Watch S&P 500 Overlap When Selecting ESG Fund

If you’re going to commit assets to an ESG fund, we believe, you’ll want your selection to make a differentiated contribution to your client’s portfolio. In our opinion, an actively managed global approach—such as what Calamos Global Sustainable Equities Fund (CGSIX) offers—is the way to go.

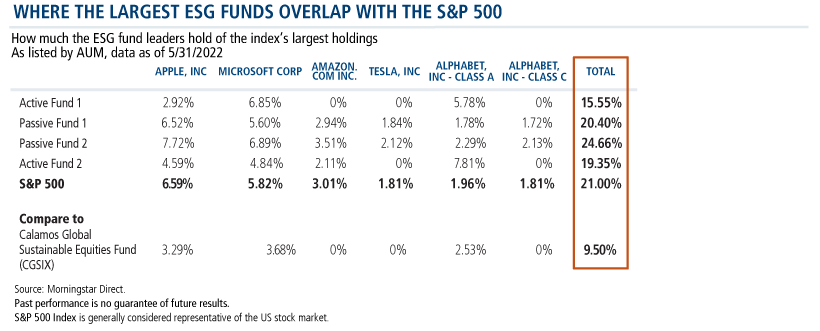

A quick look at the holdings of the four largest ESG funds, on the other hand, reveals that the leading products are more domestically focused, with a concentration in S&P 500 stocks. Such substantial overlap with the US stock index suggests that the funds may not be providing the diversification that you expect. What’s more, notes Jack McAndrew, Calamos Product Manager, if you mainly use ETFs and if you’re also using indexed large cap funds, the overlap will be greater.

Compare the largest funds—whose holdings represent from 16% to almost 27% of S&P 500 holdings—to CGSIX’s 10%. In other words, 90% of the Calamos fund has exposure away from the five largest companies in the index, McAndrew says.

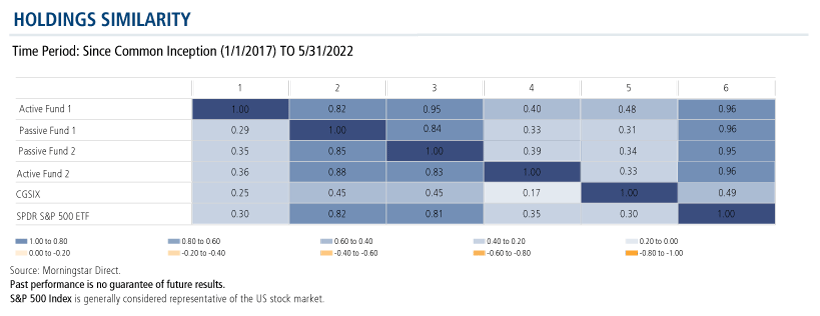

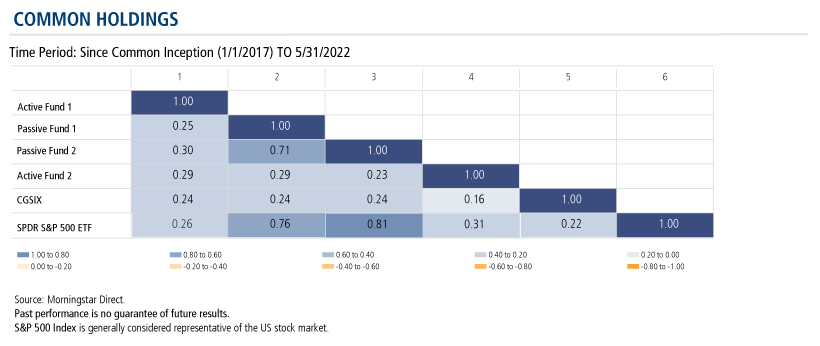

The Correlation Matrix and Common Holdings analysis below provides further analysis. CGSIX, launched in December 2021, is not yet in Morningstar. Our team defines significant overlap as common holdings greater than 40%.

Investment professionals, for more information about CGSIX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

| Company | Industry | Country | % |

|---|---|---|---|

| Microsoft Corp. | Systems Software | United States | 3.9% |

| Apple, Inc. | Technology Hardware, Storage & Peripherals | United States | 3.5% |

| Alphabet, Inc. - Class A | Interactive Media & Services | United States | 2.7% |

| CVS Health Corp. | Health Care Services | United States | 1.9% |

| Sony Group Corp. | Consumer Electronics | Japan | 1.7% |

| Target Corp. | General Merchandise Stores | United States | 1.4% |

| Merck & Company, Inc. | Pharmaceuticals | United States | 1.3% |

| Verizon Communications, Inc. | Integrated Telecommunication Services | United States | 1.3% |

| BCE, Inc. | Integrated Telecommunication Services | Canada | 1.2% |

| Waste Management, Inc. | Environment & Facilities Services | United States | 1.2% |

| Total | 19.9% |

| Company | Industry | Country | % |

|---|---|---|---|

| Microsoft Corp. | Systems Software | United States | 3.6% |

| Apple, Inc. | Technology Hardware, Storage & Peripherals | United States | 3.1% |

| Alphabet, Inc. - Class A | Interactive Media & Services | United States | 2.5% |

| CVS Health Corp. | Health Care Services | United States | 1.8% |

| Thermo Fisher Scientific, Inc. | Life Sciences Tools & Services | United States | 1.5% |

| Sony Group Corp. | Consumer Electronics | Japan | 1.4% |

| Taiwan Semiconductor Mfg (ADR) | Semiconductors | Taiwan | 1.4% |

| Merck & Company, Inc. | Pharmaceuticals | United States | 1.2% |

| Verizon Communications, Inc. | Integrated Telecommunication Services | United States | 1.2% |

| Target Corp. | General Merchandise Stores | United States | 1.2% |

| Total | 18.9% |

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

810139 522

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on July 20, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.