Up and to the Left: Asset Allocation Evolves Into Risk Diversification

After the financial crisis in 2008, many investors questioned the usefulness of diversification in protecting their assets during periods of financial stress. While this makes sense, as many investors’ portfolios were down considerably despite having been what they considered diversified, diversification was not to blame. The complexity of portfolio construction and understanding the source of risk in their allocations were most likely not fully understood, leading to underdiversified allocations.

Portfolio construction has become more complex and investors should rethink their overall approach. One approach is to think in terms of risk diversification and including new building blocks, such as alternatives, in order to minimize downside risk and create a much more diversified portfolio.

The Dominance of Equity Risk

Diversification in its simplest form is based on combining two asset classes with low or negative correlations, spreading risk across the portfolio. To illustrate this concept, three basic portfolios were created using two traditional asset classes that have low correlations over long periods of time: equities and fixed income. Over 20 years, correlations between these two assets has been about -0.02.

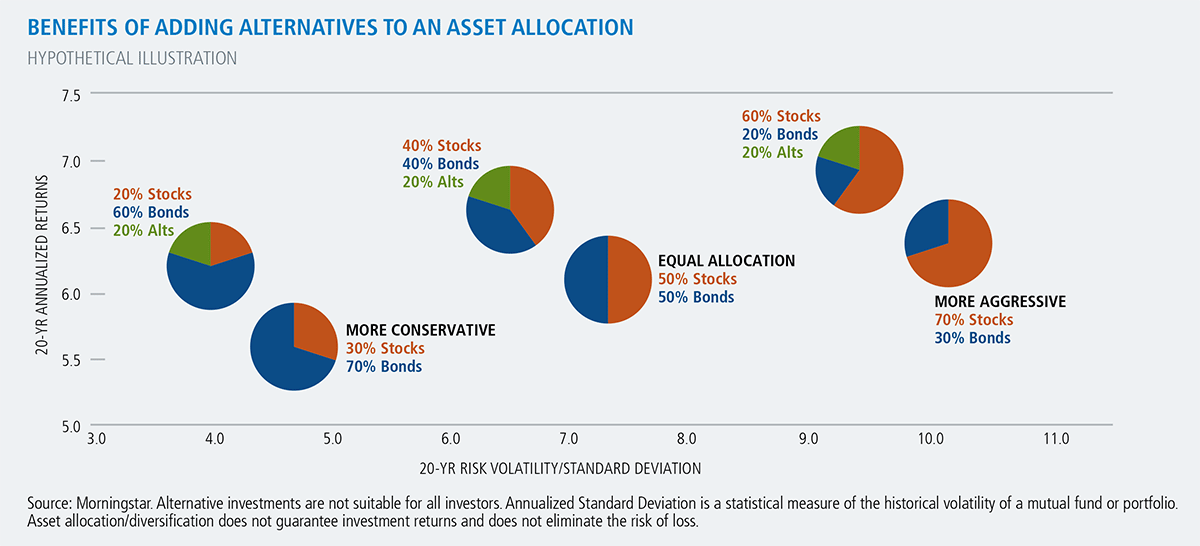

On the chart above, the left axis represents return and the bottom axis represents risk, over the same 20-year time period. The center portfolio is an equal allocation of equities and bonds, the portfolio to the bottom left would be considered more conservative with a 70% allocation to fixed income and the portfolio up and to the right would be more aggressive with a 70% allocation to equities.

Of course, this is a basic example and while the allocation has spread risk among equities and fixed income, it is still under diversified. Equity risk dominates all three portfolios. Surprisingly, even the portfolio with 70% fixed income has a high correlation to the S&P 500 over a 20-year period.

Create a Higher Probability of Favorable Outcomes

Asset allocation is evolving from the building of portfolios with traditional asset classes into risk-diversification. New portfolio building blocks are available such as alternatives and multi-asset class products to help construct portfolios that spread risk, increase diversification by adding products with low correlations to equities and bonds, and create a higher probability of favorable outcomes, especially during market downturns. These new asset classes, when added to a traditional asset allocation, can have a positive effect on portfolio risk and reward and downside protection.

To illustrate how alternatives can add value, we created an allocation that includes a 20% mix of alternatives. The alternative sleeve is represented by a mix of strategies that includes an allocation of 5% to real estate, 5% to private equity and 10% to a HFR composite that includes multiple alternative strategies.

When adding this sleeve to the original allocations, the new portfolios move up and to the left on the chart. This indicates that a more efficient allocation has been created, with lower risk and higher return expectations.

Depending on an investor’s risk tolerance and investment objective, an allocation of 10%–20% in alternatives may make sense in order to have a meaningful impact. That may seem high, but consider that many investors subject their asset allocations to 70% exposure to long-only equities across the globe. During financial stress these become highly correlated, exposing investors to potential large drawdowns.

Return to the Volatility GuideOpinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

Shawn Park, CFA

Vice President, Director of Product Management and Analytics

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.