Investment Team Voices Home Page

Investment Team Voices Home Page

A Sunny 2024 Outlook for Global Convertibles

Eli Pars, CFA

Summary Points:

- The fund navigated a challenging year of interest rate, geopolitical and economic uncertainties, and market volatility, surpassing the broad convertible market and peer category.

- We are encouraged by continued strong convertible issuance in Q4 and have a sunny outlook for 2024.

- Markets appear to be getting ahead of themselves on rate cuts, and we remain positioned for volatility.

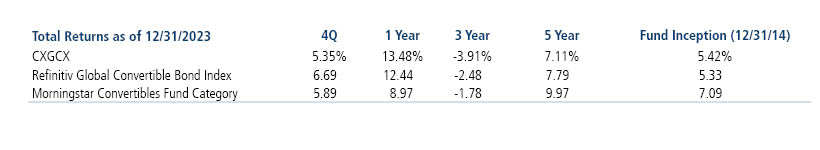

The global convertible market had a good year in 2023, and Calamos Global Convertible Fund (CXGCX) had a better one. The Refinitiv Global Convertible Bond Index posted a strong return in absolute terms, gaining more than 12% for 2023, and CXGCX beat its benchmark by more than 100 basis points and its peer group by more than 450 basis points. Throughout the year, we focused on actively managing the fund’s risk/reward, favoring issues that we believed offered an attractive blend of upside participation in global equity upside and reduced vulnerability to market pullbacks.

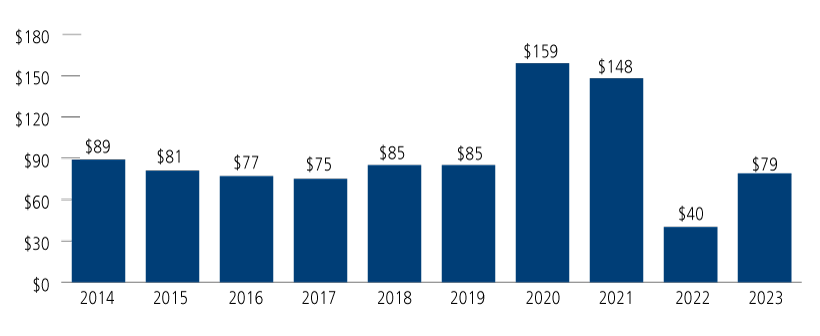

We believe new issues will be a potential bright spot for the convertible market over the next year or two. For 2023, global convertible issuance totaled $79 billion, close to the long-term trend and a significant bounce back from the soft market of 2022 when just $40 billion of issuance came to market. And with large maturity walls coming in investment-grade bonds, high-yield debt and convertibles, there should be plenty of opportunities for convertible bankers to keep busy.

Global Convertible Issuance: Regaining Momentum in 2023

Source: BofA Global Research.

The investment-grade opportunity in convertibles is particularly intriguing. In exchange for the conversion feature, convertibles typically offer lower coupons than comparable nonconvertible debt, which can be an appealing option for issuers to keep borrowing costs low. However, in the zero-interest rate world of years past, there was little incentive for investment-grade issuers to come to the convertible market. If you can issue straight debt with coupons of 2% to 3%, why bother with a convertible? But now that those companies are looking to refinance and are seeing straight debt quotes from their bankers north of 5%, we believe that we see some of them come to the convertible market to lower that coupon back closer to 2% to 3%. For CXGCX, this will likely mean an increased opportunity set, potentially with higher coupons and better credits.

Both equity and bond markets are taking the recent positive inflation data and running, pricing in multiple rate cuts starting as early as March. We will see what the future brings, but any backsliding in the data will likely be taken poorly by the markets. We remain focused on keeping a good risk/reward profile in the portfolio. The fund remains overweight the US and the technology sector and underweight Europe.

Source: Morningstar. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.25%. Had it been included, the Fund's return would have been lower.

The fund’s gross expense ratio as of the prospectus dated 3/1/2023 is 1.03% for Class I shares.

Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The Refinitiv Global Convertible Bond Index is designed to broadly represent the global convertible bond market. Morningstar Convertibles Category funds are designed to offer some of the capital-appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. To do so, they focus on convertible bonds and convertible preferred stocks. Convertible bonds allow investors to convert the bonds into shares of stock, usually at a preset price. These securities thus act a bit like stocks and a bit like bonds.

024001i 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.