Consistency Through Uncharted Waters

First published: August 7, 2023

Calamos Market Neutral Income Fund has delivered consistent performance in recent uncertain and turbulent environments.

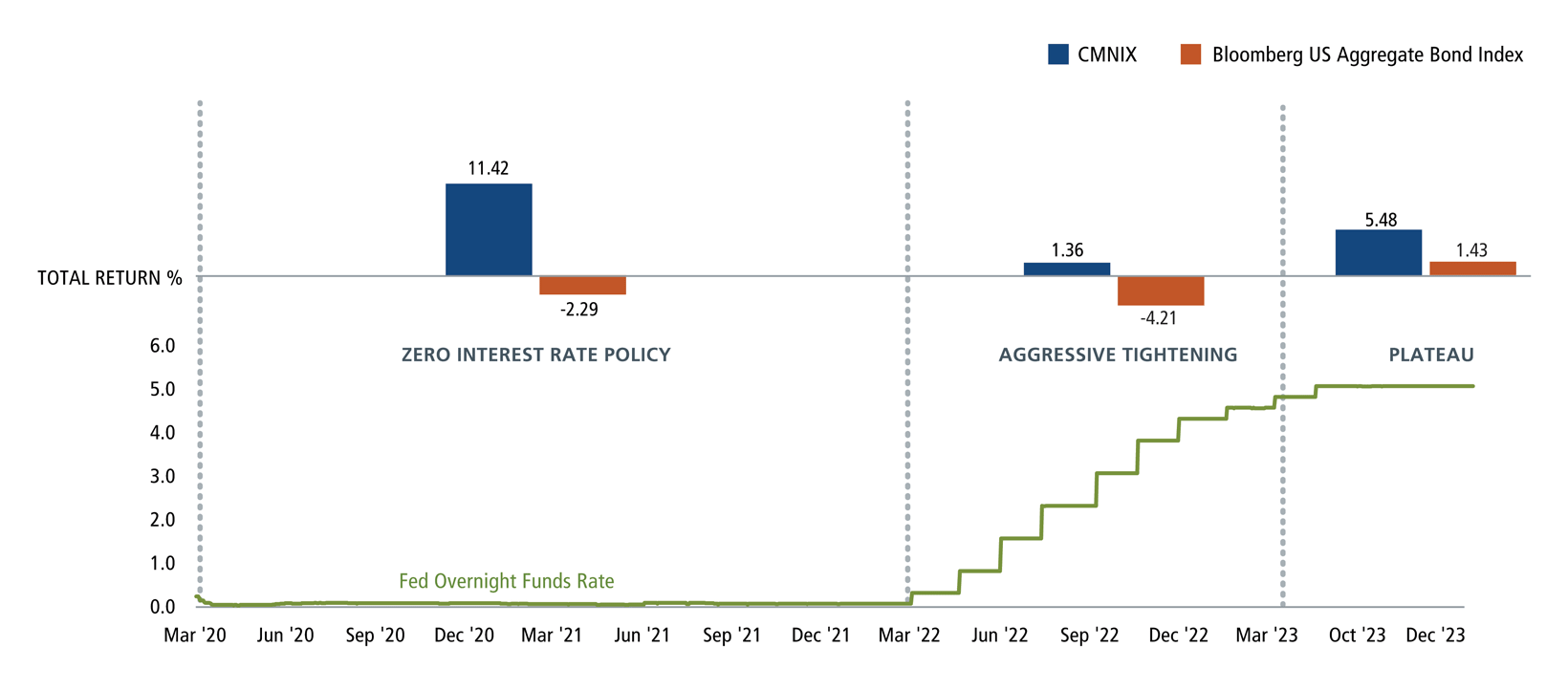

We have experienced historic monetary policy shifts and their impact on markets over recent months—from a prolonged zero interest rate policy, to the most aggressive tightening in history, to the recent plateau and reassessment. While traditional fixed income has fallen short, Calamos Market Neutral Income Fund (CMNIX) has effectively navigated through each policy regime and outperformed bonds.

Figure 1. Calamos Market Neutral Income Fund (CMNIX) Has Outperformed Bonds Across Changing Interest Rate Regimes

Past performance is no guarantee of future results. Source: Morningstar Direct and St. Louis Federal Reserve as of 6/30/2024. “Rates near zero” period includes 3/16/2020-3/16/2022, “Aggressive tightening” period includes 3/17/2022 to 5/3/2023 and “Plateau” period includes 5/4/2023 to 6/30/2024. Returns are cumulative.

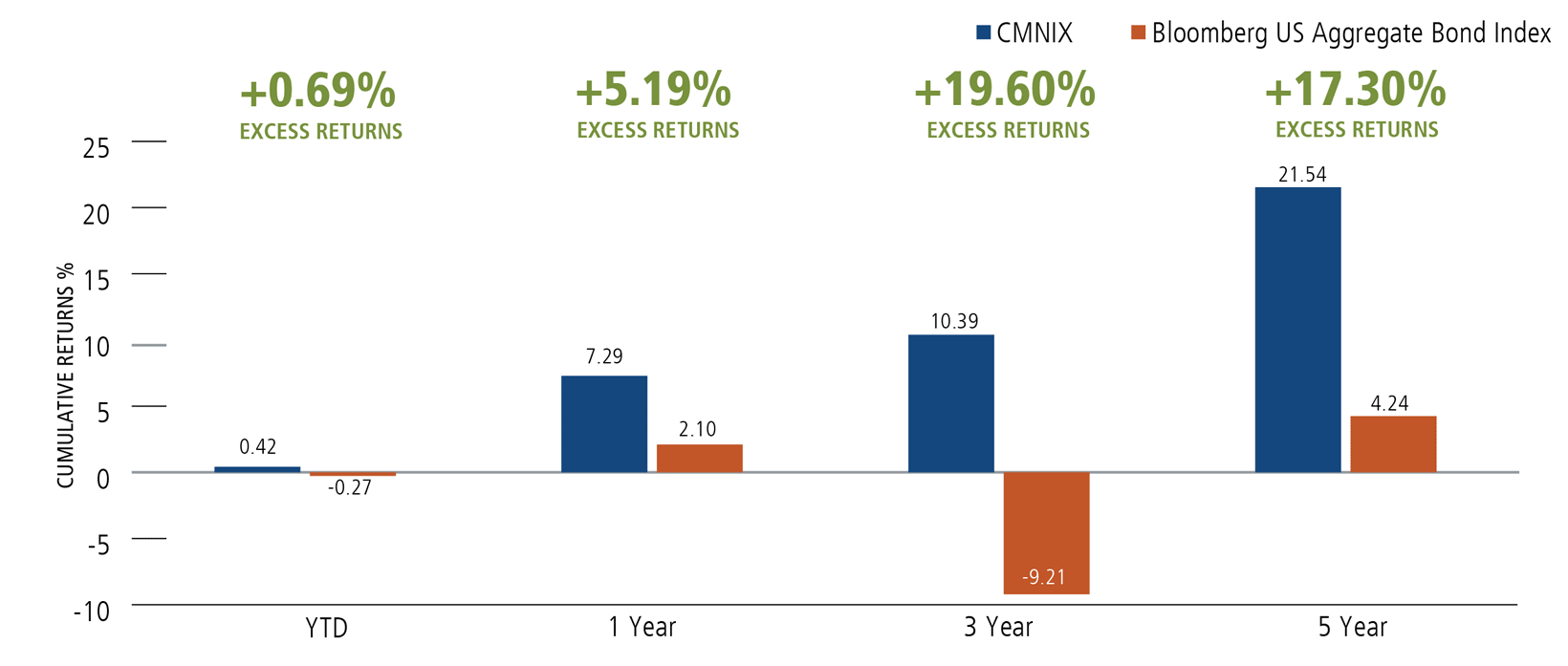

Calamos Market Neutral Income Fund has also demonstrated consistent outperformance relative to traditional bonds, as represented by the Bloomberg US Aggregate Bond Index, and investors who focus on yield over total return may be missing out on opportunities for capital appreciation. As shown in figure 2, CMNIX is up more than 23% versus bonds for the five-year period ending June 30, 2024.

Figure 2. A Compelling Alternative to Traditional Fixed Income Strategies

Past performance is no guarantee of future results. Source: Morningstar Direct as of 6/30/24.

Changing interest rates can create challenges for traditional bond strategies. Calamos Market Neutral Income Fund is designed to address these challenges, allowing investors to enhance their fixed income allocations, and providing a compelling choice for investors seeking the potential for steady performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests. The Bloomberg Short Treasury 1-3 Month Index is generally considered representative of the performance of short-term money market investments and compares performance to public obligations of the US Treasury with maturities of 1-3 months. The Morningstar Relative Value Arbitrage Category is comprised of funds that seek out pricing discrepancies between pairs or combinations of securities regardless of asset class. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

The principal risks of investing in the Calamos Market Neutral Income Fund include equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates, the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible-hedging risk, covered call writing risk, options risk, short-sale risk, interest-rate risk, credit risk, high-yield risk, liquidity risk, portfolio-selection risk, and portfolio turnover risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries. The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

088037 0624R

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.