Investment Team Voices Home Page

Investment Team Voices Home Page

A Normalizing Economic Backdrop Offers Capital Appreciation Opportunities

John Hillenbrand, CPA

Summary Points:

- The Covid pandemic triggered extraordinary monetary and fiscal actions that have taken years to unwind. We believe 2024 will be the beginning of the end of the normalization process.

- We continue to expect slowing but positive economic growth over the next year and our assessment of opportunities focuses on industries and companies positioned for real growth and return improvement.

- Over the short- and intermediate-term, improved real returns on capital should drive higher equity prices.

- We believe optimal portfolio positioning includes a neutral risk positioning focusing on areas that have real growth tailwinds, on companies with improving returns on capital in 2024, and on equities and fixed income with valuations at favorable expected risk-adjusted returns.

We believe 2024 will be the beginning of the end of the normalization process as the extraordinary measures put in place in response to the pandemic unwind. Real GDP and employment growth have in aggregate slowed to more normal levels, although growth dispersion continues across industries. Inflation continues to slow but not yet to a normalized level, again exhibiting dispersion across consumption categories. We believe central banks will start to normalize short-term interest rates over the next year, one of the last pieces of the normalization process. Aggregating these factors with the corporate cost management that occurred in the past 18 months, we believe corporate profit growth should also return to more normalized levels.

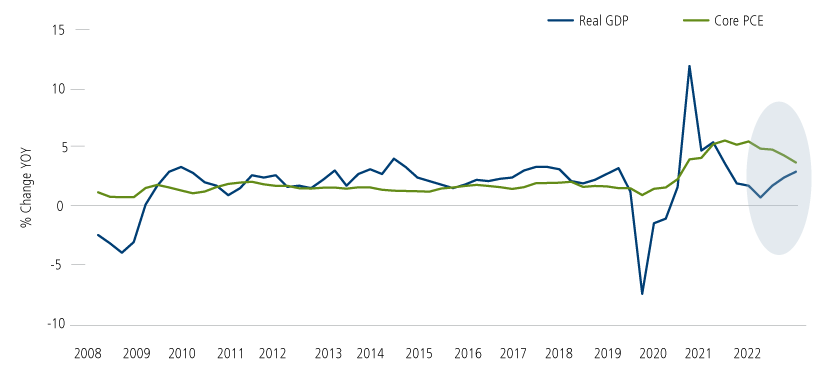

Return to Normal: Mean Reversion of Inflation and GDP Growth

Past performance is no guarantee of future results. Source: Bloomberg.

Although we have framed 2024 economic growth in terms of the disruption caused by Covid, there are other factors that should influence short-term economic growth, including improving corporate spending in select IT categories, continued infrastructure spending, healthcare innovation, continued spending from higher end consumers and tightening US fiscal budgets.

More Opportunities Are Emerging

Given our expectation of slowing but positive economic growth over the next year, we are assessing the investment opportunities with a continued focus on real growth and return improvement areas. In addition to areas with favorable cyclical factors, we believe companies that can improve profitability in a slower-growth environment are good investments. Many companies are focused on improving their returns on capital through improved efficiencies, normalized supply chains, and revised investment strategies based on the current interest-rate environment. The pace of corporate cost-cutting and restructuring has increased over the past several quarters across several areas, providing more opportunities to identify companies with improving returns on capital. Over the short- and intermediate-term, improved real returns on capital should drive higher equity prices.

Calamos Growth and Income Fund pursues lower-volatility equity participation through an equity-oriented multi-asset-class approach. We believe the best positioning for this environment is a neutral risk posture, focusing on specific areas that have real growth tailwinds, on companies with improving returns on capital in 2024, and on equities and fixed income with valuations at favorable expected risk-adjusted returns. We see compelling prospects for companies that have exposure to new products and geographic growth opportunities (examples can be found in health care, electric vehicles, and AI-related infrastructure and software), specific infrastructure spending areas (in materials and industrial sectors), and the normalization of supply chains and parts of the service economy. We are selectively using options and convertible bonds to gain exposure to some higher-risk industries. From an asset-class perspective, cash and short-term Treasuries remain useful tools to lower volatility in multi-asset-class portfolio, given their yields.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Growth and Income Fund nclude the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.