Investment Team Voices Home Page

Investment Team Voices Home Page

Global Defense Stocks Enjoy New Tailwinds

Jay Stewart, CFA

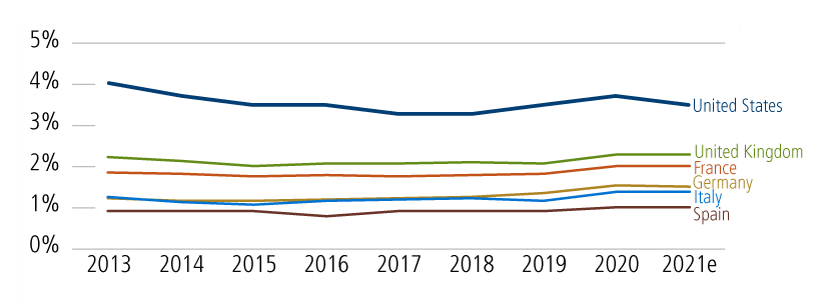

Geopolitical tensions are causing many nations to reassess their defense capabilities and readiness. Following years of peace in Europe, defense spending has been an afterthought for many countries, and budgets stagnated. Many NATO member countries have been undershooting the agreed-upon target of 2% of GDP.

Among NATO countries, only the US, UK, and France currently spend more than 2% of GDP on defense

Source: BofA Global Research, “Aerospace and Defence Update, Global Defence—New Normal in Europe,” March 2, 2022, using NATO. 2021 data is NATO estimate.

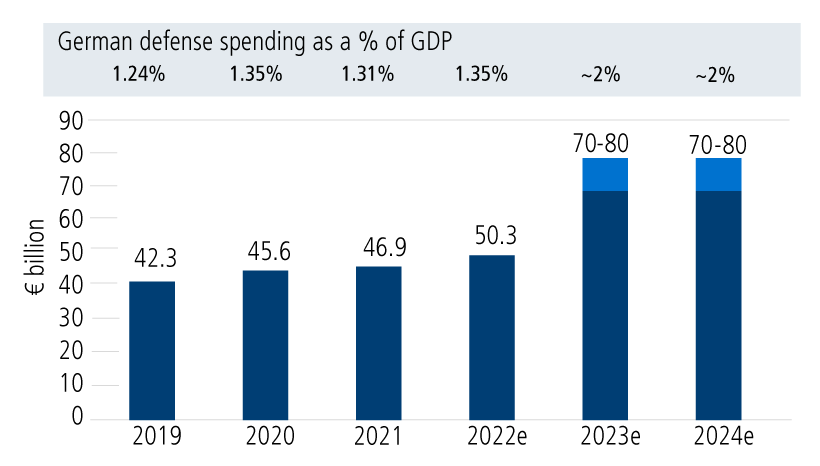

Given Russia’s invasion of Ukraine, this is all changing. Germany announced a €100 billion fund to improve military preparedness and will increase its annual spending to the agreed target, up from 1.3% in recent years. Other European nations, including the Netherlands, Poland, Denmark, Sweden, Romania and Latvia, have stated their intentions to increase spending. Furthermore, Sweden and Finland have announced plans to apply for NATO membership.

German defense spending

Source: Rheinmetall, “FY 2021 Conference Call, Taking responsibility in a changing world,” March 17, 2022. German defense spending based on German Federal Ministry of Finance. 2023 estimate based on German government draft and statements on the federal budget and Rheinmetall estimated budget development, 2024 estimate BIP data based on Statista.

Although Europe remains the focal point for the improved outlook in defense spending, an increased emphasis on military readiness will likely play out globally. The implications of this shift are significant. If European NATO members increased defense spending to 2% of GDP, the annual spend across Europe would increase by approximately 25% or about $75 billion to $375 billion.

We see three primary reasons for the recent outperformance in European defense stocks:

-

Once-limited defense spending is ramping up. European defense companies have faced headwinds from lower defense budgets and a lack of clarity around future spending, which has led market participants to view these stocks as having less attractive growth characteristics.

-

ESG concerns could wane. Many ESG-focused funds have eschewed investing in defense stocks because of negative perceptions related to social issues. However, this stance could soften. A recent report from the European Commission on Social Taxonomy provided a clear indication that defense companies should not be excluded from qualifying for ESG investment. The commission noted that defense companies could be considered inclusionary because of their activity as “human rights defenders.”

Swedish banking group Skandinaviska Enskilda Banken (SEB) is an early adopter of this evolving outlook. SEB has announced it is allowing six of its 100 funds to invest in defense companies. Although this is still a small percentage of assets, SEB’s decision could be the start of a sea change for ESG funds to complete further diligence on the industry and potentially allocate capital to this space.

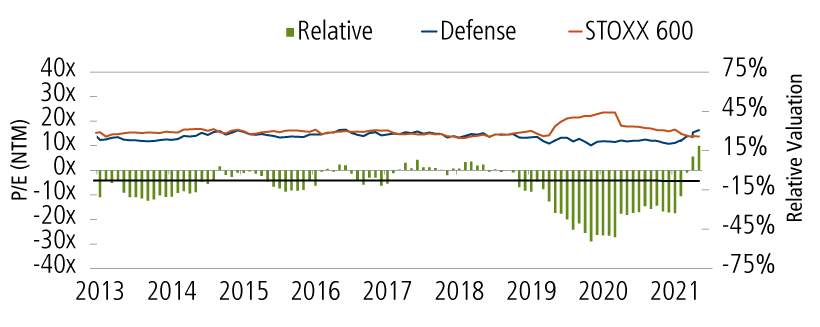

- Improving valuations. The combination of the first two factors—structural avoidance by ESG funds and a lack of confidence in the outlook for defense spending—led European defense stocks to trade at a 20‒30% discount to the STOXX 600 Index.

Relative Valuations of European Defense Stocks

Past performance is no guarantee of future results. Source: Morgan Stanley, “US vs European Defense: Mind the Valuation Gap?,” April 22, 2022, using Morgan Stanley Research, Refinitiv. NTM=next 12 months.

Clarity around multiyear spending plans across Europe should provide a tailwind to fundamentals in the years to come. We believe the recent re-rating of defense stock valuations relative to the overall index should prove sustainable as defense companies offer an attractive combination of undemanding valuations, accelerating fundamentals, and solid visibility for demand. We expect to see additional positive earnings revisions over the next 12 to 24 months as NATO countries finalize forward defense budgets.

As defense spending continues to increase globally for the foreseeable future, particularly in Europe, our Global Equity Team sees a long-term opportunity to participate in this growth. We expect nations around the world to reassess their budgets because of the Russian invasion of Ukraine. Near-term spending will focus on military preparedness, but we believe longer-term investments in research and development, technology upgrades, and procurement will be additional catalysts that will remain supportive for defense industry fundamentals. The stability in outlook should boost revenue growth, margins, and cash flows across the industry and make the defense industry a compelling area of opportunity in an uncertain world.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Indexes are not actively managed, do not include fees or expenses and are not available for direct investment. The STOXX 600 Index is a measure of European stock performance.

18957 0522

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.