Investment Team Voices Home Page

Investment Team Voices Home Page

CAPIX: A Pure Play, Institutional Private Credit Portfolio

We sat down with Tim Nest, CFA, Co-Portfolio Manager of Calamos Aksia Alternative Credit and Income Fund (CAPIX) to learn more about the private credit market and how the team is seeking to capitalize on the yield and return potential of this global asset class.

Q. Tim, CAPIX launched just a couple of months ago. Tell us how the team has invested the fund’s assets since then.

A. With CAPIX, our goal was to build an institutional-style private credit portfolio—with exposure across the asset class reflective of the quality and breadth of deals our institutional clients have accessed for years. Generally, we expect to invest primarily in senior, floating rate private loans across different corporate sectors and collateral types.

Also, we sought to invest in bilateral private deals, not traded credit. And we’ve targeted accessing these exposures directly. In time, we’ll explore opportunistic investment in private funds (often on a secondary basis), BDCs, CLOs, along with other vehicles but with a focus on minimizing blind pool risk, fees and undrawn capital.

We’re happy with the level of diversification we’ve achieved for CAPIX out of the gate. CAPIX aligns with how we would advise a large institution to build a diversified, income-focused portfolio. In CAPIX, we’ve already partnered with 20-plus leading private credit originators and private credit equity sponsors across many sectors of the market. The portfolio includes thematic and niche areas that we believe add unique value and capitalize on varying market dynamics.

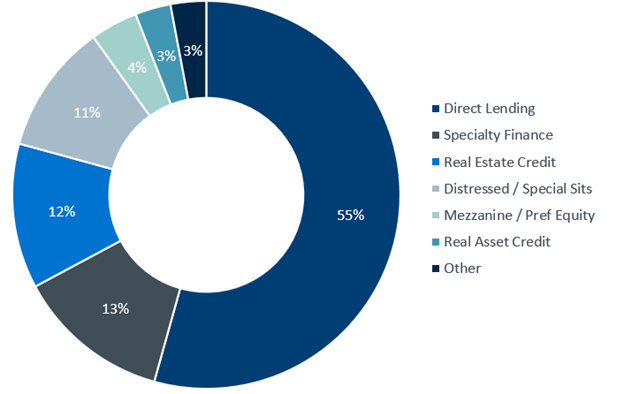

Figure 1. Current Private Credit Portfolio Positioning: Strategy

Data as of 08/31/2023. Based upon total invested and committed capital. Percentages are based on invested portfolio and are subject to change. Portfolio stats are at underwriting. Other includes investments that do not have a strategy classification.

Q. Can you delve deeper into CAPIX’s diversification?

A. Our goal for creating an institutional-style portfolio means that we’re invested across numerous sectors of the private credit market—direct lending, specialty lending, distressed and special situations, real estate credit, real asset credit and mezzanine. But CAPIX’s diversification goes deeper.

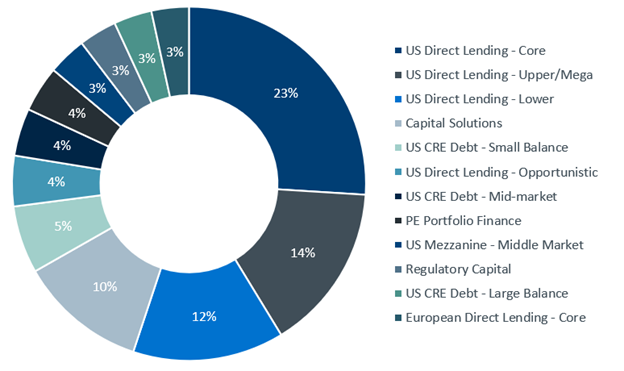

Let’s take a closer look at direct lending. There is a tendency to paint this sector with the same brush but it’s a massive market (likely $1T+) with differences in borrower size, PE sponsor, industry, deal complexity and of course geography. We’ve intentionally skewed the initial portfolio towards the upper end of the middle market as we view the relative value to be attractive as we’ve seen. We’ve been excited about opportunities to refinance previously inexpensive syndicated loans with more expensive and better structured private capital.

Figure 2. Current Private Credit Portfolio Positioning: Direct Lending

Data as of 08/31/2023. Based upon total invested and committed capital. Percentages are based on invested portfolio and are subject to change. Portfolio stats are at underwriting.

Q. What’s your view of the deal pipeline?

A. There’s a lot of capacity in the opportunities we are seeing. We’re looking at deals from groups that Aksia has long-standing relationships with—groups that we consider to be premier in the asset class, including specialist private credit originators, private equity managers where we can help support buyouts, real assets and infrastructure type managers, real estate, and the list goes on.

We’ve reviewed a wide range of situations from these partners totaling >$6 billion of direct credits, in addition to traded loans, private credit funds / secondary and other investments. But we are being highly selective—we’re doing just a small percentage of what we see.

Q. Tell us about the market backdrop for private credit.

A. We believe CAPIX launched at a great time for investors. Aksia has a long history in private credit, and we’ve seen that the best times for private credit are when you have a breakdown in the traditional capital markets. The last six to nine months have been challenging for new bank loan and high yield issuance, and the IPO market has been quiet. Private credit is taking more market share as those other markets struggle to regain their footing.

So, that’s great for private credit. But, the flip side is that there’s more risk as interest coverage ratios tighten for legacy borrowers and defaults have ticked up.

Q. How do you manage this risk?

A. It’s pretty simple—we need to be careful and stick to our core tenants – senior risk, diversified and less correlated collateral and downside protections from new and meaningful at-risk equity from the underlying deal sponsor. I also think that CAPIX launched at an opportune time as lender protections are more robust than in recent years. No doubt, in a world with a double-digit cost of senior debt, interest coverage is top of mind – especially for legacy deals.

Q. Can you give us an example?

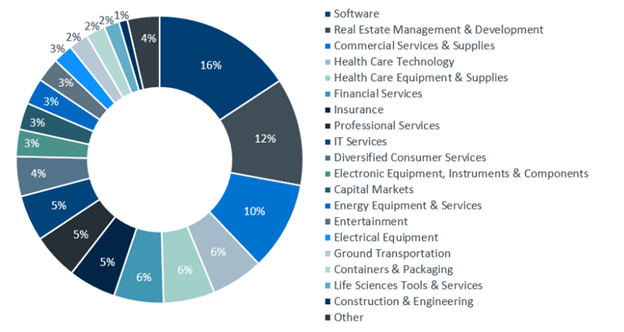

A. Right now, CAPIX’s largest industry exposure is to software. Technology has tended to be a resilient sector, and valuations have come down since 2021. It’s a good time to be a lender here—the structures and loan documents are more attractive and it’s a sector really impacting most end markets.

Figure 3. Current Private Credit Portfolio Positioning: Industry Weightings

Data as of 08/31/2023. Based upon total invested and committed capital. Percentages are based on invested portfolio and are subject to change. Portfolio stats are at underwriting. Other includes investments that do not have an industry classification.

Q. Do you have any closing thoughts, Tim?

A. Global private credit has provided institutional investors with opportunities to pursue enhanced income and total return, as well as lower correlation. All of us at Aksia are excited to provide private wealth investors with access to the private credit market through CAPIX.

About Tim Nest, CFA

Tim is the Head of Private Credit at Aksia LLC and co-Portfolio Manager of the Calamos Aksia Alternative Credit and Income Fund (CAPIX). Tim has over 23 years of experience in alternative investments with a primary focus in private markets and credit and works with a broad group of global investors focused on the private credit asset class. His team focuses on sourcing, screening, evaluating and monitoring credit-oriented investments accessed across a variety of structures including primaries, co-investments/directs and secondaries. Prior to joining Aksia in 2015, Tim spent several years as a Vice President at Frontier Capital Advisors, a secondary investment firm. Before that, Tim worked for GSC Group, focusing on two credit-based funds including the firm's distressed corporate credit and structured credit strategies. Tim began his career as an Analyst in PwC's Corporate Finance practice. Tim graduated from Boston College with a BS in Finance and Information Systems (dual degree). He holds an MBA in Corporate Finance and Law and Business from the Leonard N. Stern School of Business at New York University with specializations in Corporate Finance and Law and Business.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Interval Fund. The Fund is designed primarily for long-term investors and not as a trading vehicle. The Fund is an “interval fund” pursuant to which it, subject to applicable law, will conduct quarterly repurchase offers for between 5% and 25% of the Fund’s outstanding Shares at net asset value (“NAV”). Under normal market conditions, the Fund currently intends to offer to repurchase 5% of its outstanding shares at NAV on a quarterly basis. In connection with any given repurchase offer, it is possible that a repurchase offer may be oversubscribed, with the result that Fund shareholders (“Shareholders”) may only be able to have a portion of their Shares repurchased. The Fund does not currently intend to list its Shares for trading on any national securities exchange. The Shares are, therefore, not readily marketable. Even though the Fund will make quarterly repurchase offers to repurchase a portion of the Shares to try to provide liquidity to Shareholders, you should consider the Shares to have limited liquidity.

Risk Factors: General Economic Conditions and Recent Events. Difficult global credit market conditions have adversely affected the market values of equity, fixed-income, hard assets, and other securities and these circumstances may continue or even deteriorate further. The short- and longer-term impact of these events is uncertain, but could have a material effect on general economic conditions, consumer and business confidence and market liquidity. Investments made by the Fund are expected to be sensitive to the performance of the overall economy.

Direct Lending. The Fund will invest in directly originated senior secured loans, including unitranche loans, of performing middle market companies. The value of the Fund’s assets

is volatile and may fluctuate due to a variety of factors that are inherently difficult to predict and are outside the control of the Advisor and Sub-Advisors, including prevailing credit spreads, general economic conditions, financial market conditions, domestic or international economic or political events, developments or trends in any particular industry, changes in interest rates, or the financial condition of the obligors of the Fund’s assets.

Direct Origination. A significant portion of the Fund’s investments may be originated. The results of the Fund’s operations depend on several factors, including the availability of opportunities for the origination or acquisition of target investments, the level and volatility of interest rates, the availability of adequate short and long-term financing, conditions in the financial markets and economic conditions. Further, the Fund’s inability to raise capital and the risk of portfolio company defaults may materially and adversely affect the Fund’s investment originations, business, liquidity, financial condition, results of operations and its ability to make distributions to its Shareholders.

Loans. Loan interests generally are subject to restrictions on transfer, and the Fund may be unable to sell loan interests at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value. Accordingly, loan interests may at times be illiquid. Loan interests may be difficult to value and may have extended settlement periods, which expose the Fund to the risk that the receipt of principal and interest payments may be delayed until the loan interest settles.

Secured Debt. Secured debt holds the most senior position in the capital structure of a borrower. Secured debt in most circumstances is fully collateralized by assets of the borrower. However, there is a risk that the collateral securing the Fund’s loans may decrease in value over time, may be difficult to sell in a timely manner, may be difficult to appraise, and may fluctuate in value based upon the success of the business and market conditions, including as a result of the inability of the borrower to raise additional capital. Also, substantial increases in interest rates may cause an increase in loan defaults as borrowers may lack resources to meet higher debt service requirements.

High Yield, Low-Rated or Unrated Securities. Debt securities (including bonds) and preferred stock in which the Fund invests may or may not be rated by credit rating agencies. The values of lower-rated securities (including unrated securities of comparable quality) fluctuate more than those of higher-rated securities because investors generally believe that there are greater risks associated with them. The inability (or perceived inability) of issuers to make timely payment of interest and principal would likely make the values of the securities more volatile and could limit the purchaser’s ability to sell the securities at prices approximating the values it had placed on the securities. In general, the market for lower-rated or unrated securities is smaller and less active than that for higher-rated securities, which can adversely affect the ability to sell these securities at favorable prices. In addition, the market prices of lower-rated securities are likely to be more volatile because: (i) an economic downturn or increased interest rates may have a more significant effect on the yield, price and potential for default; (ii) past legislation has limited (and future legislation may further limit) investment by certain institutions in lower-rated securities or the tax deductibility of the interest by the issuer, which may adversely affect the value of the securities; and (iii) it may be difficult to obtain information about financially or operationally troubled issuers. The Fund will not necessarily dispose of a security when its rating is reduced below its rating at the time of purchase.

Unsecured Loans. The Fund may make unsecured loans to borrowers, meaning that such loans will not benefit from any interest in collateral of such borrowers. Liens on such a borrower’s collateral, if any, will secure the borrower’s obligations under its outstanding secured debt and may secure certain future debt that is permitted to be incurred by the borrower under its secured loan agreements. The holders of obligations secured by such liens will generally control the liquidation of, and be entitled to receive proceeds from, any realization of such collateral to repay their obligations in full before the Fund. In addition, the value of such collateral in the event of liquidation will depend on market and economic conditions, the availability of buyers and other factors. There can be no assurance that the proceeds, if any, from sales of such collateral would be sufficient to satisfy the Fund’s unsecured loan obligations after payment in full of all secured loan obligations. If such proceeds were not sufficient to repay the outstanding secured loan obligations, then the Fund’s unsecured claims generally would rank equally with the unpaid portion of such secured creditors’ claims against the borrower’s remaining assets, if any.

822180 0923

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.