Investment Team Voices Home Page

Investment Team Voices Home Page

2024: Recession Comes Later

Summary Points:

- US economic growth, inflation, and monetary policy are all likely to prove “sticky” into 2025. Sustained expansion is not just possible but likely as consumers remain steadfast in their willingness to spend.

- The impact of higher interest rates has been blunted by a healthy private sector, pro-cyclical fiscal policy, and the tailwind of public and private (nonresidential) fixed investment. Monetary policy is not as restrictive as many believe.

- The setup for financial assets has been benign because the Fed is talking in a benign manner. The next few quarters could be trickier as investor nostalgia for “low and stable” inflation is overestimating the lifespan of easy financial conditions.

- The transformative impact of AI will create winners and losers. Like the great investment themes of times past, this does not preclude a misallocation of capital amidst today’s AI spending enthusiasm. We see an AI winter on the horizon.

Calls for imminent US recession are still misplaced

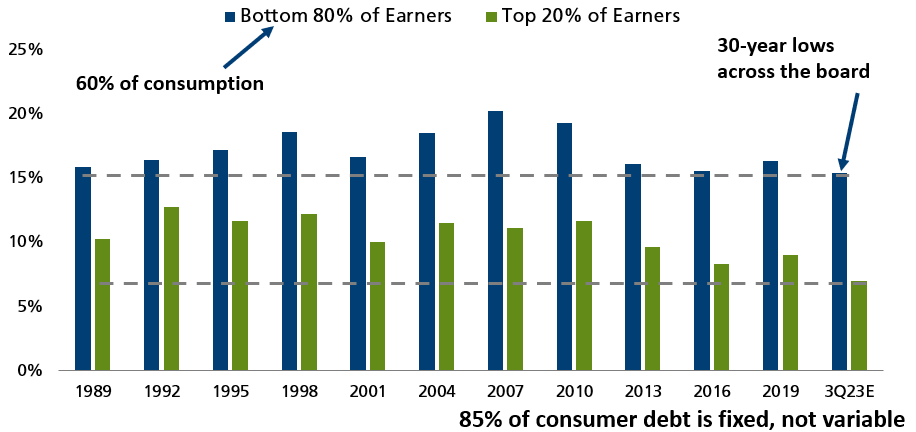

We do not see the setup for a problematic economy in 2024. Both US households and businesses are in robust health with balance sheets that are in the best shape in decades. Against this backdrop, the cannons of pro-cyclical fiscal policy are firing hard, and more recently, central bankers are dancing to the tune of monetary accommodation.

Financial flexibility: Inflation is good for balance sheets

Past performance is no guarantee of future results. Source: Empirical Research.

Some characterize the US economy as “late cycle” and, thus, point to vulnerabilities. Yet, few traditional warning signs are visible. Consumer net worth is at record highs with greater-than-usual financial flexibility. The typical overextension of spending on durables like housing and autos is hardly apparent. Indeed, recovery here seems more likely than retrenchment as both industries have struggled with supply limitations.

The corporate sector has been bracing for a recession for the past 18 months and outside of the AI boom, there is little evidence that corporates are overextended in terms of capital spending. Recent news on corporate profits is encouraging as it reinforces business resolve to hire and invest. Some of this is the unusual legacy of the pandemic and high inflation: healthy income growth, low levels of credit stress and ample economic liquidity.

There is a common assumption that monetary policy is “tight,” but this is questionable as long as income growth is comfortably ahead of policy and market rates. Housing has been dragged down by higher interest rates, yet this has been offset by the tailwind of fixed capital investment. An inverted yield curve does not have the same forecasting acumen as when the US economy was led by housing as it was for much of the past 30 years.

The Federal Reserve should not be easing monetary policy

If the economy is just fine and monetary policy is not restrictive, should the Fed be reducing policy rates? Many US industries are operating near full capacity, and employment markets are tight. To ease policy amidst a backdrop of economic resilience assumes an unusual confidence that there are no cyclical inflation pressures on the horizon. Is this the obvious time for Chair Powell to refill the punchbowl?

One interpretation is that the Fed is concerned about the size of its balance sheet, which is having an outsized impact on today’s fiscal deficit.1 This implies the unelected bureaucrats at the central bank have a hand over matters that most assume are the remit of voters. The Fed may be aiming for a healthy economy to give it time to shrink its unconventional balance sheet through quantitative tightening.

All of this leads to the same fork in the road: the debate is not the economy, which will be just fine. The real issue is that investors and central bankers are firmly on the side that inflation only trends down from here. Thus, market participants ignore recent data and Powell’s cautionary tale of two-sided risk and choose instead to run with their bias. This is not an outlandish scenario, but it overlooks the equal possibility that inflation gets stuck around today’s levels of 3% plus.

The AI winter

Key parts of the technology world have entered an AI arms race of staggering proportions. To put this in context, the US has spent around $250 billion/annum on data center buildouts over the past five years. Investors anticipate this progressing to $1 trillion/annum by 2027. If correct, this would consume almost all the free cash flow of today’s leading spenders, a small group of mega-caps. Meanwhile, there is no line of sight on the revenues or business models to support this.

Many of the great investment themes of times past can be judged as “good bubbles” in that they benefited the future of society and economic activity. We refer here to the railroad booms, the electrification of modern industries, and of course the internet euphoria of the late 1990s. All of these generated an enormous misallocation of capital because the pace and nature of how these technologies would evolve were unclear. These same uncertainties confront AI.

We are optimistic that AI will lead to a long tailwind of economic growth, but it will take time, and the business cycle has not been suspended. One only needs to look at what is happening in China today where a price war has broken out between the two largest cloud providers, Alibaba and Tencent, to see how quickly consolidation and commoditization can emerge.

CPLIX Positioning

The fund has been highly tactical around key positioning narratives in Q1. This included leaning into several of the AI themes while maintaining a modest level of net equity exposure. In retrospect, the fund’s reduction of market risk was premature but partly offset by strong stock selection in the mega-caps and by the preference for cyclicals versus defensives amidst today’s sustained economic expansion.

We struggle to see financial conditions improving much from current levels, largely because the latest data support our view of core inflation getting stuck near 3%. The phase of global goods price disinflation looks to have ended, while service price inflation remains sticky. We therefore view this positioning balance between limited equity risk and healthy rotation opportunities as appropriate for the coming quarter.

1See my blog post, “Nothing Is Obvious,” January 4, 2024.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

024014h 0424

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.