Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Global Opportunities Fund: Investing in the World’s Most Exciting Growth Themes—with a Risk-managed Approach

Q&A with Dennis Cogan, CFA, SVP and Senior Co-Portfolio Manager

Time has shown CGCIX’s approach has served investors well

Calamos Global Opportunities Fund (CGCIX)

Morningstar Overall RatingTM Among 338 Global Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 338, 320 and 240 Global Allocation Funds, respectively, for the period ended 6/30/2024.

Key Points:

- Calamos Global Opportunities Fund (CGCIX) has delivered better returns than the global equity market with historically less risk since the fund’s inception.

- By tapping into Calamos’ extensive convertible expertise, CGCIX differs from traditional balanced funds.

- We believe now may be an especially good time to consider this fund as tailwinds for overseas markets strengthen.

- CGCIX includes companies at the center of exciting themes, such as the global AI and GLP-1 value chains, as well as trends US investors may not have heard of … yet.

To find out more about how the fund has achieved its historical success and the opportunities it provides to investors today, we asked Dennis Cogan, CFA, a senior member of the fund’s investment team, five key questions.

CGCIX offers:

- Time-tested and robust investment process

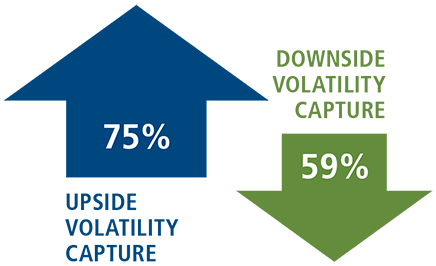

-

A history of capturing more upside than downside of global equity market.

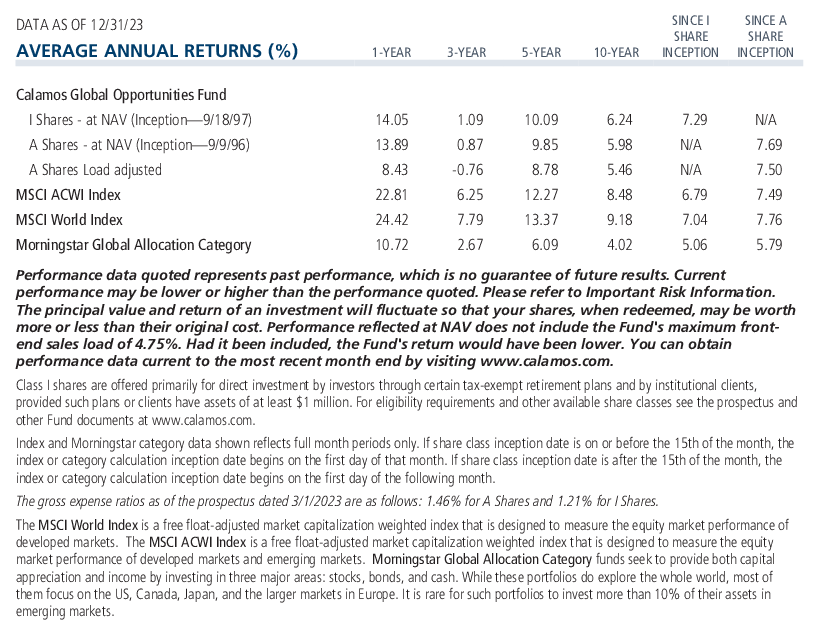

Data as of 12/31/23, since fund inception as of 9/8/1997. Global equity market represented by the MSCI ACWI Index. Source: Morningstar. Past performance is no guarantee of future results.

Data as of 12/31/23, since fund inception as of 9/8/1997. Global equity market represented by the MSCI ACWI Index. Source: Morningstar. Past performance is no guarantee of future results. - A strategic allocation to core equities designed to help investors stay the course

- Many investors recognize that global equities offer capital appreciation potential and diversification but are worried about volatility. How does Calamos Global Opportunities Fund seek to solve this challenge?

Our team manages CGCIX to serve as a strategic allocation to global equities—one that can be held for the long-term. Maximizing the opportunity of equities requires staying the course through short-term volatility. We want investors to feel confident about holding the fund through the ups and downs in the market. To make it easier for investors to stay the course, we focus on providing lower-volatility global stock market participation, with an emphasis on mitigating the impact of drawdowns in the market. - Since its inception, CGCIX has earned returns comparable to the global equity market with less volatility. What has driven the fund’s historical success?

There are three important drivers, in my opinion:- We’re managing risk/reward differently from many of our peers—in a way that we believe provides better potential outcomes for investors. Traditional balanced funds invest primarily in stocks, bonds and short-term cash instruments. Our multi-asset approach is differentiated by our use of convertible securities and options--core capabilities of Calamos Investments. In our opinion, our experience in convertibles and options can give us an edge in striking a favorable risk/reward balance, or “skew,” over cycles.

-

Our process is time tested. Each part of a company’s capital structure offers different risk/reward characteristics—and CGCIX seeks to take advantage of that. Since its founding in the 1970s, Calamos has focused not just on identifying the most compelling companies but also on identifying what we believe are the most attractive ways to invest in a company—for example, through a stock, bond or convertible.

We also analyze top-down macro influences, secular growth trends and short-term cyclical growth themes. Companies aligned with thematic tailwinds don’t just have better return prospects—in our experience, they often have been more resilient during challenging economic environments. So, focusing on themes is another way to manage risk. - Our integrated management team brings extensive experience. Our portfolio management team has worked closely together for nearly two decades, and we’re well seasoned in capital structure research and thematic investing. We’re collaborating closely with our dedicated team of analysts and sector research experts to generate cross-asset-class insights.

- You mentioned CGCIX’s investments in convertible securities as a key differentiator from peers. Tell us more about the potential benefits of convertibles across market and interest rate cycles.

Convertible securities combine characteristics of stocks and bonds. With active management, convertibles can provide the opportunity for upside equity participation with potentially less exposure to drawdowns. They have been less vulnerable to changes in interest rates than traditional bonds are. So, convertibles provide an attractive way to navigate market volatility and interest rate risk in our opinion.Calamos has been investing in convertibles since the 1970s, and our founder and Global Chief Investment Officer John P. Calamos, Sr. is a pioneer in convertible investing, so we’re bringing decades of experience in convertibles to CGCIX.

Timely opportunities for global stocks—and CGCIX

- Relative strength in select global economies versus the US

- Economic reforms in many overseas markets encourage capital to go where it is treated best.

- Regional-specific secular themes and tailwinds.

- Why do you believe today’s environment is especially compelling for Calamos Global Opportunities Fund?

First, we’d emphasize that the case for global equities is a strategic one. Global funds have greater flexibility than single-country or regional funds, and experienced managers can capitalize on that through market and economic cycles.That said, our team believes there is an especially strong case for Calamos Global Opportunities Fund now. We’re finding many opportunities in the United States, but we’re also seeing a growing set of attractively priced opportunities emerge in non-US markets, where thematic, macro and market trends are providing powerful catalysts.

- Can you give us some examples about how CGCIX is participating in global opportunities?

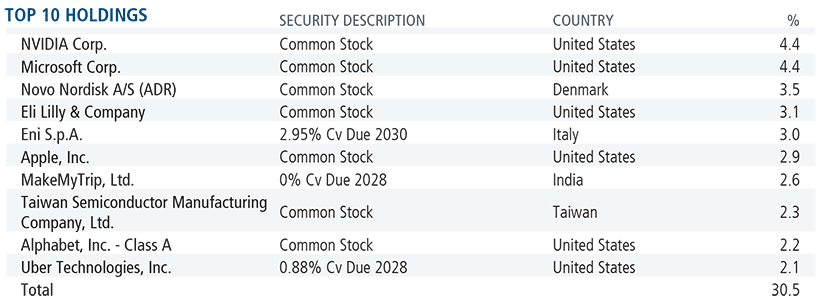

We believe that if you’re not investing globally, you’re limiting your participation in some of the world’s most powerful themes, such as AI and GLP-1s. There are US companies that have benefited greatly—for example, Nvidia in the case of AI and Eli Lilly in the case of GLP-1s, particularly for indications of obesity. We believe both are fantastic companies and CGCIX has exposure to both.But there are also attractive parts of the AI and GLP-1 value chains outside the US that are riding the same waves. In AI, these include leading-edge semiconductor foundry Taiwan Semiconductor and chip designer Alchip in Taiwan. Within GLP-1s, Novo Nordisk of Denmark was the first mover, has leading market share, and boasts the deepest pipeline of related R&D.

We’re also investing in companies at the forefront of regionally specific trends that are less familiar to US investors. India is a great example here, where improving living standards, favorable demographics, and pro-growth reforms provide one the most attractive investing backdrops in the world. As Indian incomes rise, we’re seeing increased demand for a wide range of goods and services, including travel and tourism. Online travel agent MakeMyTrip is the local leader, and our team believes the company has a long and attractive runway for growth. CGCIX has owned MakeMyTrip’s convertible bond to gain exposure to that growth potential, but in a structure that could limit downside exposure if the underlying equity declines.

In a more cyclical area, we see an attractive opportunity in memory chips, where a recovery from a significant downcycle is developing. SK Hynix of Korea is a pure-play memory manufacturing company that may benefit from this upcycle. It’s also the leader in high-bandwidth memory, which is essential to AI. When our team looked across SK Hynix’s capital structure, our view was that the convertible bond offered the most attractive risk/reward skew—in other words, the convertible structure provides a potentially less volatile way to gain exposure to an attractive growth company in a historically volatile industry.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Morningstar RatingsTM are based on risk-adjusted returns and are through 12/31/23 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2024 Morningstar, Inc.

Top 10 Holdings % Net Assets 12/31/23. NVIDIA Corp. 4.4%, Microsoft Corp. 4.4%, Novo Nordisk A/S (ADR) 3.5%, Eli Lilly & Company 3.1%, Eni S.p.A. 3.0%, Apple Inc. 2.9%, MakeMyTrip Ltd. 2.6%, Taiwan Semiconductor Manufacturing Company Ltd. 2.3%, Alphabet Inc. - Class A 2.2%, Uber Technologies Inc. 2.1%

Other Holdings Referenced % Net Assets 12/31/23. Alchip Technologies Ltd. 1.1%, SK Hynix Inc. 2.0%

Holdings and weightings are subject to change daily. Holdings are provided for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned. Top 10 Holdings are calculated as a percentage of net assets and exclude cash or cash equivalents, any government / sovereign bonds or broad-based index hedging securities the portfolio may hold. You can obtain a complete listing of holdings by visiting www.calamos.com. The Sector table Other row includes securities that do not have a sector classification.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

900079 0224

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.