Investment Team Voices Home Page

Investment Team Voices Home Page

Stabilizing Interest Rates Can Set the Stage for a Merger Surge

Summary Points:

- By pursuing absolute returns that are largely uncorrelated to equity and fixed income markets, we believe CMRGX provides a compelling way to combat equity market and interest rate volatility.

- Our team’s extensive experience with arbitrage strategies gives us a potential edge in public acquisitions where we can utilize convertible bonds, liquid options, or other securities within a merger target’s capital structure.

- The current regulatory environment, although volatile, provides ample opportunities for our merger arbitrage strategy.

As investors know all too well, diversification strategies built exclusively around traditional stock and fixed income funds are not failsafe asset allocation approaches. To address the challenges of an environment that we believe increasingly warrants enhanced diversification (e.g., liquid alternative strategies), Calamos recently introduced Calamos Merger Arbitrage Fund (CMRGX).

The Mechanics Behind Merger Arbitrage Opportunity

When mergers between companies are announced, there’s typically uncertainty around the consummation of the deal and the timeline of the merger’s completion. As a result, the stock price of the acquisition target is normally lower than the announced acquisition price. Our team seeks to provide absolute returns that are largely uncorrelated to equity and fixed income markets by taking advantage of dislocations between potential and proposed merger-and-acquisition deal prices and where companies’ stocks are publicly trading before the deals are completed.

The Calamos Edge: Experience and Proprietary Research

We can go about capturing this arbitrage spread in a variety of ways, and we believe our decades of experience with comprehensive capital structure research gives us an edge in altering risk/reward through different securities and trade structures. In some situations, equities provide what we believe are the most attractive opportunities, and in other instances, we will choose convertible bonds or other fixed income securities. Liquid options provide additional tools for tailoring risk/reward.

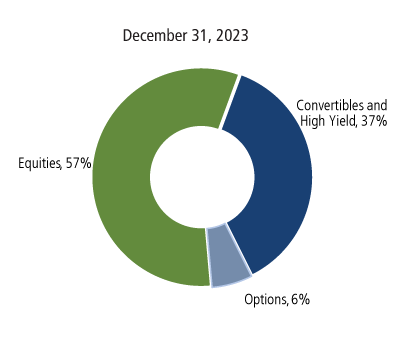

We believe CMRGX is well positioned to take advantage of the merger landscape. As of the close of the reporting period, CMRGX held securities associated with 33 deals or potential deals. Equities made up 57% of the securities in the fund, followed by convertible securities and high yield at 37%, and options at 6%. We have used fixed income and options positions to manage downside risk, and we believe these positions can continue to provide valuable benefits.

CMRGX: Finding Opportunities across Target’s Capital Structures

The portfolio is actively managed and subject to change daily without notice.

Finding Opportunity in Fluid and Even Volatile Conditions

We are always mindful of the political and regulatory backdrop. As it relates to mergers, the Biden Administration has taken a more holistic approach to identifying harms, which has played out through government agencies making additional requests for information and through lawsuits trying to block deals that in the past might not have garnered scrutiny. Although this has made for a bumpier ride, the volatility has provided us with opportunities to make money.

That said, a tighter regulatory environment and a volatile interest rate world have negatively impacted the quantity of deals in our universe, which is typically US targets with market caps of more than $500 million. However, we believe there is substantial pent-up demand among companies that are ready to sign deals once rates settle down. We expect significant activity when rates simply stabilize; in our opinion, they don’t even have to fall to create a tailwind for a ramp-up in merger activity.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Merger Arbitrage Fund include: in the case of an investment in a potential acquisition target, if the proposed merger, exchange offer or cash tender offer appears likely not to be consummated, in fact is not consummated, or is delayed, the market price of the security to be tendered or exchanged will usually decline sharply resulting in a loss to the fund, the fund invests a substantial portion of its assets in securities related to a particular industry, sector, market segment, or geographic area, its investments will be sensitive to developments in that industry, sector, market segment, or geographic area, the Fund is classified as “non-diversified” under the Investment Company Act of 1940, American Depository Receipts risk, call risk, convertible hedging risk, convertible securities risk, covered call writing risk, currency risk, debt securities risk, derivatives risk, equity securities risk, foreign securities risk, hedging transaction risk, high yield risk, lack of correlation risk, liquidity risk, MLP risk, options risk, other investment companies (including ETFs) risk, portfolio selection risk, portfolio turnover risk, REITs risk, Rule 144A securities risk, sector risk, short sale risk, small and mid-sized company risk, Special Purpose Acquisition Companies risk, special situations or event-driven risk, synthetic convertible instruments risk, tax risk, total return swap risk, U.S. Government security risk, and warrants risk.

024001d 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.