Investment Team Voices Home Page

Investment Team Voices Home Page

The "Visible Hand" Part 3: What Beijing’s Anti-Monopoly Scrutiny Means for China’s Leading Internet Platforms

Alex Wolf, CFA

Understanding bottom-up opportunities requires a top-down framework. In our “Visible Hand” series, our global equity team explores how the policies of the Chinese Communist Party (CCP) create significant disruption and opportunity across industries.

Our next case study on the CCP’s Visible Hand focuses on anti-monopoly regulations and enforcement. Over the past several months, regulators in China have targeted practically every successful platform internet company in China, citing antitrust concerns. Although the headlines may be disconcerting and many risks are real, we believe the case for many major internet platform players remains strong.

Why now? There have been signs of increased regulation and enforcement coming for a few years. The State Administration for Market Regulation (SAMR) was formed in 2018 to oversee all market controls, including anticompetitive practices. By late 2019, SAMR began drafting more rules specific to online commerce. The shift toward heavier scrutiny over the past several months is a product of multiple motivations. The vocal opposition of billionaire founders to the government certainly attracted negative attention to their companies. More importantly, the COVID-19 pandemic created a changed dynamic.

Many of Beijing’s pro-competition initiatives were likely in the pipeline but were put on hold when the pandemic began and the importance of platform internet companies to the day-to-day economy was magnified. But as life normalizes, the CCP has refocused on the bifurcation between those benefiting and those struggling. The disparity widened during the height of the pandemic, as mega-cap companies earned hefty profits while lower income families tightened belts. (See our post, “China’s Consumer Recovery: Lessons from the Tortoise and the Hare?”) There is now a growing desire to see these profits shared with regular citizens, including overworked delivery drivers and the producers of the goods sold on platforms.

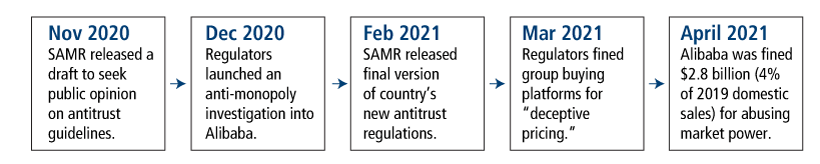

Source: Morgan Stanley, “Single Stock Teach-In: Alibaba,” May 24, 2021.

What does China want to accomplish? The government hopes to rein in high-profile billionaires, but the CCP’s ultimate goal is to ensure that companies focus on serving societal and government ambitions. The CCP realizes that the “real economy” is just as critical as ever, and that China must remain a strong manufacturer and producer of goods, especially as it works to cut dependance on overseas markets and localize its supply chains. The government does not want disruptive pricing practices dislocating any agricultural or manufacturing supply chains.

Additionally, small and medium-sized enterprises (SMEs) are important to the CCP, given their ability to create jobs, and the government will continue to crack down hard on any platforms treating them poorly. In the digital age, merchants need the platform companies to sell their products and under fair terms. Consumers also must be protected, and product quality in new areas of e-commerce is essential. Moreover, labor protections in many gig-economy industries are crucial to support these workers.

The CCP’s interest in regulating platform companies and supporting SMEs is not dissimilar to the priorities that regulators are pursuing worldwide. Globally, regulators and legislators are pushing to limit the power of big technology companies and regulate some of the most innovative and dynamic industries. The key difference between China and most other countries, however, is the speed in which Chinese regulators operate and CCP’s unfettered ability to get things done.

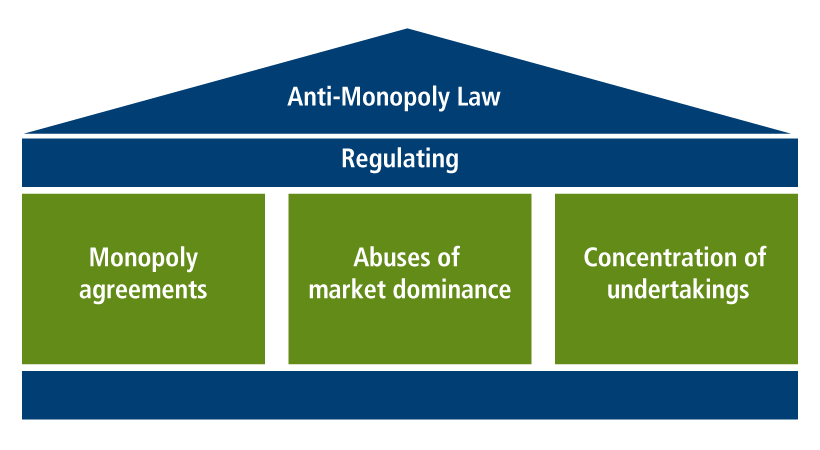

Source: Credit Suisse, “China Internet Platform regulation: navigating the competitive landscape,” July 8, 2021, using NPC and Credit Suisse.

What is changing? China’s SAMR is focused on controlling companies that are exploiting their dominant positions in a specific market, with e-commerce, food delivery, travel, ride hailing, and search engines among the areas facing pressure. Exclusivity contracts have been one of the biggest points of frustration for the CCP. E-commerce companies and food delivery companies have forced merchants to choose a single platform rather than building competitive relationships with multiple platforms. If merchants failed to comply, they faced higher fees or were even kicked off a particular platform. These exclusivity agreements are a priority for the CCP to ban. In the community group buying space, which appeals to price-oriented shoppers, platform companies have been competing irrationally (e.g., offering huge subsidies that disrupt agricultural supply chains). Other areas that are seeing increased regulatory inspection include data protection, blocking links to competitor apps, and the M&A approval process.

E-commerce naturally gets a large share of the regulatory focus given the scale of transactions and the bearing on both consumers and small businesses. China’s big platform companies—including Alibaba, Tencent, Meituan, JD, and Pinduoduo—have already felt the weight of this scrutiny. Regulators have levied fines and penalized firms are submitting self-rectification plans.

There is no disputing that increased regulation will have an impact on the stocks of these companies, both from a fundamental perspective and as an overhang on investor sentiment in the shorter term. Companies have incurred increased costs as they invest in areas that are more supportive and friendly to the merchants on their platforms. As we look to future years in our financial models, there is no doubt some of the best-case scenarios for market share and fee level assumptions have become less likely. But as we have revisited our models over the past few months, we are confident the risks have been priced in and there’s still very favorable long-term upside for many of the major platform companies.

China’s major platform companies are certainly not going away. These companies’ successes are a great source of pride for the CCP, and the current situation is more about Beijing realigning companies’ priorities. Increased regulation certainly comes with higher costs, but over time it can add an incremental barrier to entry and further cement the status of the entrenched players. These companies have been dealing with the government for a long time, and although some executives will exit over time, the businesses will remain. We are confident in our ability to pick those companies with the strongest competitive positions and greatest adaptability.

Conclusion

We’re constantly watching the political tides and adjusting our own internal assumptions and probabilities. Compared to just a year ago, the CCP has now provided a clearer picture of how it wants to regulate these industries, which we view as a positive for understanding the investment landscape. Change will certainly continue, which is to be expected when investing in innovative and disruptive industries, but we believe the CCP has largely written out the new rules and its road map for combatting monopolies.

We are confident industries such as e-commerce are not being completely uprooted because their economic importance is secure. Still, businesses will have to adapt from an environment of “grow at all costs” to a more sustainable, stable growth atmosphere. Companies will have to focus on more than just attracting as many customers as possible, with increased oversight to protect consumers and new start-ups. However, China’s big tech companies will remain as vital as ever in driving innovation, making them a compelling way to access growth in the global economy.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

18904 0821O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.