We have an economy which is doing very well with high economic growth, but one where that growth is softening.”

He expounded on the good news first: “In terms of the growth side of the equation, the economy is clearly doing well. We had 6.9% gross domestic product (GDP) growth in Q4. Two-thirds of that growth was due to building inventories, which is to be expected as supply chains re-establish themselves.” He then acknowledged, “However, GDP is showing that Q1 growth will be a small fraction of Q4, and then moderating for the rest of the year.”

Freund noted, “Although we think inflation is peaking, this peaking is a process and not an individual date. We think inflation will be moderating as the year progresses."

“In fact, it’s almost guaranteed that we’re going to see inflation fall from current levels, but it's not going to fall back to 2%, and one of our key messages is that while we do expect inflation to moderate, we expect it to remain above the Fed’s forecast.”

From Whatever It Takes to Whatever It Costs

Freund remarked that the Fed has gone from “whatever it takes to get the economy going to whatever it costs to put inflation back where it belongs.” He added, “We expect them to raise rates starting in March and raise rates consistently throughout the year.”

Central Bank Tightening: A Global Trend with Differing Outcomes

Bear flattening or bear steepening? The global bond markets have taken diverse approaches.

Freund emphasized that steps announced by the Federal Reserve are not an outlier unique to the United States: “We saw the European Central Bank meet in recent weeks, and it is very clear that they are going to let the Fed do the work first, but they will follow suit and are expected to raise rates as the year progresses.”

According to Freund, the US approach is resulting in short rates rising significantly but long rates only to a modest degree—a bear flattening. Elsewhere, in Germany for example, rates are rising and the yield curve there is steepening.

He further noted, “We also believe the Fed when they say they’re going to let their balance sheet run off. There is a lot of guidance and forward communications because they want the market to do the work for them, and it is in large part, but the Fed is clearly going to hike rates. They are preparing the markets for a reduction in liquidity.”

“The Fed’s rhetoric is at its peak,” continued Freund. “They are very clear about their intentions. If inflation stays high; if growth stays strong; if the dollar stays elevated; they’re going to take these actions.

“It is our expectation, though, that their actions will cause changes in those underlying conditions, and when push comes to shove, the Fed is going to err on the side of moderation. Is the Fed ahead of itself? They’ve got a lot of work to do before we have to worry about whether they are going to be raising rates five, six or seven times in a row.”

He added, “Despite all its dysfunction, Congress has also provided some degree of fiscal tightening by not passing any new fiscal support. We’re running enormous deficits, but less enormous than recent years.”

Credit Markets’ Response: Partly Sunny and Partly Cloudy

Carmody offered several points of reference: “Year to date, we’ve seen the 2-year note widen by 75 basis points, the 10-year note widen by 40 basis points, and the 30-year note by 33 basis points, so we’ve seen substantial moves in rates to start the year.”

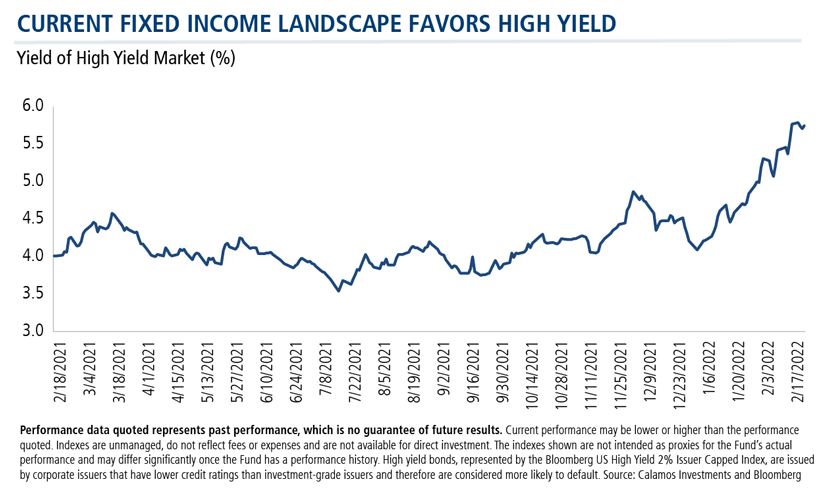

He continued, “When we think about credit markets, there are two main pillars we focus on. The first is fundamentals. From a fundamental standpoint, we feel good. Issuers have strong balance sheets. Their margins remain very strong, and they have ample liquidity. The market has very limited refinancing needs over the next couple of years, so we feel like there’s a good runway for high yield issuers, and defaults remain exceedingly low. The current default rate is about 0.24%, so from a fundamental standpoint, the high yield market remains in very good shape.”

From a technical standpoint, Carmody acknowledged that issuance has been slow year to date. “So far, we’ve had about $32.5 billion of issuance this year. That compares to about $76.5 billion last year, so much slower than we saw last year, and we’re coming off a couple years of record issuance.” He further noted, “Regarding the other part of the technical backdrop (fund flows year to date), the high yield market has seen about $14 billion of outflows, and that’s after pretty substantial outflows last year. From a technical standpoint, the market has seen some pressure.

He concluded, “As the high yield index approaches a 6% yield, it’s definitely getting more interesting. We’re seeing a lot more opportunities and it has become a market that we think really favors our credit process.”

The 3 Types of Fixed Income Managers

Brobst offered thoughts on what differentiates Calamos fixed income funds by breaking out the universe of fixed income managers and strategies into three groups:

- Closet Indexers. “First, there are plenty of managers out there who are essentially closet indexers, providing investors broad exposure to the market. What they deliver is essentially some heavy market data related to the fixed income markets with very little differentiation from benchmark performance over time.”

- Macroeconomic. “The second school of thought includes those managers who focus largely on macroeconomic calls. While we clearly do take macroeconomic conditions and risks into consideration in our positioning, they are not going to be the drivers of our alpha, either in the short term or over a full market cycle.”

- Deep-credit Evaluation. “The third school of thought is those that fall into the Calamos camp, which is a very deep-credit analyst-driven research process that results in bond-by-bond portfolio construction. And this is the approach that we subscribe to.”

A Substantially Different Year

“We believe that over time, our approach can deliver consistent outperformance with lower volatility over a full market cycle,” he continued. “What’s interesting is that we’ve seen this dynamic play out over the changing market conditions that existed through much of 2021, which was very much risk on across risk asset classes, but particularly, in fixed income credit markets as high yield and loan spreads, and even spreads in the investment-grade markets, continued to grind tighter and trade in a very tight range over the course of the last calendar year.”

He concluded, “Into 2022, which has felt substantially different from a risk-appetite perspective, we’ve introduced some of the factors that Matt and Chuck spoke about related to the Fed, fiscal policy, and economic developments. Our relative performance within the peer group, as well as our absolute performance, is being driven by specific credit selection, which we would highlight particularly in the Calamos High Income Opportunities Fund, but really across all our funds.”

Investment professionals, for more information about the Calamos fixed income fund lineup, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

The principal risks of investing in the Calamos High Income Opportunities Fund include high-yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk, foreign securities risk and liquidity risk.

808666 222

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 22, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.