Even a Modest Uptick in Inflation Can Drive Rates Higher—How Convertibles Can Help

Unprecedented Federal Reserve aggressiveness to reflate the economy is prompting some advisors to ask: How much is all this going to cost? The concern is that the Fed’s actions will result in inflationary pressures that could ultimately hurt the economy and investors.

In fact, a headline in last week’s Wall Street Journal went so far as to conclude, “If Inflation Is Coming, the Market Isn’t Ready.”

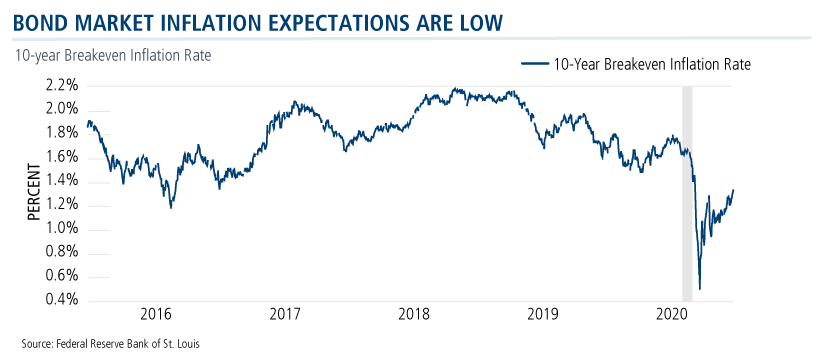

It’s been years since inflation was a serious concern, and the article cited the bond market’s expectation that inflation will rise at just 1.5% annually over the next 30 years, and below 1% for the next five years (for more on the measure of inflation expectations, see this post).

Calamos on Inflation

January 28, 2020: In the face of unprecedented and unexpected events—such as the global spread of a new coronavirus—markets often sell off with little warning… There’s another risk investors should pay close attention to in 2020: the potential for higher long-term interest rates, due to inflation or geopolitical events. Inflation pressures increase as the economy grows at a faster rate, with wage growth among the important contributing factors. Geopolitics can also sow the seeds of inflation—for example, a geopolitical event can stoke rising oil prices, in turn pushing up costs across the economy. Read more in Convertible Securities Offer Many Benefits— Including as a Hedge Against Inflation.

May 2020: …we are still in a period of unprecedented uncertainty. There are a range of potential outcomes for fiscal policy and the U.S. election. Depending on the political climate, economies could be healing, but corporations may not be optimistic in the face of less business-friendly fiscal policy. Inflation is not a concern for 2020, but pressures are likely to build in 2021 and beyond, as supply chains become more localized and labor becomes scarcer. Read more in the Economic and Market Outlook.

June 2020: In recent months, the Federal Reserve and other central banks have lowered short-term interest rates to help the global economy through the pandemic. As economic activity improves, this course may reverse. Meanwhile, as shuttered economies open up, pent-up consumer demand and a shift to more localized supply chains could fuel inflation pressure. Read more in Investor Insights.

Even so, inflation has been on Calamos’ radar since the beginning of the year, well before most of the world grasped the seriousness of the coronavirus and before markets corrected (see this paper by Calamos Founder, Chairman and Global Chief Investment Officer John P. Calamos, Sr.). The concern at that time was related to the fast-growing economy. In May and most recently this month, with a nod to the unusual environment, the Calamos Investment Committee acknowledged inflation as a possibility in 2021.

While our CIOs don’t expect runaway inflation, even a modest rise in inflation can drive long-term interest rates higher. In addition, inflation has the tendency to ramp up quickly.

The Resilience of Convertibles

How can you prove the Journal wrong and “get ready”? This is yet another scenario where we like convertibles as a means of potentially shielding your clients from the corrosive effect that inflation can have on fixed income investments.

Convertibles’ unique structural features—the combination of attributes of both stocks and bonds—enable them to serve as a hedge against rising rates.

We propose convertibles as an alternative to fixed income because their prices may be more resilient to rising interest rates and inflationary pressures. As you know, traditional bonds tend to lose value in an environment of rising rates. Although convertibles are influenced to a degree by interest rate fluctuations, their underlying stocks may also appreciate during an improving economy.

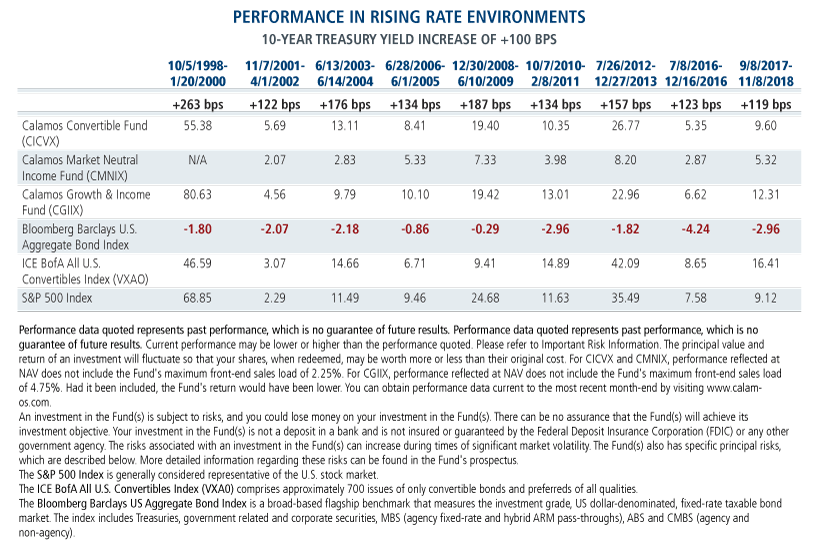

Convertibles’ equity sensitivity historically has helped minimize the negative effect of rising interest rates—resulting in superior performance for the three Calamos convertible-using funds Calamos Convertible Fund (CICVX), Calamos Market Neutral Income Fund (CMNIX) and Calamos Growth and Income Fund (CGIIX) shown below.

For more information about convertibles or Calamos funds that use convertibles, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CICVX's standardized performance.

Click here to view CMNIX's standardized performance.

Click here to view CGIIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. For CICVX and CMNIX, performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.25%. For CGIIX, performance reflected at NAV does not include the Fund's maximum front-end sales load of 4.75%. Had it been included, the Fund's return would have been lower. You can obtain performance data current to the most recent month-end by visiting www.calamos.com.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Convertible Arbitrage involves buying convertible bonds and short selling their underlying equities to attempt to hedge against equity risk, while still providing the potential for upside returns.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

Convertible Hedging Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

802057 620

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 25, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.