Could Calamos Convertible Fund Help Reduce Your Retirees’ Worries?

The financial advisor’s retirement planning challenge: Based on current life expectancies, a 65-year-old retiree faces the prospect of needing to fund a retirement period that is likely to last approximately 20 years. How will you—his or her advisor—help secure a source of income that can be relied on for decades?

Most retirement specialists, including Calamos, would argue that exposure to the stock market is essential to provide sufficient growth. Unfortunately, widely varying returns from the stock market can mean widely varying results for investors, depending on when they invest and in what.

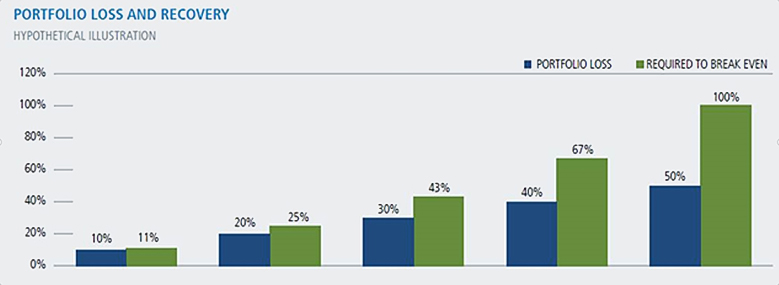

Unlike younger investors, retirees can’t afford the time required to recover from major market drawdowns. As illustrated below, the larger the loss, the larger the subsequent gain that’s needed to recover lost ground and get back to the original value. Losing 10%, for example, is recovered from with a subsequent return of 11%. But a 40% drawdown? That requires a gain of 67% to break even.

For retirees, then, limiting losses can be just as important as maximizing gains. Advisors, consider Calamos Convertible Fund (CICVX) for a strategy that aims to buffer volatility and make returns more consistent—participating in equity market gains while limiting downside. Strategic use of convertible securities has helped the fund preserve capital and position for growth over time.

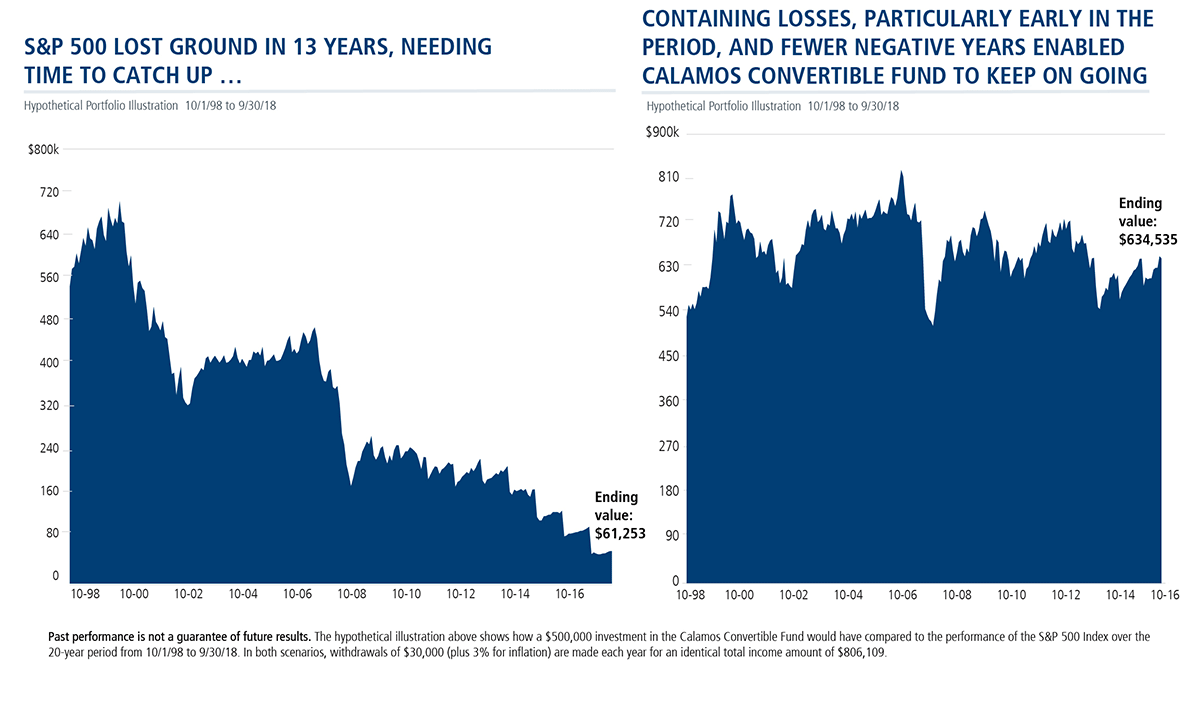

The hypothetical illustration below compares the path of the fund versus the S&P 500 over the last 20 years (10-1-98 to 9-30-18). Over time, the fund's difference was its ability to lose less during drawdowns and experience drops less frequently. Because an investment didn’t fall as steeply (early in the period in particular), the fund preserved more of its value and kept on growing.

The table below shows that the year-end value of the S&P 500 was lower than the previous year in 13 of the years included in the period measured (as opposed to the fund's nine), and the S&P needed time to recover from those losses. Retired investors who may have relied too heavily on equity allocations would have had many anxious moments.

This hypothetical illustration shows how a sum of $500,000 invested in either Class A Shares of the Calamos Convertible Fund or an investment that mirrored the S&P 500 Index would have funded a 20-year retirement. This would have enabled withdrawals starting with $30,000 (adjusted by 3% for inflation each year) for an identical total income amount of $806,109. But look at the difference in the ending values: $634,535 versus $61,253. The fund would have provided enough for retirement well beyond age 85.

Withdrawal Example: Calamos Convertible Fund vs. S&P 500 Index

$500,000 INITIAL INVESTMENT, $30,000 END-OF-YEAR WITHDRAWALS, 3% ANNUAL INFLATION

TOTAL INVESTMENT: $500,000

TOTAL WITHDRAWALS: $806,109

CALAMOS CONVERTIBLE FUND ENDING VALUE: $634,535

S&P 500 INDEX ENDING VALUE: $61,253

| YEAR (10-1-98 to 9-30-18) |

INITIAL INVESTMENT ($) |

END-OF-YEAR WITHDRAWALS ($) |

CONVERTIBLE FUND YEAR-END VALUE ($) |

S&P 500 INDEX YEAR- END VALUE ($) |

|---|---|---|---|---|

| 1998 | 500,000 | 30,000 | 534,154 | 595,301 |

| 1999 | 0 | 30,900 | 690,805 | 689,661 |

| 2000 | 0 | 31,827 | 709,081 | 595,045 |

| 2001 | 0 | 32,782 | 645,966 | 491,537 |

| 2002 | 0 | 33,765 | 582,743 | 349,140 |

| 2003 | 0 | 34,778 | 693,717 | 414,511 |

| 2004 | 0 | 35,821 | 710,221 | 423,797 |

| 2005 | 0 | 36,896 | 693,353 | 407,718 |

| 2006 | 0 | 38,003 | 718,672 | 434,111 |

| 2007 | 0 | 39,143 | 750,143 | 418,818 |

| 2008 | 0 | 40,317 | 515,718 | 223,547 |

| 2009 | 0 | 41,527 | 649,539 | 241,181 |

| 2010 | 0 | 42,773 | 677,147 | 234,738 |

| 2011 | 0 | 44,056 | 606,116 | 195,639 |

| 2012 | 0 | 45,378 | 594,371 | 181,570 |

| 2013 | 0 | 46,739 | 668,676 | 193,639 |

| 2014 | 0 | 48,141 | 653,596 | 172,004 |

| 2015 | 0 | 49,585 | 578,996 | 124,799 |

| 2016 | 0 | 51,073 | 553,369 | 88,652 |

| 2017 | 0 | 52,605 | 580,059 | 55,401 |

| 2018 | 0 | 0 | 634,535 | 61,253 |

Past performance is not a guarantee of future results. The hypothetical illustration above shows how a $500,000 investment in the Calamos Convertible Fund would have compared to the performance of the S&P 500 Index over the 20-year period from 10/1/98 to 9/30/18. In both scenarios, withdrawals of $30,000 (adjusted by 3% for inflation) are made each year for an identical total income amount of $806,109. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

We understand that these results are stunning and, advisors, you’ll want to see the underlying hypotheticals for yourselves. Please contact your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com for more information about the Calamos Convertible Fund, whose I share is CICVX.

Of course, it’s impossible to know what the future will bring, and whether such a discrepancy would recur between our convertible fund and the S&P. This 20-year window shows that dramatically different results are possible, but it by no means guarantees similar performance across other time frames. While the timing and extent of drawdowns will always be impossible to predict, it’s not a stretch to say they can create conditions that warrant a long-term, diversified investment approach.

If nothing else, this illustration can be used to demonstrate—in dollars and cents—the value of protecting against the downside. This is why convertible securities investors are willing to exchange maximum possible upside—and, as this hypothetical historical illustration shows, why it may be to the investor’s benefit over the long term.

Click here to view CICVX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed rate and hybrid ARM pass-throughs), ABS, and CMBS sectors.

The ICE BofAML All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofAML indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

The S&P 500 Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation. It is widely regarded as the standard for measuring U.S. stock-market performance.

The Value Line Convertible Index is an equally weighted index of the largest convertibles. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Morningstar Convertibles Category funds are designed to offer some of the capital appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. To do so, they focus on convertible bonds and convertible preferred stocks. Convertible bonds allow investors to convert the bonds into shares of stock, usually at a preset price. These securities thus act a bit like stocks and a bit like bonds.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

801402 1218R

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end performance information, please CLICK HERE. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on December 17, 2019Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.