CTSIX’s Nelson on Politics and the Markets

With the presidential election now less than one year away, investors are beginning to contemplate what a change in the country’s leadership could mean to the stock market.

“I wouldn’t suggest using election-related data as one’s only guide to portfolio positioning,” says Brandon M. Nelson, CFA, “but instead, consider it one of many important pieces of the investment positioning puzzle.”

To Nelson, Senior Portfolio Manager of Calamos Timpani Small Cap Growth Fund (CTSIX), there are three key questions:

- How does the stock market typically perform during the various years of a presidential term?

- What are the implications for the first few years of the upcoming new decade?

- Does the stock market perform better when one political party controls the White House, Senate and House of Representatives or do investors prefer some sort of political gridlock among the entities?

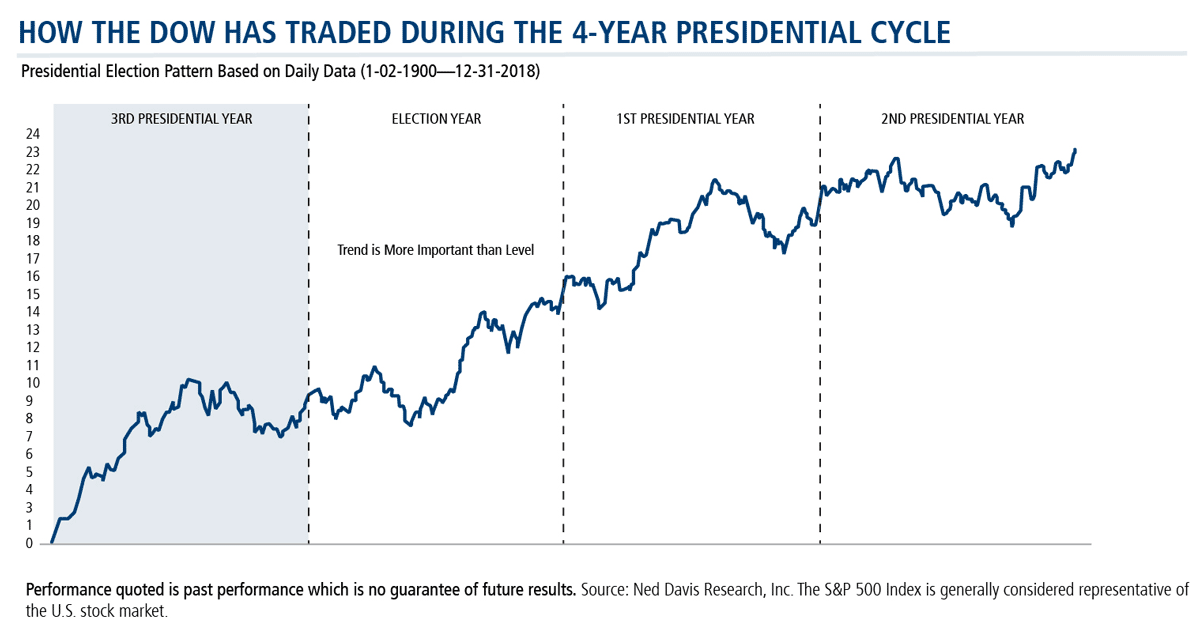

Nelson offers the chart below to address the first and second question.

The chart segments 118 years of Dow Jones Industrials’ performance by years of the presidential cycle while providing a roadmap for the first three years of the new decade.

“What caught my attention the most,” says Nelson, “was the predicted surge that begins in the middle of the election year and lasts through the middle of the year after the election. Then, it looks like we would be in a trading range through the end of that year, only to begin another surge starting near the end of the second presidential year.”

He turns to the chart below for insight on how investors react to two scenarios. The chart shows the average annual S&P 500 returns during the years when one political party controlled both the White House and both houses of Congress versus when there was political gridlock. The finding: Stock market performance since 1928 through August 2018 was similar in both scenarios, with political gridlock only slightly outperforming.

“As it relates to impact on the stock market, perhaps today’s day-to-day political jaw-boning is getting far too much attention,” says Nelson.

“With a moderate growth economy, an accommodative Federal Reserve, and reasonable valuations, we continue to think it is wise to have exposure to the stock market—especially to small caps which continue to look extremely inexpensive versus large caps,” he says.

Geopolitical and political considerations are likely to factor into market and economic performance over the next 12 months. We look forward to providing you with ideas for keeping your clients’ portfolios moving ahead, regardless of politics. Financial advisors, for more information, talk to a Calamos Investment Consultant, call 888-571-2567 or email caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk.

The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

801824 1119

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 25, 2020Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.