Hillenbrand on CGIIX’s Flexibility in Navigating a Very Different Mid-cycle

“In some ways it is a typical mid-cycle environment; in other ways, it has a very different feel given several major, historic factors,” said John Hillenbrand, Co-CIO, Head of Multi-Asset Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager of Calamos Growth and Income Fund (CGIIX) during his Feb. 23 CIO call (listen to the call in its entirety here).

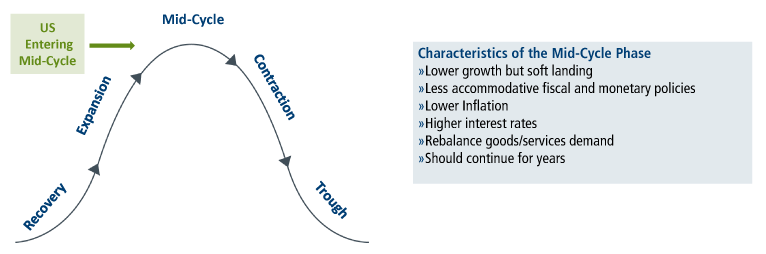

Hillenbrand began his remarks by mapping out macro coordinates. “We believe that we are entering a mid-cycle phase, which can continue for years, by the way.” He went on to explain this determination:

- “We’ve passed from the recovery into the expansion phase where we’ve experienced some strong growth. As we enter mid-cycle, we’ve seen that growth slow.”

- “We’re witnessing a reduction of fiscal and monetary policies, which can be a sign of transitioning to mid-cycle.”

- “We’ve seen a rise in inflation that began during the expansion stage, and generally the economy starts to slow as a result, another sign of mid-cycle.”

- ”Typically, there’s a rebalancing of goods and services during the beginning of the expansion phase, where the demand for goods increases, but as the economy starts to slow, we transition away from goods. We’re seeing this happen.”

Hillenbrand acknowledged that others believe that the end of the cycle is closer and that the slowdown is the beginning of a contraction.

“Why do we not think that we’re at the end of the economic cycle? We would argue a couple of points. Leading economic indicators still look positive. Financial conditions are still very accommodative, and even though they’re slowing, PMIs are still expansionary. The leading indicators that we look at say we have a mid-cycle growth run ahead.”

However, he admitted that this cycle is definitely different from previous mid-cycle phases and expounded on why he thinks this cycle stands out:

- “First, the initial recession in 2020 was driven by a historical healthcare crisis. We think the worst of it is likely behind us, but it could still flare up again.”

- “Second, negative impacts from supply chain issues could persist for a while, and that is a new wrinkle that wasn’t present in other cycles.”

- “Third, areas of the economy are growing at different rates. Some are seeing accelerating growth; some are seeing deceleration. Some are actually confronted by negative numbers.”

- “Fed policy has some new twists. For one thing, we’re starting with the fed funds rate at zero. In addition, the Fed is planning to tighten in what is already a decelerating economy. They are later to the game than prior periods.”

“Overall, we’re confident that we are entering this mid-cycle phase, and it should continue for a while. Consumers are in good shape and should be for some time,” Hillenbrand affirmed.

The Major Challenge of the Day: Inflation

“Inflation at 7% year over year certainly is a shocking number. It only gets that big when it is pressured on both the supply and demand sides,” according to Hillenbrand. “On the supply side, we see inflation in nearly every area whether it be transportation, labor or energy costs. Yes, Covid disruptions are affecting many of these supply inputs, but they are also exacerbated by more demand than we have capacity to meet.” He continued, “This is causing the supply chain to pass on costs, given that they need to be able to reinvest back into their businesses to create more capacity.”

“We also have the demand side to consider due to excess fiscal policy,” he said. “Certainly, the checks that were sent out and the small business accommodations pushed a lot of money into the economy and that pushed demand up above trend. So, the goods economy has been above trend, while other areas on the service side were below trend.” He went on to note, “The good news is supply and demand should normalize through time. That’s what happens in the mid-cycle. More supply comes online and demand starts to wane modestly. We don’t see inflation continuing at 7%.”

What does the Fed have to do with all of this? Hillenbrand offered this answer. “Certainly, interest rates are one of the tools to slow up demand and ease inflation. I believe that the Fed is going to stick with these modest and steady increases through time and they’re going to attempt to be data dependent, seeing how inflation plays out over the next couple of months.”

“If the Fed raises rates too hard and fast, it will be more difficult to avoid overshooting. If we look where we were at with interest rates pre-Covid, around 2018 and 2019, I think we saw curves at the short end around 2.0% to 2.5% and at the longer end 2.5% to 3.0%. I don’t think the curve is going to be that much different, even with today’s economy. I think that’s the environment we’re looking at where the curve is not that steep, but the demand for capital and the demand for Treasuries is such that we keep the long end of the curve from going too high.”

Macro Environment Impacts on CGIIX

“If I start with the premise that we’re in mid-cycle, it probably means more historically typical returns,” he said. “During these transition times, things can certainly get volatile, and that’s what we have been feeling these last few months. With this recent drawdown, many are wondering whether the Fed is acting too late. There are also many ongoing concerns driven by Covid. How many people are going to return to work? What about wage increases?”

What About Ukraine?

Hillenbrand’s view is that Russia/Ukraine conflict will not have a significant impact on the global economy over time.

“As geopolitical events arise, concerns abound about the effects these events could pose for the US. Russia seems to have won the first round because the sanctions that have been leveled by the West are not commensurate with Russia’s actions,” he said.

“Although the West does want to inflict pain on Russia, they don’t want to hurt their own economies,” he said. “The silver lining is that sanctions also shouldn’t impact US growth since we conduct a meager amount of trade with Russia. Europe, whose economies are more intertwined, might feel more pain if the crisis is protracted.

“Although nobody except for Russian leadership wants war and all the suffering that accompanies it, the conflict shouldn’t have a significant impact on the global economy over time.”

“Specific to the fund, starting points matter. What do I mean by that? What do valuations look like today in the asset market? From a sentiment standpoint, things look pretty challenged. We’re seeing some areas of the economy starting to soften in terms of growth. There’s a lot of uncertainty about what the Fed is going to do. We’ve got the Cboe Volatility Index (VIX) at 29.00. Although higher volatility doesn’t feel good, it usually is a good set-up for investment opportunities. In a year or two, many of the risks we worry about today will have played out.”

“Valuations have been more of a rollercoaster these past few years as parts of the market went from fair valued to overvalued and, recently, are making their way back down to fair value,” he said. Hillenbrand explained his team’s approach. “We have an intrinsic value model that shows discounted cash flow models over a 20-year period and these help us ascertain the actual value of businesses. Many growth companies that were expensive a year ago now look more fairly valued. A lot of the cyclical companies that looked cheap a year ago, now look to be fair valued. Another sign that we’re in mid-cycle is that valuations have evened out across the board.”

In terms of macro positioning, Hillenbrand said the team will overweight parts of the economy that show improving revenue and margins. “We think service parts of the economy such as travel, entertainment, medical procedures or loan growth on the service side could see some acceleration and also exercise pricing power to make sure margins go up too. We are also looking at the goods side of the economy but we’re more selective there. That would be autos, energy, or materials, as examples, where we see sustained demand that won’t be pulled down by overconsumption.”

He added, “These are some things we’re trying to do in terms of positioning the portfolio. We’re looking for great businesses at good prices. We’re certainly looking for industry leaders with a high return on capital, more stable cash flows, pricing power, stronger balance sheets, in addition to favorable valuations.”

CGIIX Multi-Asset Class Strategy Offers Advantages in a Volatile Market

Hillenbrand described the fund as “a multi-asset-class, equity-oriented product, which affords tremendous flexibility.”

Calamos Growth and Income Fund (CGIIX)

Morningstar Overall RatingTM Among 302 Moderately Aggressive Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 302, 277 and 228 Moderately Aggressive Allocation Funds, respectively, for the period ended 6/30/2024.

“While a range of asset classes—equities, convertibles, fixed income and options—are available, the team favors equities and equity-sensitive securities for the mid-cycle phase.” He explained, “We don’t think traditional fixed income is the place to be right now. We would rather try to mute volatility through the use of convertible securities. And, we’re also using listed options to reduce volatility in some areas where we would like to capture equity upside. We’ve decided to use S&P puts in the portfolio in order to dampen downside volatility while still capturing upside, as opposed to buying straight bonds.

“On the convertible side, we’re looking for better balance sheet businesses including those in the service economy with improving revenues. In addition, we pursue convertibles with balanced structures that give us access to higher-risk equity in a lower-risk structure. Sometimes we will invest in equity-sensitive names that offer a yield advantage. We also look at lower-delta or more bond-like convertibles to collect more income. That’s a way to keep volatility low in a name that has upside potential. These are a small piece of the portfolio, though we are favoring them right now.”

Investment professionals, for more information on our equity perspective or CGIIX, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The S&P 500 Index is generally considered representative of the US stock market.

The ICE BofA All US Convertibles ex Mandatory Index (VOAO) represents the US convertible market excluding

mandatory convertibles. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

Morningstar Allocation—70% to 85% Equity Category funds seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 70% and 85%.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2022 Morningstar, Inc. All rights reserved.

808671 0222

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

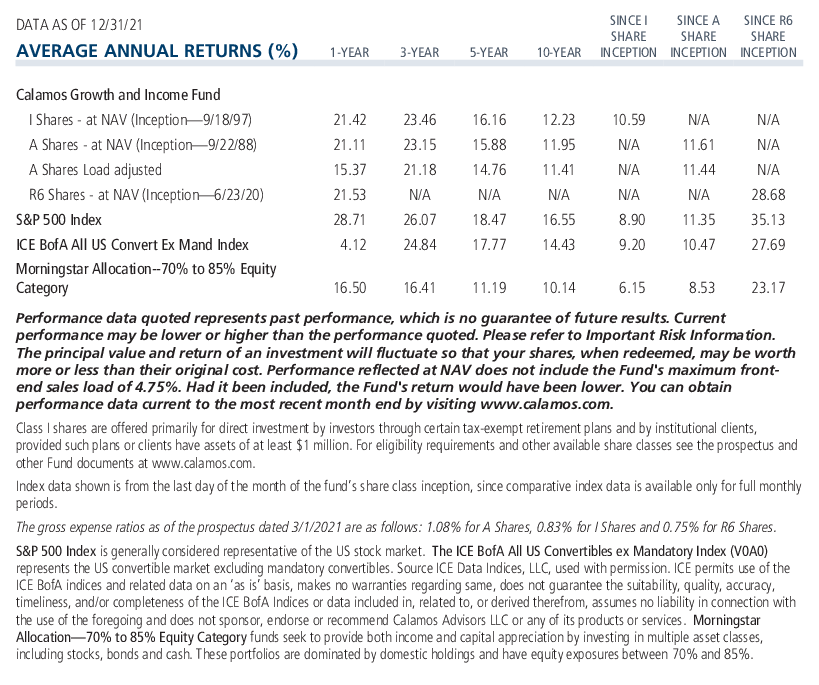

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 01, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.