Investment Team Voices Home Page

Investment Team Voices Home Page

What Does Market Volatility Mean For Your Asset Allocation?

John P. Calamos, Sr.

Wild market swings. Slowing global growth. Impeachment controversy. Trade tensions. Global political uncertainty.

These have not been easy months for investors. Political unknowns, trade tensions, and softening global economic data contributed to a volatile third quarter that included shifting market leadership, sharp equity selloffs and falling bond yields. The fourth quarter has also begun on a turbulent note, as markets digest weaker-than expected U.S. manufacturing data and geopolitical tensions wear on.

We expect volatility to remain elevated through this phase of the economic cycle. We are likely to see episodic selloffs due to any number of headlines, a slowing global growth outlook, central bank policies and an acrimonious political climate in the U.S. that is likely to become more contentious over coming months.

However, as I’ll explain below, there are reasons to stay invested—and many strategies for doing so in a risk-managed way.

Volatility isn’t necessarily bad—if you are a long-term investor

One of our favorite sayings at Calamos is that flipside of volatility is opportunity. We have invested through more than four decades of market cycles—including selloffs and saw-toothed markets. These experiences affirm our view that there are compelling opportunities in every environment.

In times like these, it’s important to take a long-term view. Trying to trade off of the short-term headlines is not a wise strategy. Instead, investors should focus on ensuring they have a long-term plan in place that reflects their risk tolerance and their financial goals. With the right balance in place, it can be much easier to stay calm in the face of short-term market moves.

The U.S. economy can continue to grow

We are vigilant to the signs of pressure in the U.S. economy, such as manufacturing data, the yield curve, and high levels of corporate leverage. More measured sentiment in the service sector and trends in employment data warrant close monitoring, but we are balancing our view of the recent slower growth in these areas against the longer-term strength we’ve seen.

Recent softer conditions are more likely pointing to slowdown rather than an imminent recession. The U.S. economy can continue to grow, supported by benign inflation, accommodative Federal Reserve policy, extremely low unemployment and a still-healthy consumer. Outside the U.S., the economic data and geopolitical landscape are more challenging, but we expect expansion to continue, albeit at a more subdued pace.

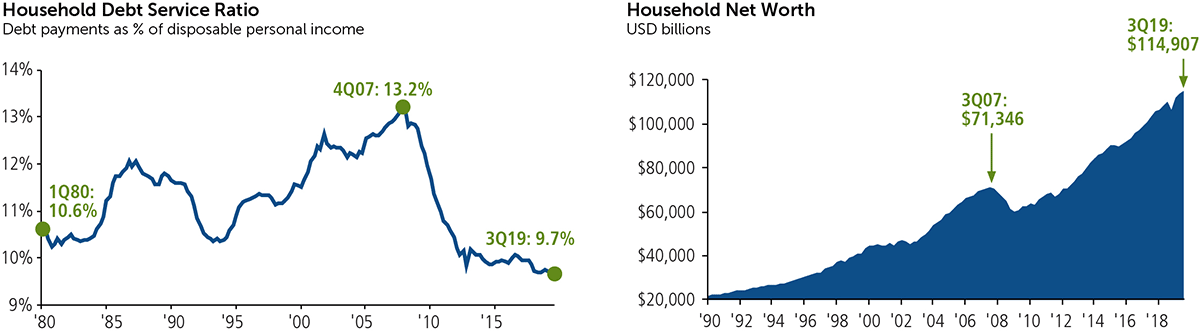

A healthy U.S. consumer has helped sustained U.S. economic growth

Sources: JP Morgan Guide to the Markets, using BEA. 3Q19 figures for debt service ratio and household net worth are J.P. Morgan Asset Management estimates. Data are as of September 30, 2019. Household debt service ratio is seasonally adjusted.

Balance upside participation with risk management

I still see many opportunities in the stock market, but elevated equity market volatility highlights the need for risk-managed and selective investment approaches. There are many ways to manage the risks in the equity markets. In a number of our strategies, our teams are favoring higher quality businesses, such as those with strong cash flows and healthier balance sheets.

Diversification is also an important dimension of risk management. For example, a stock portfolio diversified across the market capitalization spectrum may result in a better risk/reward profile over time, as companies of different sizes respond differently in a particular economic environment. For example, this may be a good opportunity to build complementary allocations to small and mid cap U.S. growth names. Smaller companies may be less directly exposed to U.S.-China trade negotiations and a global growth slowdown. (Learn more about our capabilities.)

Against a backdrop of volatility, convertible securities offer another attractive way to pursue risk-managed equity participation. Convertible securities provide the opportunity for upside equity exposure with the potential for downside risk mitigation. With active management, convertible securities can enhance portfolios in ways that stocks or bonds alone cannot. They can either be the mainstay of a portfolio or be combined with equities. (Learn more about the different ways we actively manage convertibles to address asset allocation goals.)

Opportunity in a market of bonds

Many investors look to fixed income securities to dampen equity market volatility and support income objectives, and we see a strong case for maintaining exposure to the asset class. While much of the world is caught in a market of negative yielding bonds, U.S. investors can access some of the highest interest rates in the world, even if they have trend lower.

Importantly, the fixed income asset class should be understood as a market of bonds, not a bond market. There are a breadth of opportunities for experienced, risk-conscious managers. In the current environment, we believe these include select high yield bonds. Default rates have ticked up for the asset class but are still low, with issuer fundamentals continuing to trend favorably and particularly in comparison to investment grade debt. Short-duration bonds provide another way to diversify into an asset class that is likely to be less volatile. (Learn more about our high yield and short-duration bond capabilities.)

The potential of hybrid securities

Since Calamos’ founding in the difficult financial markets of the 1970s, we’ve focused on finding opportunities that many may overlook. We were among the first to recognize the potential of convertible securities, which are “hybrids” that combine characteristics of equities and traditional fixed income. (High yield bonds are another example of hybrid securities.) We see compelling merits within another hybrid security type, the preferred security. Preferred securities are lower in the capital structure than debt, but they are higher than common stocks and are typically issued by higher rated companies. In the preferred universe, we are opportunistically identifying issues with compelling credit fundamentals, as well as attractive yields.

Dynamic multi-asset approaches for income-oriented investors

There’s a saying, “the whole is more than the sum of its parts.” At Calamos, we put this maxim into practice through a variety of multi-asset class strategies. For example, in our closed-end funds, our teams dynamically allocate among multiple asset classes, such as convertibles, equities, high yield, to name a few. Because our toolkit includes investments that have been less exposed to duration risk, it’s an alternative to funds that rely exclusively on traditional areas of the fixed income market to support distributions. Since we launched our first closed-end fund in 2002, we have been able to provide competitive monthly distributions and capital appreciation.

Look to alternative strategies for enhanced diversification

Finally, in the face of equity market volatility and low interest rates, we believe investors are well served by increasing allocations to alternative strategies. Market neutral income approaches can complement traditional fixed income strategies, while hedged equity and long/short strategies can deploy a range of tools to manage equity exposure and navigate short-term downturns. (Learn more about our alternative capabilities.)

Conclusion

For some investors, the hardest truth about investing is that there is always uncertainty. This next phase of the market cycle will require added patience and discipline. I believe the Calamos portfolios are positioned to rise to the challenge, supported by our experience identifying opportunity and managing risk in volatile environments.

Past performance is no guarantee of future results. Opinions are as of the publication date, subject to change and may not come to pass. Information is for informational purposes only and shouldn’t be considered investment advice. Diversification does not guarantee a profit or protect against a loss. Alternative strategies entail added risks. Small caps entail added risks relative to large caps.

Convertible securities risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting individual companies, sectors or industries selected for the Fund’s portfolio or the securities market as a whole, such as changes in economic or political conditions. Equity securities are subject to “stock market risk” meaning that stock prices in general (or in particular, the prices of the types of securities in which a fund invests) may decline over short or extended periods of time. When the value of a fund’s securities goes down, an investment in a fund decreases in value.

Fixed income securities are subject to interest rate risk; as interest rates go up, the value of debt securities in the Fund’s portfolio generally will decline.

18744 1019O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.