‘Experience Will Matter More from Here,’ Says Fixed Income Head Matt Freund

October 5, 2017

What’s ahead for fixed income? We are at the beginning of a long transition as equities as an asset class return to their traditional role in providing capital appreciation to a portfolio and bonds re-assume their role of providing income. This is according to Calamos Co-Chief Investment Officer and Head of Fixed Income Strategies Matt Freund, CFA.

“There’s still plenty of opportunity in fixed income,” Freund adds. “But now it’s less about the sector you’re in and more about the individual opportunities. Experience will matter more from here."

As an example, in high yield in particular, “we don’t need to be in an environment where ‘a rising tide is lifting all boats,’” he says. “There are still opportunities to be had…You just need to know where to look.”

The Calamos fixed-income team has been quietly growing since late last year after Freund joined the firm, having left USAA Investment Management Company where he had served as Chief Investment Officer. Senior level analysts and another portfolio manager have been added.

In a recent Q&A, Freund elaborated on his mandate to extend the Calamos fixed income legacy. He notes John P. Calamos, Sr.’s pioneering use of convertible bonds to enhance returns and manage risk, including deep experience in credit research. Calamos launched one of the first liquid alternative U.S. mutual funds—an income-oriented market neutral strategy (see CMNIX). In 2002, the firm introduced closed-end funds, which invest dynamically across asset classes, including in high yield bonds and convertible bonds.

Opportunities That the Pack May Miss

“I’ve really come to believe that you need a differentiated perspective to outperform. It’s all about thinking outside of the box. I was attracted to Calamos because of its willingness to diverge from the herd and to see opportunities that the pack may miss,” Freund says.

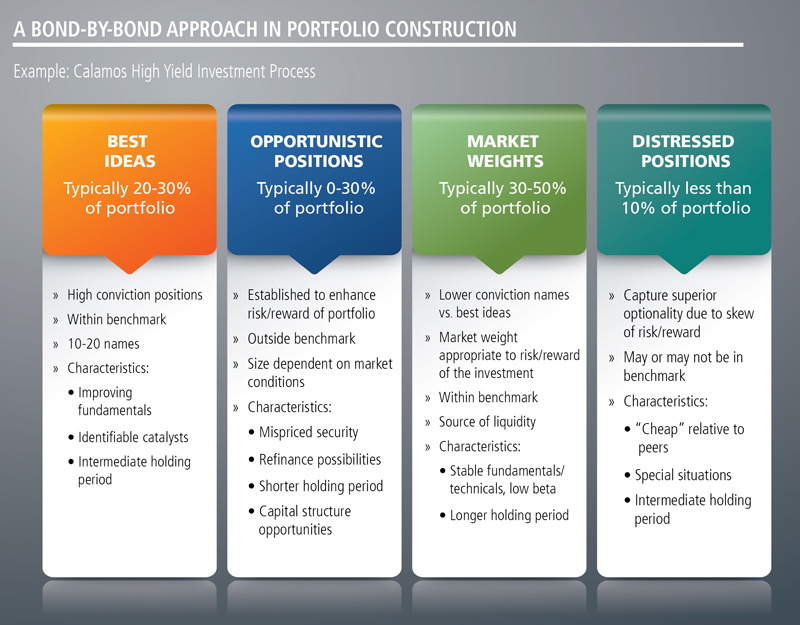

Key to the differentiation is the fixed-income team’s bond-by-bond approach driven by fundamental research. "While we are mindful of macro considerations, we spend the majority of our time focused on individual issues. This is an approach that I’ve used for decades—through credit, economic, market and interest rate cycles,” he says.

Advisors, for more on Calamos Total Return Bond Fund (CTRIX) or Calamos High Income Opportunities Fund (CIHYX), talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is no guarantee of future results. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve their investment objectives. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also have specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund(s)’ prospectus.

Opinions are as of the publication date, subject to change and may not come to pass. Information is for informational purposes only and shouldn’t be considered investment advice. Convertible securities entail interest rate risk and default risk.

The principal risks of investing in the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk, foreign securities risk and liquidity risk.

800819 10/17