Investment Team Voices Home Page

Investment Team Voices Home Page

The Fed’s Pivot: Clear but Not an “All-Clear”

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Summary Points:

- We believe the Fed is unlikely to deliver on the market’s current expectation of six interest rate cuts in 2024 beginning in March; we expect cuts to start later in 2024.

- Our base case for 2024 includes slowing but stable economic growth, a Fed funds rate of 4.0%‒4.5% at year end, a steepening yield curve, and widening credit spreads.

- Mindful of the risks we see in a decelerating economy, we continue to migrate the credit qualities of the Calamos fixed income funds higher.

Despite the headlines, interest rate hikes, AI excitement, energy volatility and an increasingly unsettled geopolitical environment, 10-year US Treasury yields ended the year less than 1 basis point from where they began. However, the year was nothing if not eventful for the fixed income markets.

The Fed started the year with the intention of doing whatever it would take to push inflation to its 2% target, even if unemployment was rising. Nevertheless, although inflation was still well north of the Fed’s target, a softening in inflation data and moderating job growth prompted the Fed to pause its rate hiking campaign in the summer. The Fed’s decision to extend the pause in the fourth quarter, combined with particularly dovish commentary from Chair Powell in December, left the market largely convinced that the Fed’s next move would be a rate cut—and potentially the first of many. Powell’s holiday pivot led the markets to quickly price in six rate cuts in 2024 with the first potentially occurring in March.

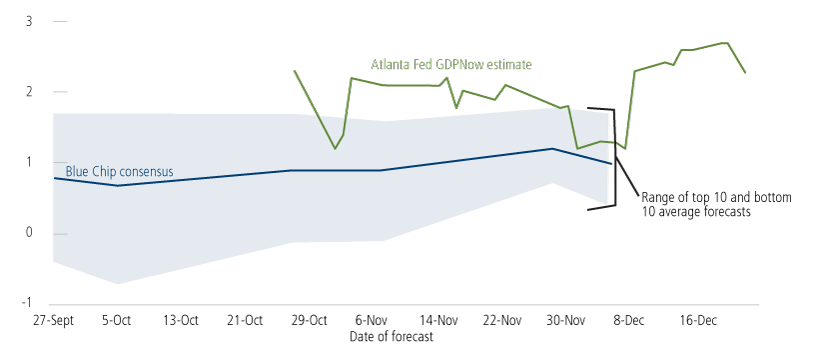

Market participants continue to be surprised by the consumer’s resilience. Rewind to a year ago, and it would have been quite difficult to find economists or market participants who expected growth in the second half of 2023 to accelerate, let alone run at a 5% clip as it did in the fourth quarter. Hotter-than-expected November retail sales data already has the Atlanta GDPNow’s fourth-quarter forecast for economic growth back above trend in the mid-2% range.

Recession Expectations Have Been Pushed Further Out

Source: Federal Reserve Bank of Atlanta (GDPNow - Federal Reserve Bank of Atlanta (atlantafed.org)) using Blue Chip Economic Indicators and Blue Chip Financial Forecasts. Data as of 12/15/2023. Seasonally adjusted annualized rate. The top (bottom) 10 average forecast is an average of the highest (lowest) 10 forecasts in the Blue Chip survey.

We believe the forecast of six rate cuts in 2024 is the market’s average of two very different outcomes. If systemic stress or employment weakness show up relatively quickly, it is possible that the Fed could cut rates far more than what markets are currently anticipating, but we assign a low probability to this outcome. In alignment with our base case, the second outcome is that the economy avoids recession altogether in 2024 and instead maintains a shallow growth trajectory with inflation falling below 3%. If our base case is correct, this allows for slight eases in monetary policy closer to the end of 2024, supporting our expectation that the Fed funds rate will end the year roughly 100 basis points lower than its current level, in the 4.0%‒4.5% range.

The yield curve will likely steepen because the Fed’s moves will have more influence over short- and intermediate-term maturity rates. Long maturity rates (those applied to maturities of 10 or more years) should face greater difficulty falling materially from current market rates near 4%. A combination of factors, including continued government deficit spending and its resulting debt issuance, the return of term premium,* and a lack of marginal buyers, should mean long rates remain “sticky” at higher levels.

Credit spreads present a conundrum. The spreads we see today have historically been more aligned with the early or middle innings of an expansionary cycle. In our view, spreads are too tight today, given the consensus—and our team’s—expectations for decelerating growth. Additionally, although credit fundamentals remain solid, they have been deteriorating as leverage increases and interest coverage and balance sheet liquidity decline. Given these mounting pressures, we expect credit spreads to move wider in the coming year, particularly in the investment-grade market, where spreads are only 25 basis points away from their tightest points of this millennium.

Although we believe growth will continue decelerating, it is too soon to call for a recession in 2024. Despite signs that the environment is more balanced than early in the calendar year, employment conditions continue to appear robust, leading us to assign a low probability to a labor-driven recession. Liquidity conditions also remain favorable, and access to capital is not a challenge for all but the most stressed borrowers. Our thesis has been that the impact of higher rates would take longer to flow into the economy because consumers and businesses were able to refinance debt at low levels during the pandemic, and this view appears to be holding.

That said, we do not profess to have a crystal ball, and we are mindful that recession signals are present, whether it is 19 consecutive months of negative leading economic indicators, the persistently inverted yield curve, or low consumer confidence survey results. In this environment, we continue to scrutinize company and industry results, looking for the excesses that typically surface ahead of recessions.

Positioning Implications

The November and December bond rally reloaded expectations for more meaningful cuts in the coming year, but we believe the Fed will have a difficult time justifying that level of accommodation unless the economy falls into a recession. Typically, when the markets anticipate more rate cuts than we believe possible, we would position the funds with durations shorter than those of their benchmarks. However, our expectation for a steeper curve where short maturities benefit from Fed easing and long rates are stickier at higher levels has led us to position Calamos Total Return Bond Fund and Calamos Short-Term Bond Fund with neutral to slightly long duration. The duration of Calamos High Income Opportunities Fund remains below its benchmark, but interest rate sensitivity in the high yield market is a smaller driver of risk and return.

Credit spreads are the most challenging piece of the puzzle to square with other economic realities. We believe the risks to credit spreads are asymmetrically unfavorable at these levels. Our fundamental research continues to identify high yield issuers and industries where investors are well compensated for the current risk profile, but we have continued to migrate portfolio credit quality higher across the Calamos fixed income funds as we prepare for what we expect to be a weaker 2024.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Dovish refers to accommodative monetary policy.

*The term premium is the amount by which the yield on a long-term bond is greater than the yield on shorter-term bonds. This premium reflects the amount investors expect to be compensated for lending for longer periods.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

024001h 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.