Investment Team Voices Home Page

Investment Team Voices Home Page

Risk in the Rally?

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

Summary Points:

- We remain wary of chasing highly valued stocks and are vigilant to the potential for elevated volatility after a long rally in the US stock market.

- Our use of alternative data, particularly environmental factors, gives us a more complete view of the risk/reward opportunities in sectors, industries and individual companies.

“The longer the expansion and the longer the bull market, the more intense the speculation at the end of it is. People’s sense of disbelief gets eroded, and their skepticism gets eroded the longer things go on. They begin to realize that traditional metrics of value don’t count.”

—Jim ChanosNothing slowed equities in the first quarter as market participants accentuated the positive and pushed the S&P 500 Index nearly 30% above its October 2023 lows. Liquidity continued to play a large part in massive gains across most asset classes, as it has since the end of the Great Financial Crisis. Markets seem to be pricing in a high probability of a soft landing, and risk aversion is taking a back seat. We believe the resulting lack of fear and volatility leaves room for negative surprises to roil the markets with relatively high valuations likely to exacerbate drawdowns.

So far in 2024, a small group of AI-related tech names continue to contribute outsized performance to market-cap weighted indexes, like the S&P 500. Just four stocks—Nvidia, Microsoft, Meta and Amazon accounted for nearly half of the S&P 500’s gain for the quarter.

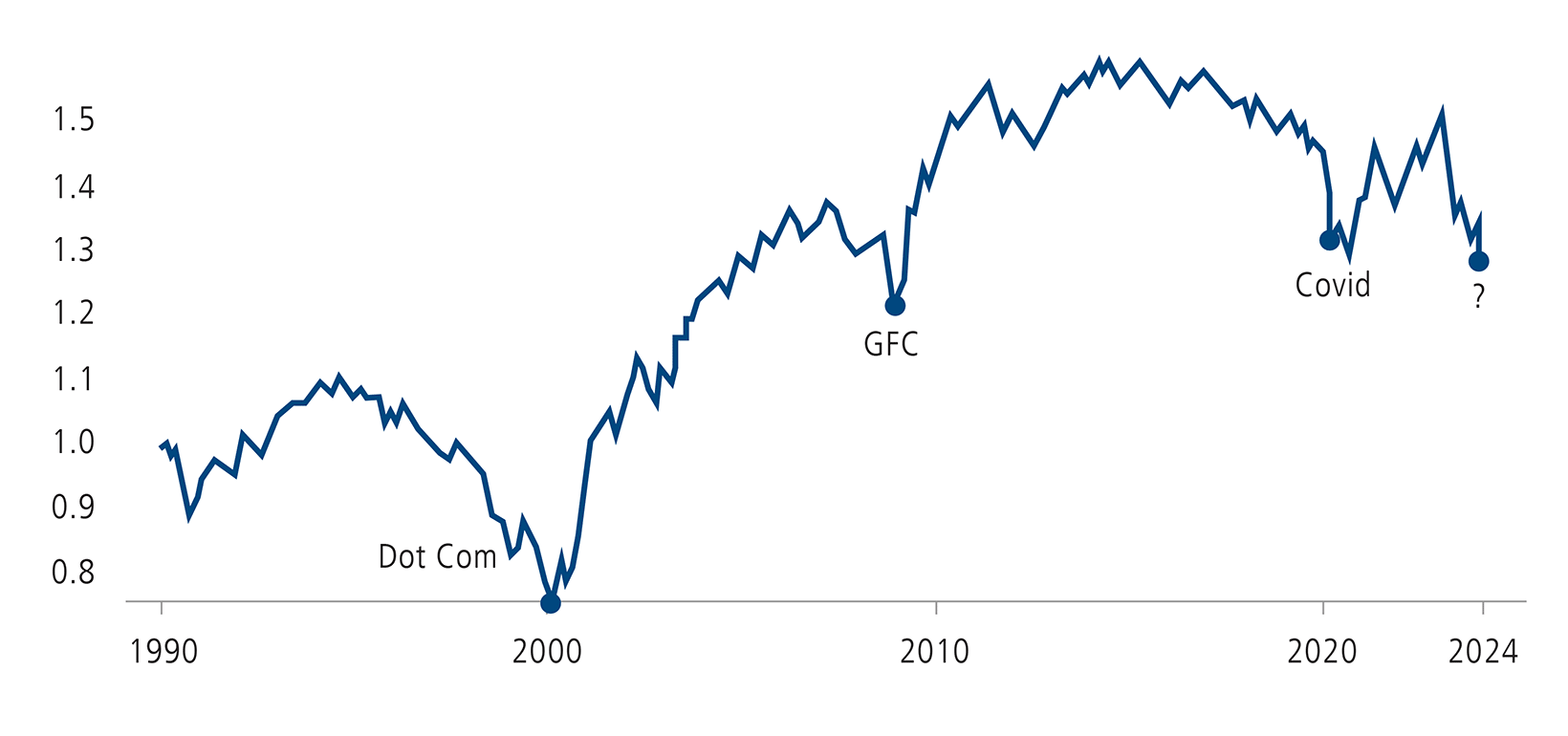

To put this in perspective, during the first quarter, the market-cap weighted S&P 500 gained 10.6% while the S&P 500 Equal Weighted Index gained 7.9%. History has shown that when the equal-weighted index underperforms meaningfully, there’s usually been a negative reason.

When the average stock lags, it’s been due to a bubble or crisis. Why now?

Past performance is no guarantee of future results. Source: Bloomberg, “Magnificent or Marxist: Passive Investing Is Back on Trial,” John Authors, February 8, 2024.

Whatever the reason, equity diversification has not worked well during this rally. Despite the current environment, we continue to believe that holding a high-quality, diversified basket of stocks is the best way to achieve outperformance with less volatility over the long term.

We’re often asked to weigh in on the intensifying debates about ESG, which are getting more political by the day. The issues are complicated, but our answer is simple: As stewards of investors’ capital, we are concerned with the financial not the political. We follow how and where capital is flowing, and carefully consider all available data about potential risks.

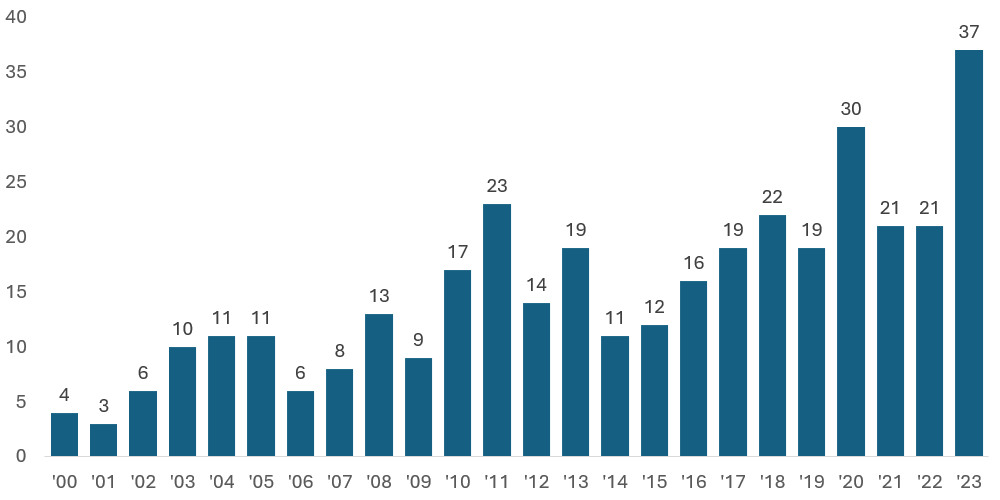

Alternative data is an essential part of the risk/reward equation. For example, we are highly selective in our approach to insurance companies because environmental factors (weather) are creating challenging capital implications for that industry. Traditional analysts who don’t take environmental risks into account may miss important risks. Consider that in 2023, there were 37 insured billion-dollar economic loss events because of extreme weather, which set a new record, according to Aon.

Extreme weather, extreme balance sheet risks

Source: Aon, “2024, Climate and Catastrophe Insight.”

These numbers are too big to ignore if you are trying to understand the industry and companies in it. This is why, for more than 25 years, the Calamos Sustainable Equities Team has incorporated alternative data, especially environmental data, into our investment decisions.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The S&P 500 Equal Weighted Index includes these same companies but is not market cap weighted.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s)will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo. Giannis Sina Ugo Antetokounmpo is the majority shareholder of Original C, with a 68% ownership interest.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

The Adviser is jointly owned and controlled by Calamos Advisors LLC and, indirectly, by Mr. Antetokounmpo, a well-known professional athlete. Unanticipated events, including, without limitation, death, adverse reputational events or business disputes, could result in Mr. Antetokounmpo no longer being associated or involved with the Adviser. Any such event could adversely impact the Fund and result in shareholders experiencing substantial losses.

024014e 024

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.