Investment Team Voices Home Page

Investment Team Voices Home Page

Opportunities in Disruption: Finding Growth Opportunities in the Payments Ecosystem

Global Team Perspectives by Alex Wolf, CFA

The concept of payments has existed throughout history, with transactions evolving over time from use of bartering, to precious metals, to fiat currencies. The evolution continues today at a rapidly accelerated pace with choices that span from cash, to cards, to mobile or electronic options. Despite all the headlines on newer mediums of payment, cash still dominates a large share of the ecosystem. Per a study by the San Francisco Federal Reserve, cash represented 30% of U.S. transactions in 2017. An ECB study put this number at 75% within the EU,* and we would expect it to be even higher in many other parts of the world. Cash is likely to remain an important part of the system for a significant period going forward, but the evolution of the payments ecosystem provides a long-term steady tailwind for the providers of card-based and electronic options as cash usage slowly dissipates.

Payments Ecosystem

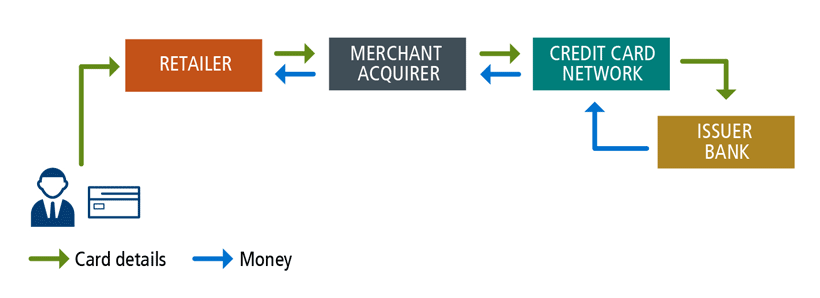

Paying a merchant with a credit card might seem very simple. You can swipe your card and take your merchandise or click a button on a phone and wait for delivery. When you dive deeper, the inner workings of the ecosystem are more complicated. The diagram below shows the flow of data and money in a typical transaction.

- The merchant acquirer will sign up a merchant into payment acceptance agreements, effectively bringing them into the broader ecosystem.

- That acquirer or a different processor company will process the payments, which involves authorizing, transmitting data, security checks, and settlement.

- Next come the networks (card schemes) who essentially act as payment “rails.” They connect transactions to issuing banks and set many rules, including governing interchange rates and acceptance rules.

- From there, transactions are processed for the banks, with this step often done by the same or similar company as the first processor or by the bank themselves.

- The flow of data comes to completion at the Issuer Bank who make money on interchange but of course can also capture interest income and late fees from the cardholder.

- From a fee standpoint, the acquirers charge the merchant a gross fee but only get the net amount after network fees, interchange, and processing fees.

- The money is remitted back in reverse order, allowing the merchant to get paid net of fees.

The Opportunity

We believe this is a highly attractive industry globally, with the forefront reason being the pure size of the market. Estimates are that global card payment volumes are already well over $20 trillion. The fees earned by various players can be very complex and vary quite a bit depending on where you sit within the ecosystem and how many services you are providing, in addition to geographical rules and the type of merchant you serve. They can vary from just a few basis points of each dollar transacted to as high as 3% in some countries. No matter how small the take rate, the trillions of dollars in transactions offers quite a high revenue opportunity to try to capture.

In addition to the large existing base of transactions, numerous forces are pushing volumes into this ecosystem and expanding the opportunity. These include global consumer GDP growth in the high single digits, compounded by the shift of cash-to-card and growth of ecommerce on top of that. Ecommerce accounts for about 12% of global retail right now, but we expect many of these forces to help drive ecommerce volumes to grow near a 20% rate over the next few years.

We believe there are enticing investable opportunities across the globe within payments, however Europe offers interesting dynamics that set it up very nicely going forward on a relative basis. To start, Europe is a much less mature payments industry than the U.S. This is evident in the relative share of cash transactions previously mentioned. Even within ecommerce, the use of “cash on delivery” is still very prevalent in Europe. Europe is also a much more fragmented market, in contrast to the U.S. where consolidation is likely at the tail end of a multi-year period. In the U.S. the top 3 players in 2017 captured 75% of the revenue earned by the top 10. This number was only 57% in Europe, but we expect this gap to close over time as legacy players with antiquated technology continue to lose share. Regulations also will help drive this, as over the past several years initiatives have been put in place to eliminate national barriers to payments, reduce transaction costs, foster innovation and competition, along with a desire to educate and increase communication to the population. Additionally, individual governments are working to move payments away from cash to better help restrict money laundering and tax evasion.

Our Favorite Themes

We see attractive investment opportunities in both the networks and the acquiring spaces. We believe these industries offer unique dynamics of technology-driven top-line growth along with scalable models that can achieve attractive margins at relatively early stages of their business lives. The networks have a lot of monopolistic qualities, with built-up brands and competitive moats that put them in a great place to benefit from many of the industry themes already discussed. While broader growth in Europe stagnates, the networks should generate double-digit top line growth in the region.

While the networks should offer steady compounding growth stories, it is the merchant acquiring space that offers more dynamic change and ability for disruption. This is where consolidation will play itself out and the best service providers will win. The industry is evolving from merchants taking the easiest route, and often just partnering with the bank they use and rarely negotiating fees. They are moving to a desire to look for true FinTech companies that will partner with them to achieve all of their goals. Chief Technology Officers are playing a larger role in choosing payment partners and evaluating the underlying technologies. Acquirers can differentiate themselves by offering fully integrated services, instead of being just processers of payments. They can link the services as well with full gateway capabilities that provide high quality interfaces on their websites. Newer competencies are also being offered from a data perspective, where payment data can be sent back to the merchants to be easily incorporated into their other systems and drive important business decision-making processes.

As the payments landscape changes, merchants need more than a company that essentially just signs them up to access credit card networks. They require the capabilities to accept various types of electronic payments, some of which are native to other geographies. Global companies need to seamlessly process payments across countries and currencies. With the growth of online marketplaces and fully integrated omnichannel experiences, there are more layers of complexities that payment providers can help their merchants navigate through. Perhaps most importantly, the proper data and systems can drive acceptance rates up through lower false positive rejections, which adds true incremental sales dollars. On the other side, more effective fraud prevention can bring down costly chargebacks.

Unlike many other industries, we see investable companies within the European payments space that are at the cutting edge of this technology and helping to disrupt the market with the same level of innovation or higher that you see at American companies. We also believe that Europe being behind in consolidation offers more opportunities to search out the disruptors that can reach that level of scale. There are certainly risks to these companies, such as new technologies like Libra (see our blog) or the route that China has taken where the whole payments system is dominated by the largest technology companies. These alternative paths create the risk of disrupting many of these business models, but ultimately we believe companies with strong technology and appeal to merchants and consumers will prevail. Our understanding of these dynamics allows us to effectively navigate the rapidly changing market and invest in the companies that are truly adaptable and innovative and ultimately best set up to profit from these themes.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

*Sources: Federal Reserve Bank of San Francisco, “2018 Findings from the Diary of Consumer Payment Choice,” November 1, 2018, Raynil Kumar, Tayeba Maktabi and Shaun O’Brien; and European Central Bank, “New €50 banknote starts circulating today,” April 4, 2017.

18739 0919O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.