Investment Team Voices Home Page

Investment Team Voices Home Page

Sorting Through a Mixed Bag

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Summary Points:

- We believe the market continues to price in a rate path that is too aggressive, even as its expectations for Fed cuts have moderated.

- Economic data has become increasingly mixed, and we are seeing early signs of building stress, although not as much as we would expect in credit markets.

- We continue to migrate portfolio credit quality higher across the Calamos fixed income funds in anticipation of a softer economy.

Economic pessimists were frustrated as the long-awaited economic slowdown refused to materialize in the first quarter. The labor market was resilient, although tighter monetary policy led to a more equal balance between labor supply and demand. Consumer spending continued to be strong despite the interest rate backdrop. Even so, inflation, although higher than the Fed’s target, has been gently falling over the past year.

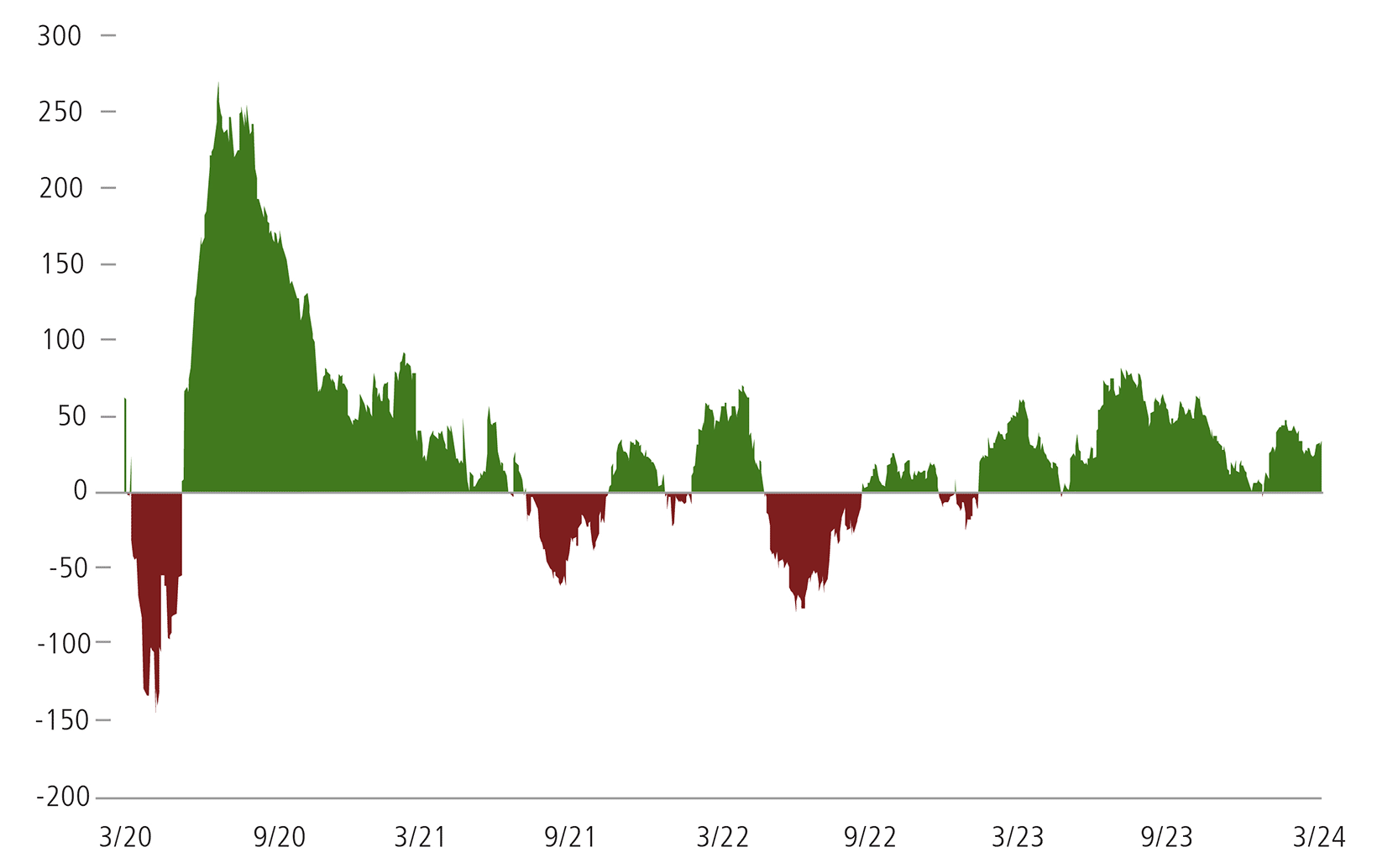

The US economy has bested economist estimates through most of the post-pandemic period

Source: Bloomberg. The Citi Economic Surprise Indices measure data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected and a negative reading means that data releases have been worse than expected.

The quarter was a healthy one for corporate credit metrics. Leverage ratios (debt to EBITDA) in the universe of investment-grade rated companies were stable, while those in the high yield market improved slightly. Surprisingly, in the first quarter, the steep deterioration in high yield interest coverage that had been underway for over a year reversed, but coverage ratios in investment-grade markets continued to fall.

Typically, we would expect to see more stress building in credit markets as the tightening cycle matures, but it hasn’t materialized. The market has taken notice of these fundamentals, and spreads in both high yield and investment grade are within easy striking distance of the tightest levels since the Great Financial Crisis (as spreads come in, bond prices increase).

Still, there are early signs of building stress that warrant vigilance. Consumer delinquencies across debt types (autos, credit cards, unsecured consumer loans) and borrower quality (prime, near-prime, subprime) are increasing. In some areas, delinquencies now exceed those of the pre-pandemic years. Manufacturing activity is soft-to-contracting, and the yield curve remains deeply inverted, indicating continuing stress in the financial sector.

In this environment, we believe the Fed is looking for reasons to cut rates and provide relief to the weaker parts of the economy (especially commercial real estate). The question is whether inflation data will continue to normalize, allowing for some relief in the form of easier monetary policy. The inflation reports from January and February make it more difficult for the Fed to move quickly, and the market has finally dropped the (unrealistic) expectation of up to seven cuts in 2024 (three are now expected by year-end). We continue to believe the forward curve implies too much easing of policy in both 2024 and 2025, unless economic activity weakens more than expected.

Overall, the views we set forth at the start of the year are intact. We continue to believe that it is too soon to call for a recession in 2024, though we anticipate additional softening in growth. Employment conditions are more balanced but certainly sufficiently robust for us to assign a low probability of a labor-driven recession. Liquidity conditions remain favorable and access to capital is still not yet a challenge for all but the most stressed borrowers. Our thesis has been that higher rates would take longer to impact the economy because consumers and businesses have taken advantage of low rates to extend their loans, which has made them less vulnerable to higher interest rates, and this outlook appears to be playing out.

Positioning Implications

That said, recession signals are present, including the persistent inverted yield curve, a long stretch of negative leading economic indicators, and low consumer confidence survey results. We continue to scrutinize company and industry results, looking for the excesses that typically surface ahead of recessions.

The team’s expectation is for defaults in the high yield market to continue to increase to its long-term average, with large performance differences between the winners and losers. Our fundamental research process continues to identify high yield issuers and industries where investors are well compensated for current risk profiles. We have continued to migrate portfolio credit quality higher across the Calamos fixed income funds as we prepare for what we expect to be a softer economy.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Dovish refers to accommodative monetary policy.

EBITDA earnings before interest, taxes, depreciation, and amortization is a measure of the overall profitability of a business.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

024014c 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.