Investment Team Voices Home Page

Investment Team Voices Home Page

Global Cybersecurity Stocks: Benefitting from Mix of Long- and Short-Term Factors

Alex Wolf, CFA

Our team has recently written about the tailwinds for global defense stocks amid heightened geopolitical tensions, and we see these trends having a comparable impact on cybersecurity spending. The industry already had a nice setup of long-term secular drivers as the need for protection in an increasingly digital world grows. Now shorter-term effects enhance this backdrop as the need to fend off imminent threats grows amid global tensions.

Source: Palo Alto Networks, “Q3 Fiscal Year 2022 Earnings Call,” May 19, 2022.

Over the past several years, vast secular changes in corporate IT infrastructure have exacerbated the complexity of securing those networks. Workloads are increasingly spread across hybrid environments that utilize combinations of public cloud, private cloud, and on-premise data centers. Additionally, a workforce that continues to spread across remote locations expands the attack surface, and the need for more security checkpoints expands with it. As a result, there is a growing need for securing and responding to those threats and utilizing newer generation products that were built for cloud-hosted environments. “Zero trust” is a popular term used in cybersecurity, which essentially means moving away from a traditional “secured walls” environment toward a state of constantly monitoring and assessing all users for potential threats, within or outside a network. This need for constant monitoring changes the landscape of security and the products that are needed to constantly assess and validate users and threats.

At the same time networks are becoming more difficult to protect, hackers are becoming more sophisticated. “Zero day” is a term for a vulnerability in a network that can be exploited so fast that no patch can be created quickly enough to defend it. These zero days often are sold through a unique, opaque system of brokers who sell them to the highest bidder. Traditionally, these zero days have been bought and exploited by large governments around the world for espionage, but with growing tension and hostilities, the pool of buyers is rising along with the potential for nefarious uses.

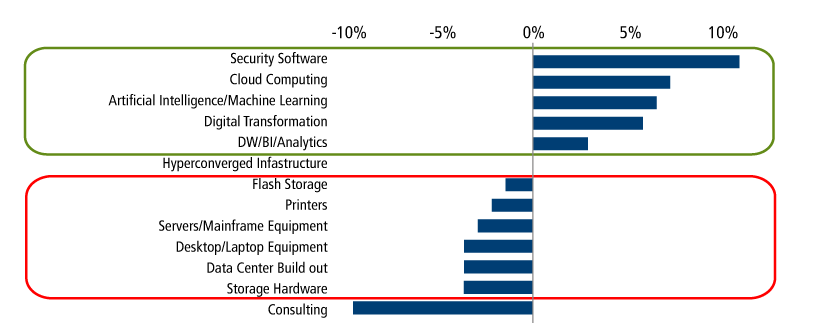

CIOs were asked the following: “Which external IT spending projects will see the largest positive and negative impacts to spend due to uncertainty in macro and geopolitical outlook?”

Source: Morgan Stanley “1Q22 CIO Survey – A Surprisingly Durable View on Growth,” AlphaWise n=50 (US and EU data), Morgan Stanley Research, March 31, 2022.

From an investing perspective, this is a compelling time to invest in cybersecurity. Many cybersecurity companies had been among the most expensive stocks, and now they are facing pressures in a rising rate and inflationary environment. This volatility has created opportunity for a select group of companies, and we see pockets of the sector offering highly compelling valuation opportunities. Security also offers some of the best defensive characteristics within tech.

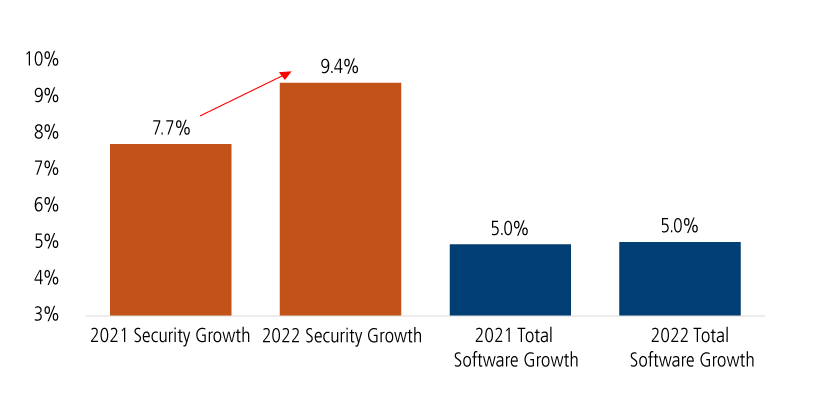

Budget growth: security versus overall software

Source: Morgan Stanley, June 1, 2022, AlphaWise (Morgan Stanley CIO Survey during November and December 2021), Morgan Stanley Research. n=60 (US and EU data).

As far as the types of companies that the Calamos Global Equity Team seeks in the current market environment, we believe that having resilient models with strong balance sheets is crucial. Sustainability of growth is essential as well, and we prefer acceleration in demand trends. In terms of the specific business models, a platform-type approach is a significant advantage. Companies that have built a long history of working with huge client bases but also are leaders in the most advanced products can continue to sell deeper into their customer bases. Alternatively, companies that dominate a vital and growing niche with a proven edge in that service will remain mission critical.

The tailwinds in cybersecurity are certainly not unknown, and it is a highly competitive market in terms of the number of vendors a company can choose from. Big Tech has many offerings as well. We believe the best long-term investment opportunities are companies that have deep customer relationships and top-tier products, as well as compelling stock valuations that have been unfairly caught up in recent market rotations. Although the US certainly has terrific cybersecurity companies, we believe a global approach is wise as we see an emergence of companies in Europe, Israel, and elsewhere that offer the attributes we seek.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18964 0622

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.