Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) Investment Team Outlook

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

- The dominance of mega-cap tech stocks looks set to give way to broader leadership, potentially favoring quality companies across sectors, in both developed and emerging markets.

- We believe SROI will be well positioned in an environment where quality is rewarded and risk management matters.

- We consider not only financial risk but also nonfinancial risks to identify what we believe are fundamentally strong companies that are at the cutting edge of secular trends and ahead of the curve in managing the challenges of the global economy.

Narrow Market Likely to Broaden to Quality Stocks across Sectors

Stock markets held up during the second quarter as investors piled into US large-cap technology and Japanese stocks, despite aggressive central bank policy, fading fiscal support, lower levels of liquidity, and growing worries about China’s economy. The S&P 500 Index’s rally was primarily attributable to a bull run in a handful of mega-cap stocks boosted by the exuberance over artificial intelligence. Japanese stocks climbed on a recovering domestic economy, a weaker yen, the prospect of continued low interest rates, and low relative valuations.

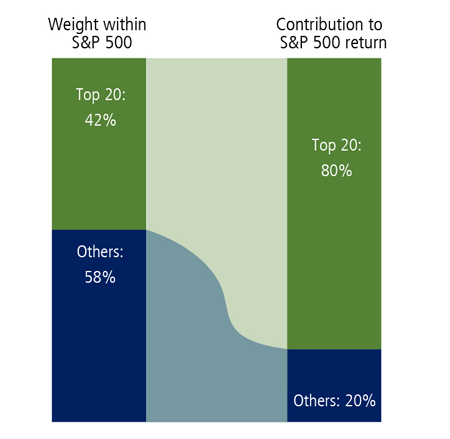

Figure 1. Narrow leadership: A handful of stocks drove S&P 500 returns in 1H 2023

Source: Bloomberg. Past performance is no guarantee of future results.

The prospect for further outperformance in big-cap tech is becoming less likely given extended valuations and continued central bank hiking in developing markets. We believe that broader exposure to other economic sectors and emerging markets will pay off. As such, our portfolio is overweight quality stocks in our opinion with reasonable valuations in the industrials, materials and healthcare sectors. From a geographic standpoint, SROI is overweight select emerging markets with favorable long-term growth characteristics, such as India, Mexico and Brazil.

We believe that quality, more broadly, should hold up given that interest rates are not likely to go down soon, global economic growth isn’t rebounding, and 2023 earnings are flattish. The “risk” part of the risk and return equation is likely to matter in the coming quarters after several months of investor complacency. The portfolio is positioned accordingly.

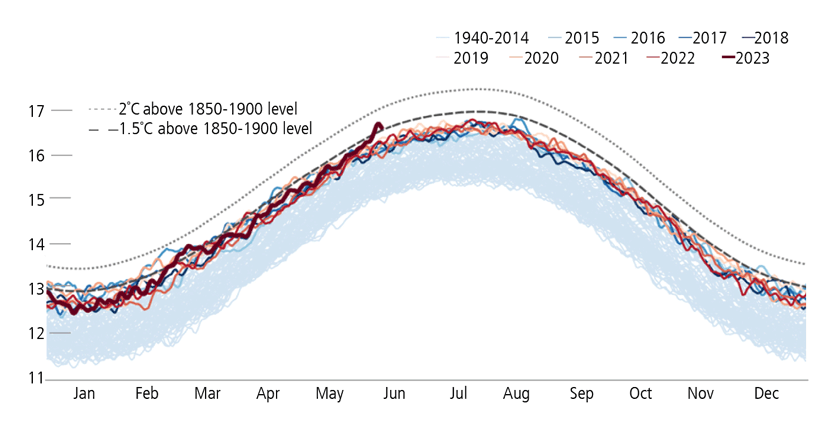

It’s not just big-cap technology stocks that have been hot as of late. Global temperatures in June hit the highest level on record for this time of the year, causing temperatures to exceed preindustrial levels by more than 1.5°C for the first time. A heat wave smashed temperature records in China, and the country joins India, the UK and other nations in bracing for a scorching summer. Europe already had the warmest summer on record last year, contributing to thousands of deaths, marine heat waves and extreme weather. The world’s oceans were the warmest on record in April and May, a development that could mean more severe weather over the next few months and trigger a rise in sea levels. Texans’ power prices surged 80% in a matter of hours amid shrinking spare electricity supplies in June as searing heat puts the state’s grid to the test.

Figure 2. Daily global average temperatures (°Celsius) from January 1, 1940

Source: Copernicus.

Climate change is clearly taking a major human, economic and environmental toll. Putting a price on carbon is one of the strongest levers to tackle climate change. This is happening. Today, there are 70 carbon pricing initiatives globally, whether a carbon tax or emissions trading scheme, covering 23% of global emissions.

In our opinion, companies that are already reducing their emission profiles—and future environmental liabilities—have a competitive advantage and are better positioned to outperform over the long term. We continue to work diligently to identify the best investment opportunities across the globe in this regard.

*Top 10 Holdings % of Assets as of 7/3/23: Apple Inc., 3.6%; Microsoft Corp., 3.6%; Alphabet Inc. – Class A, 3.0%; Quanta Services Inc., 1.6%; Visa Inc. – Class A, 1.6%; Ferguson PLC, 1.6%; Applied Materials Inc., 1.5%; Sony Group Corp., 1.4%; Merck & Company Inc., 1.4%; SAP SE, 1.3%

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

The portfolio is actively managed. Holdings subject to change daily.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s)will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Antetokounmpo Global Sustainable Equities ETF include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The Fund’s ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund’s exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund— positively or negatively—depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940,serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo. Giannis Sina Ugo Antetokounmpo is the majority shareholder of Original C, with a 68% ownership interest.

The Adviser is jointly owned and controlled by Calamos Advisors LLC and, indirectly, by Mr. Antetokounmpo, a well-known professional athlete. Unanticipated events, including, without limitation, death, adverse reputational events or business disputes, could result in Mr. Antetokounmpo no longer being associated or involved with the Adviser. Any such event could adversely impact the Fund and result in shareholders experiencing substantial losses.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

Foreside Financial Services, LLC, Distributor

Calamos Antetokounmpo Asset Management LLC 2020 Calamos Court | Naperville, IL 60563-2787 866.363.9219 | www.calamos.com |caminfo@calamos.com © 2023 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

822099 0723

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.