In our January outlook, our Investment Committee discussed our view that unusually low levels of market volatility would give way to higher—and more normal—levels. This has indeed been the case, and as we enter into this new phase of the bull market, many investors are asking what to expect from here—and what to do about it.

We anticipate more volatility as interest rates adjust to the prospect of stronger and sustained global economic growth. Market participants are likely to remain very sensitive to economic releases. This morning, it’s CPI and retail sales data. However, it’s important to not lose sight of fundamentals, including a positive outlook for corporate earnings. As long as the upward corporate earnings trend remains intact due to ongoing global expansion, the bull market in equities can continue.

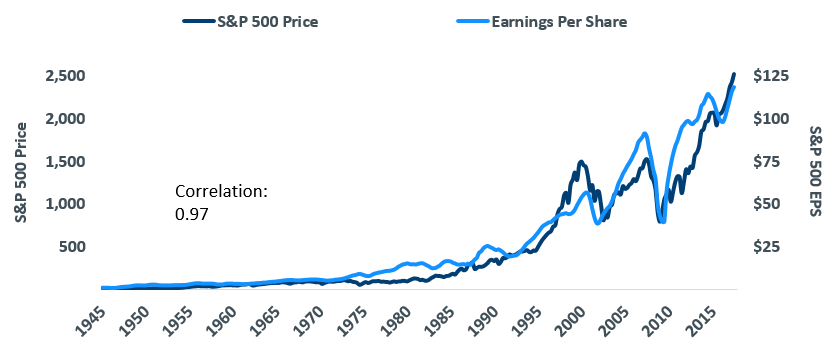

Figure 1. Earnings Have Driven Stock Prices

Historically, the performance of the S&P 500 Index has been aligned with the direction of earnings growth.

Past performance is no guarantee of future results Source: Bloomberg, Standard and Poor’s. Data as of 9/30/2017.

Volatile markets are exactly when patience and discipline matter most. Our teams are sticking to their disciplines and finding ways to turn short-term turbulence into a strategic advantage. They are paying close attention to potential downside risks, and seeking out companies with attractive long-term fundamentals.

I’d encourage investors to apply similar principles. Take a long-term approach, with a proactive focus on risk management. To me, this environment once again highlights the value of actively managed strategies. Passive strategies can’t respond the way active ones can to the risks and opportunities associated with broad selloffs. For example, during this most recent spike in volatility, our active and experienced approach to risk management was a key differentiator for our convertible and alternative strategies.

Investors who try to time the market end up getting whipsawed, while those who stay the course tend to be better positioned in the long term. (See my recent post on the dangers of market timing.) I’ve seen this play out throughout my investment career—from the difficult financial markets of the 1970s to the tech market collapse in 2000, through the subprime mortgage crisis. In each of these periods, the flipside of volatility was opportunity. I believe what we are seeing in the markets now is no different.