Investment Team Voices Home Page

Investment Team Voices Home Page

Vaccination Trends and Economic Data Support a Bullish Outlook for International Equities

Nick Niziolek, CFA

Throughout 2020 and 2021, our team has shared our constructive view about the relative opportunities in overseas equities, including emerging markets. At points, our optimism has run counter to market sentiment, such as in the first quarter, when investors focused on three factors, namely: (1) the speedy rollout of vaccinations in the U.S., (2) strength in U.S. economic data, and (3) U.S. fiscal stimulus. (See our second quarter outlook, “Synchronized Global Recovery on the Horizon.”) This U.S. trifecta drove a spate of strength in the U.S. dollar but did not shake our longer-term expectation of a stable-to-weakening dollar that would provide tailwinds to non-U.S. markets.

As our team discussed in May, “As the Global Recovery Takes Hold, the Dollar Resumes a Downtrend,” the pivot we expected has begun, with the dollar depreciating an additional 1.6% in May* and overseas equities and emerging market equities closing the gap on U.S. markets.

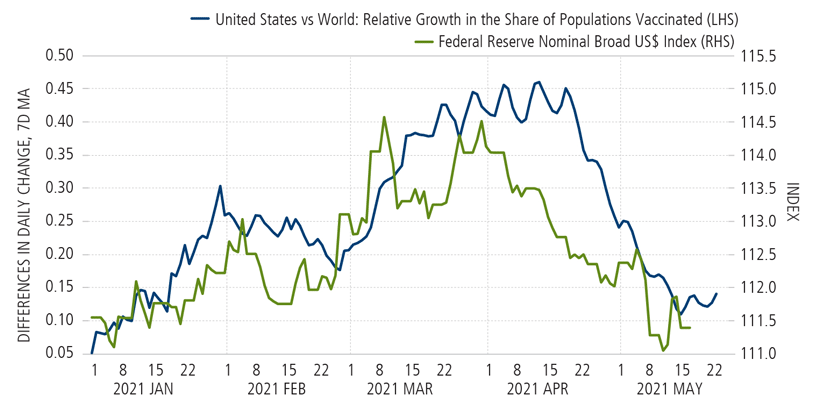

We expect that the impact of the U.S. trifecta will continue to wane, supporting a sustained weak dollar regime and opportunities in overseas markets. The pace of vaccinations is slowing in the U.S., but it’s poised to increase elsewhere. This provides an important pillar of support for our weaker dollar outlook. Recent data from Gavekal is an excellent illustration of the relationship between relative vaccination rates and U.S. dollar strength (Figure 1). There are (relatively speaking) a finite number of arms awaiting vaccinations, in contrast to a continued ramp-up in vaccine availability. Certainly, getting vaccinations to many countries will not happen overnight, but we are encouraged by recently announced plans for the U.S. to support global vaccination efforts.

Source: Gavekal Research/Macrobond, “No Reason To Reverse A Weak Dollar Call,” May 24, 2021.

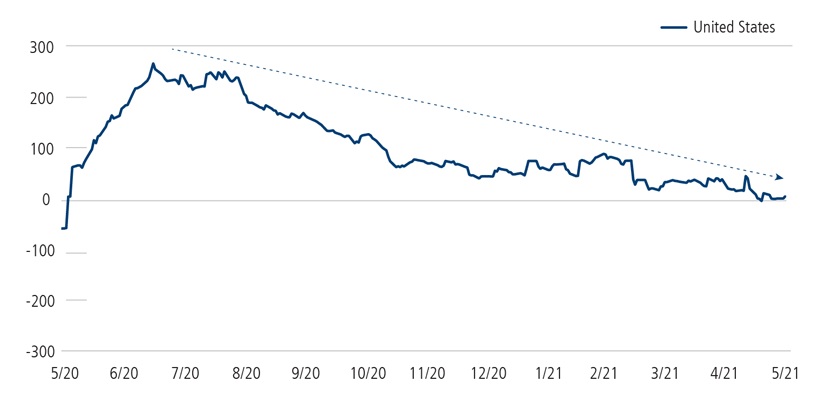

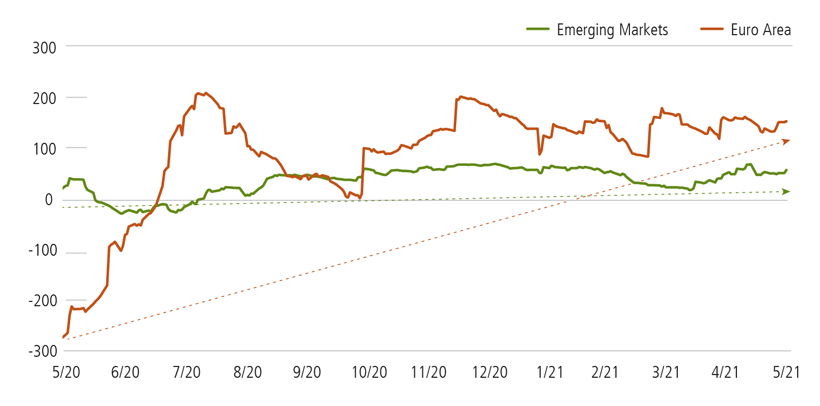

We’re also seeing global economic data trend in the direction we expected. There’s no doubt that the U.S. economy is in the midst of a strong recovery. If we look at the Citi Economic Surprise Indexes, for example, we see that data in the U.S. is still coming in better than expected, but much less so than last summer. In 2021, there was a small pick-up in late February/early March, but the trend is decelerating again. Meanwhile, in emerging markets and Europe, expectations moved down due to lockdowns, but economies have adapted more than expected and data continues to surprise to the upside.

Citi Economic Surprise Indexes, December 31, 2019 to May 31, 2021

The U.S. economy is strong, but positive economic surprises are falling.

In Europe and the emerging markets, surprise data has trended more favorably.

Source: Bloomberg. The Citi Economic Surprise Indexes are objective, quantitative measures of economic news that measure the difference between actual releases and the median of Bloomberg survey data.

Conclusion

As global vaccination efforts continue and economic recovery re-synchronizes, our outlook for a sustained weak-dollar regime is intact. Against this backdrop, the case for building allocations to international equities—in both developed and emerging markets—remains strong.

For more on our team’s perspectives on the dollar, the global economy and where we see investment opportunities, visit our blog and Global Funds Insights.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

*Source: Bloomberg. The U.S. Dollar Index (DXY) measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18887 0621

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.