The Long and Short of CPLIX—Alpha

For investors with cash on the sidelines or looking to de-risk an equity allocation, Calamos Phineus Long/Short Fund (CPLIX) provides a trusted solution for turbulent markets.

- CPLIX is a strategy rooted in a true hedge fund approach, and in 2022, provided alpha from both its long and short positions.

- CPLIX’s actively managed shorting has enabled it to be more hedged during prominent market drawdowns, thereby garnering alpha relative to long-short competitors over both the short and long term.

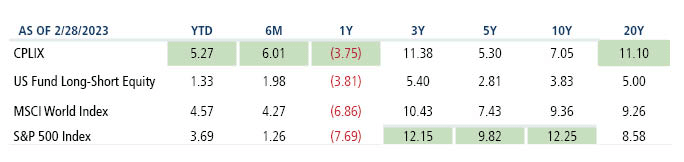

- CPLIX has ranked as the top-performing fund in its Morningstar category over the 20-year period,†outperforming both the S&P 500 and the MSCI World Indices as of February 28, 2023.

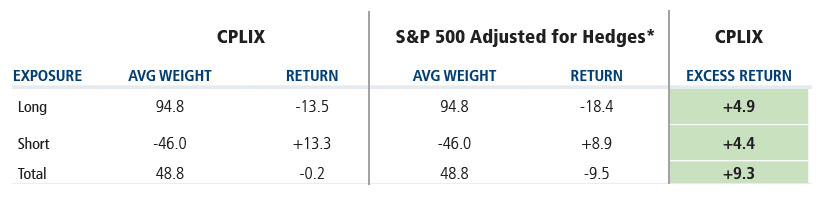

Both Long and Short Positions Contributed to Returns

The fund’s performance in 2022 provided a great illustration of how CPLIX actively manages the portfolio to derive attribution from both long and short positions, offering flat returns in a year when the S&P 500 Index was down almost 20%. The chart below shows how CPLIX generated excess returns in 2022 through both its long and short positions. The S&P 500 Index returns are adjusted for the same net exposure as CPLIX.

2022 Sources of Excess Return (%)

Source: Calamos Investments. Past performance is no guarantee of future results. Estimates are before fees.

*The S&P 500 Index returns are adjusted for the actual long and short exposures of CPLIX, thereby highlighting what the CPLIX returns would have been without the benefit of alpha. The difference is the excess return.

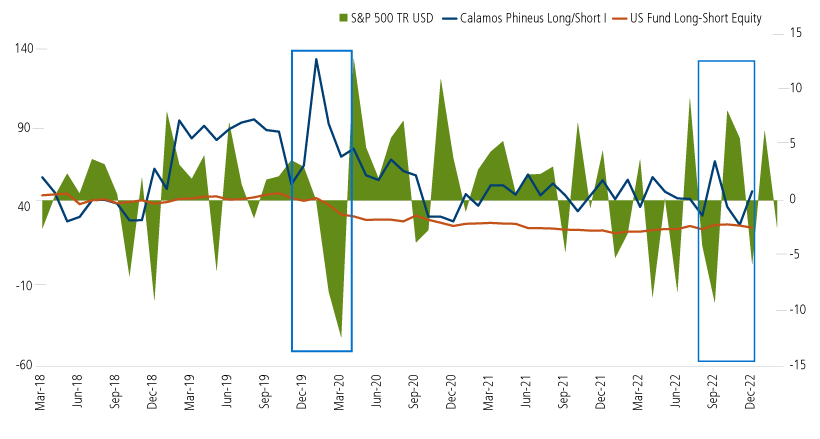

CPLIX Uses Shorts Seeking to Avoid Large Downturns in Volatile Markets

Active management of our shorting has allowed us to be more hedged during prominent market drawdowns and garner alpha relative to our competitors. CPLIX constantly adjusts its overall market exposure, as opposed to many peers who are more “range-bound” in their hedging approaches. This has fostered capital preservation during periods of market stress and high volatility, as was especially the case in 2020 and 2022.

Short Allocation for CPLIX and Long-Short Equity Category Average (%) vs. S&P 500 Monthly Performance (%)

Source: Morningstar Direct as of 12/31/22.

Dynamic Use of Shorts Translates to Performance

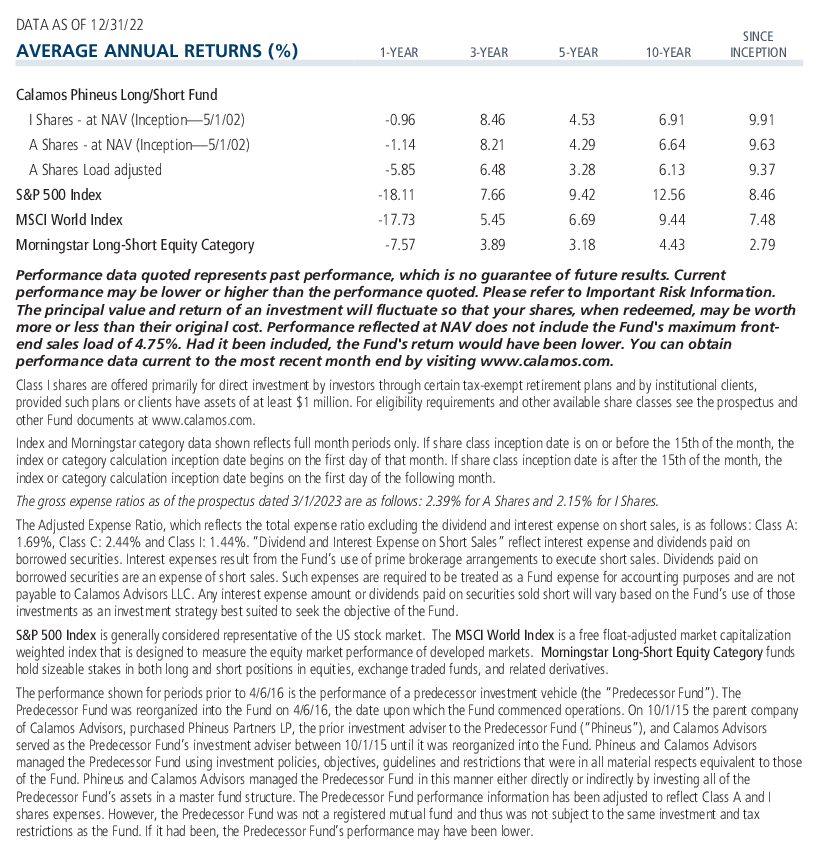

This translates directly to a track record in which CPLIX delivered returns superior to the Long-Short Equity Category over trailing periods going back 10 years. It should be noted that CPLIX’s average exposure has been approximately 28% net long over the 20-year trailing period, and yet it has ranked as the top-performing fund in its category,†outperforming both the S&P 500 and the MSCI World Indices over the period.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

For more information on how CPLIX can help de-risk an equity allocation while pursuing alpha, reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

†Data as of 2/28/23. Morningstar category percentile ranking is based on annualized total return for the 1-year, 3-year, 5-year, 10-year and 20-year periods. Calamos Phineus Long/Short Fund Class I Shares were in the 52nd, 16th, 22nd, 14th and 1st percentiles of 197, 180, 170, 79 and 16 funds for the 1-year, 3-year, 5-year, 10-year and 20-year periods, respectively, for the Morningstar Long-Short Equity Category.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Unmanaged index returns, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Alpha is a measurement of performance on a risk-adjusted basis. A positive alpha shows that performance of a portfolio was higher than expected given the risk. A negative alpha shows that the performance was less than expected given the risk.

821035 0323

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 30, 2024Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.