Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investments’ Legacy in Convertibles: Reflections from our Founder

John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

“Investing is like flying an airplane – you better do your homework before you take off.”

John P. Calamos, Sr.I’m often asked how I first became interested in convertible securities. In fact, my background in convertibles actually pre-dates the founding of Calamos Investments in 1977. Before I began my investment career, I served as a military pilot in the United States Air Force. During my downtime, I studied the markets, which had been an interest of mine since I was a teenager. As I studied convertible bonds, I was intrigued by their ability to manage risk and enhance returns, concepts essential in flight and investing. Ultimately, I dedicated my career to investing and went on to write two books on convertibles.

Fast forward nearly 50 years, Calamos Investments is the largest US convertible securities manager.1 I believe the opportunity in convertibles is as strong as ever, and we continue to seek out innovative ways to provide access to the asset class and its risk management characteristics.

At Calamos, we offer the most complete spectrum of convertibles strategies in the marketplace. We have a well-established presence through our variety of funds, which include income-oriented closed-end funds, total return-oriented mutual funds, one of the longest-running liquid alternative funds, and UCITS. I am excited about our current expansion into ETFs with innovative takes on convertible investing.

Our Conviction in Convertibles

When I founded Calamos Investments, my goal was simple: I wanted to help my clients navigate the difficult financial markets of the 1970s—a time of high inflation, high interest rates and volatile equity markets. Convertibles were not widely used in investment portfolios, but it was during this period that my conviction in the asset class was forged.

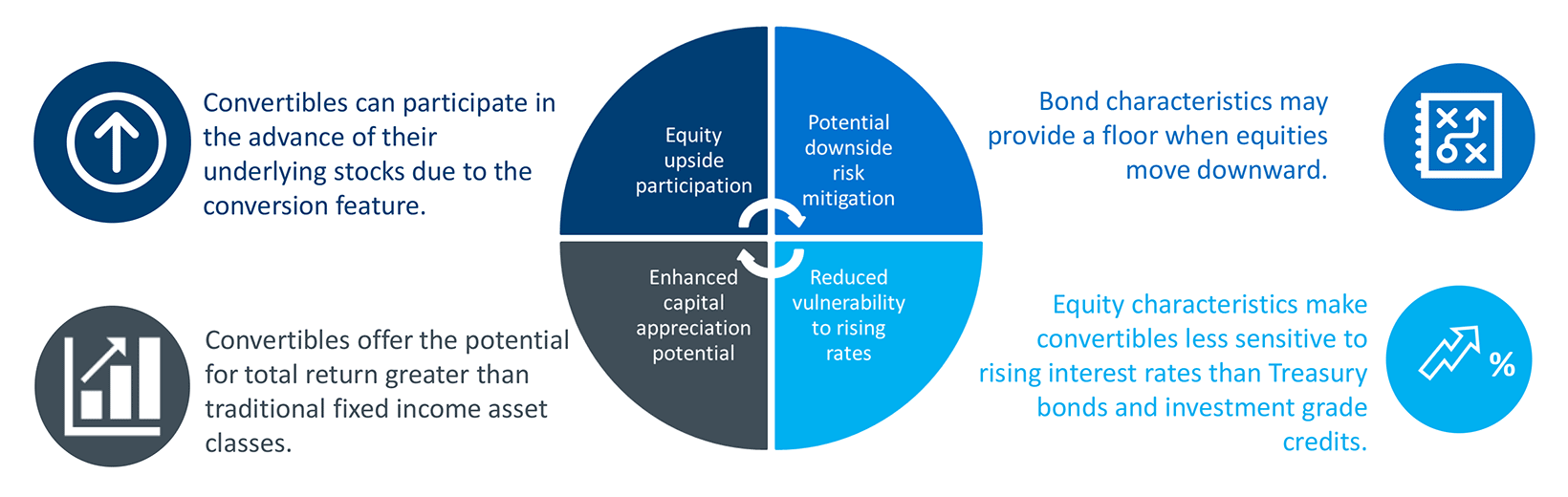

As hybrid securities, convertibles can provide the opportunity for upside participation in the stock market with potentially less exposure to downside equity movements and less vulnerability to interest rate risk. However, it is not simply the use of convertibles that makes a strategy work. What matters is how convertibles are selected and managed to achieve an investment goal. I realized that I could select convertibles that could serve as equity alternatives, and this approach provided opportunities in a market environment when stocks and bonds were challenged.

Convertible Securities: Hybrid Characteristics with Many Potential Benefits

Note: The chart above illustrates general concepts about convertibles. In practice, the degree of potential risk mitigation, capital appreciation potential, equity upside participation and vulnerability to rising rates would vary from convertible to convertible.

The Next Chapter

What makes convertibles so exciting is the continued evolution of the asset class, and what makes Calamos Investments so unique is our commitment to innovating in the convertibles space. We place our clients first and that requires consistently evaluating the asset class to find new ways to deliver differentiated points of access and investment outcomes.

I’m very proud that Calamos Investments has been able to play such an important role in democratizing and popularizing the asset class to investors and investment professionals alike.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

1Source for data for largest convertible manager: FUSE Research, July 2023 based on mutual fund, exchange-traded fund, closed-end fund, and insurance products net assets in the US and non-US domiciled products.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Convertible Securities Risk–The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline.

18176 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.