Investment Team Voices Home Page

Investment Team Voices Home Page

Favorable Tailwinds for Convertible Securities

Jon Vacko, CFA, and Joe Wysocki, CFA

- Balanced convertibles remain the mainstay of the fund because they offer an attractive level of equity upside participation with less structural exposure to downside volatility.

- The fund is aligned with secular trends, including artificial intelligence, productivity enhancement, cybersecurity and electric vehicle adoption, and cyclical opportunities tied to consumer activity.

- Issuance trends this year are encouraging, with investment-grade companies increasingly recognizing the potential benefits of issuing convertibles.

We entered 2023 with the view that the macro variables—most notably inflation, economic growth, monetary policy, and geopolitical events—that had driven recent market volatility would likely dominate headlines to start the year. However, we also believed that as the year progressed, market participants would gain clarity around the severity of these headwinds, and a stabilization could potentially turn into a tailwind for risk assets.

As we reach the second half of 2023, inflation has continued to cool, the Fed has paused interest rate hikes, geopolitical risks have not escalated, and a systemic spread of major bank failures has been avoided. Although macro variables are far from signaling “all clear,” we are cautiously optimistic that this relative stability can continue into the back half of the year.

With this backdrop, our focus remains on actively managing the risk/reward tradeoffs within Calamos Convertible Fund (CICVX). Broader equity market indexes posted solid gains during the first half of 2023, but a small set of larger-cap companies have primarily driven returns. We believe a continued stabilization of the macro backdrop could turn this narrow market leadership into broader strength, which would benefit convertible issuers that tend to be more mid-cap, growth-orientated companies.

We maintain our preference for balanced convertible structures that provide a favorable asymmetric payoff profile by offering attractive levels of upside equity participation with less exposure to downside moves. We also see select opportunities within the bond-like segment of the convertible market in issues that can potentially benefit from spread compression while offering attractive yields and good structural risk mitigation from potential equity market weakness. We remain especially selective in the group’s most distressed names, focusing on those with solvent business models that have liquidity.

Technology, healthcare and consumer discretionary are the largest sector allocations in the fund. We emphasize bottom-up company analysis, favoring companies that are executing well despite macro uncertainties and positioned to benefit from thematic tailwinds. Select cyclical trends, particularly among consumers’ resilient demand for services over goods, remain strong. In addition, secular trends such as artificial intelligence, productivity enhancement, cybersecurity and electric vehicle adoption are strong long-lasting growth opportunities. Many companies within these areas have shifted their focus toward efficient growth, improving margins, generating free cash flow and increasing profitability. These efforts should prove advantageous going forward as higher-quality growth becomes scarce as the era of free money ends.

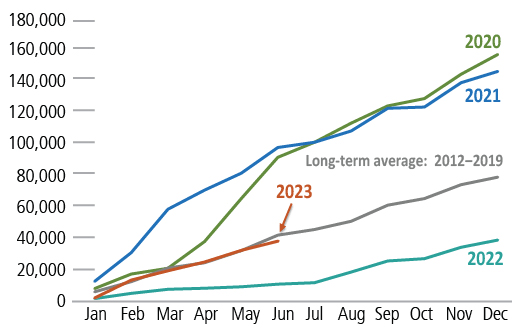

Convertible new issuance has accelerated after a subdued pace last year, with issuance returning to longer-term trend levels (Figure 1). In particular, investment-grade companies are coming to the convertible market at a more rapid pace than we have seen in many years. We are optimistic about issuance prospects going forward and believe the pace will continue to be strong as companies increasingly recognize the benefits of taking on lower borrowing costs by issuing convertibles instead of traditional bonds in an environment of higher interest rates.

Figure 1. New issuance: Back to trend

Source: BofA Global Research. Data through June 2023.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.