Three Reasons the Time May Be Ripe for Calamos Global Opportunities Fund

Calamos Global Opportunities Fund (CGCIX)

Morningstar Overall RatingTM Among 338 Global Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 338, 320 and 240 Global Allocation Funds, respectively, for the period ended 6/30/2024.

-

Global exposure makes sense as macro headwinds dissipate.

Inflation pressures are abating: the resolution of supply chain bottlenecks is putting downward pressure on inflation readings, although pressures persist in services and less interest-rate sensitive areas of the global economy. Monetary indicators point to a meaningful drop in inflation in the coming quarters.

The monetary tightening cycle is likely peaking: Although the debate will continue concerning the lagged impacts of tighter monetary conditions and whether to expect a “soft landing” or recession.

-

Global thematic and country-specific fundamental improvements are presenting opportunities.

Relative valuations look attractive across many countries: The US economy continued to grow at a healthy clip with services activity looking quite strong. Europe is a more complex story given monetary tightening, China linkages and war in Ukraine, although lower commodity prices supported activity. Japan received a recent boost from attractive relative valuations, favorable regulatory policy developments, and a broad, sustained reopening. Many emerging market economies are benefitting from geopolitical tensions between China and the US. In China, expect geopolitical and regulatory risks to be countered by additional monetary and fiscal stimulus.

-

The fund’s convertible securities can help mitigate downside volatility.

When a stock price falls, the convertible bond price typically declines only so far: Then its bond-like attributes establish a “floor” providing relative resilience if the underlying stock’s price continues to decline. While convertibles are sensitive to their underlying equities’ price movements, convertible investors—as bondholders—still receive the interest income and the principal repayment that bonds offer. And because they have both debt and equity characteristics, convertibles are historically less sensitive to interest rate fluctuations compared to traditional fixed-rate bonds.

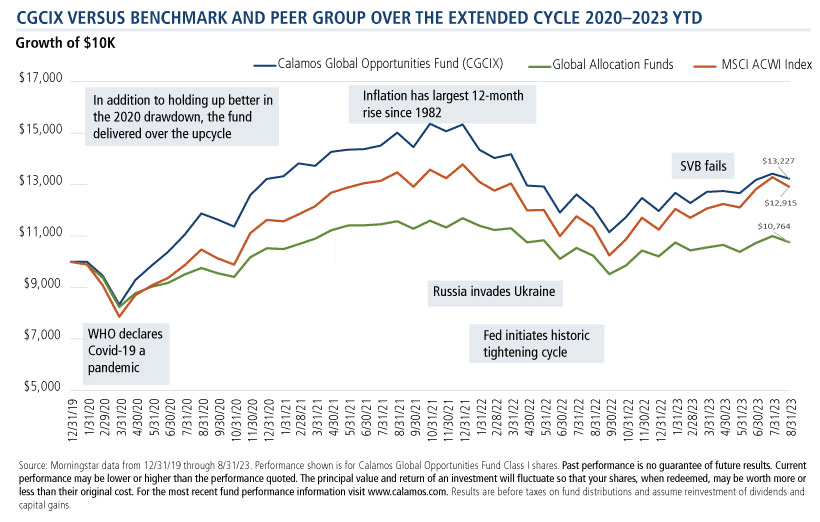

Three Hallmarks of our Investment Approach helped the fund outperform its benchmark and peer group during the recent dramatic cycle

- Manage risk first and returns second.

- As we saw the Covid-19 pandemic looming in the first quarter of 2020, we took multiple steps to de-risk the fund and lower the overall sensitivity to global equities.

- Employ capital structure research across a wide universe of companies.

- The insights our team gained from the reopening of credit markets and strong convertible bond issuance in early April 2020 provided a key signal to re-risk our portfolio and participate in the powerful recovery in global risk assets.

- Uncover cyclical and secular demand trends, using them to the portfolio’s advantage over time.

- During this pivotal period in the global economy, we demonstrated our expertise in harnessing secular themes, as disruptions that typically took years to unfold occurred in a matter of months and touched nearly every industry.

Rigorous research. A wide investment universe. Decades of risk-managed investment expertise. To learn more about the potential benefits of including Calamos Global Opportunities Fund in an asset allocation, please contact your Calamos Investment Consultant at 866.363.9219.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

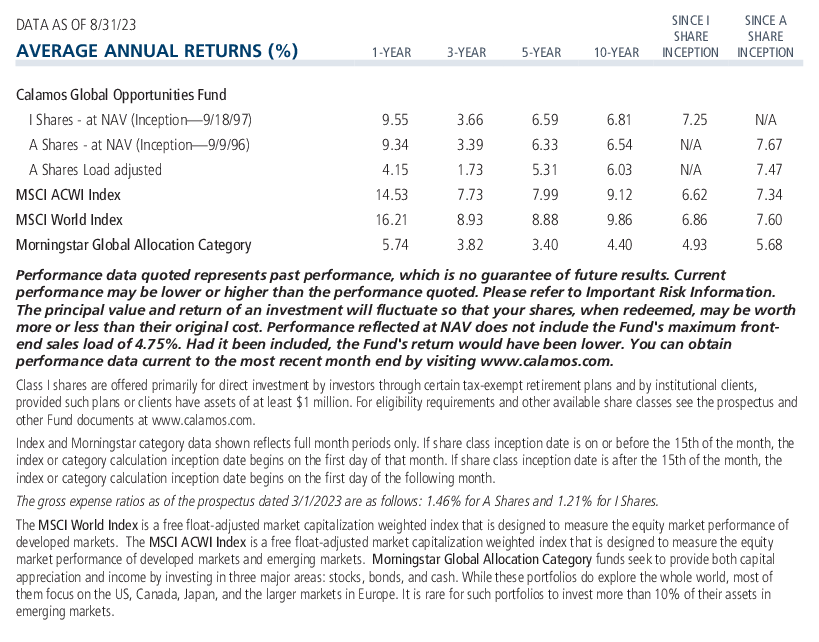

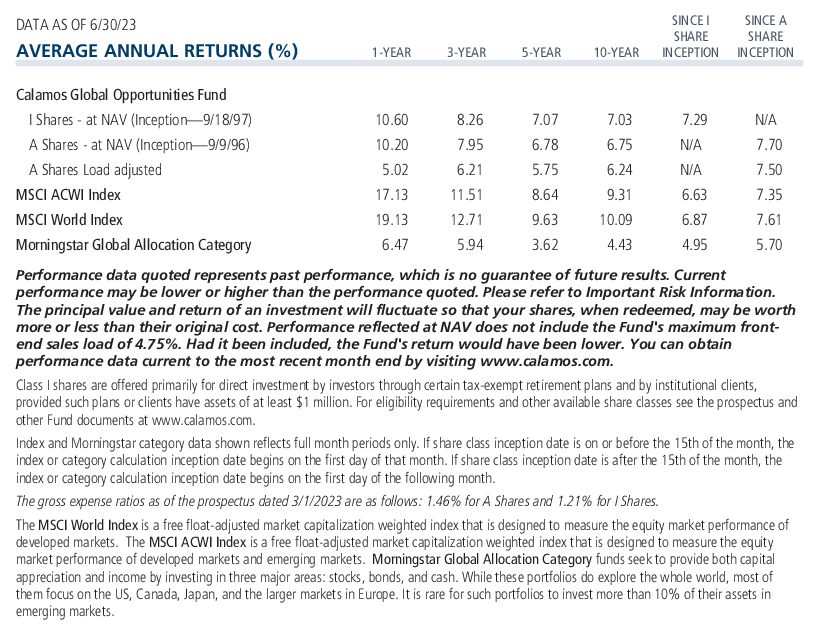

Morningstar RatingsTM are based on risk-adjusted returns and are through 8/31/23 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against US domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2023 Morningstar, Inc.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

822157 0923

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.