Demystifying Calamos’ 100% Downside Protection ETFs

How can Calamos build an ETF with 100% downside protection? Is there a catch?

Since launching Calamos Structured Protection ETFs™, we’ve received multiple questions along these lines from advisors and investors alike. While it may seem too good to be true, one look under the hood of the Structured Protection ETFs can help demystify the ability to deliver 100% downside protection inside the tax-efficient ETF vehicle.

Calamos Structured Protection ETFs are designed to achieve three outcomes:

- Capture upside performance of an index (e.g., S&P 500®) to a defined cap

- Protect 100% of capital against loss

- Deliver results over a one-year outcome period (before fees and expenses)

In short, Structured Protection ETFs allow investors to know their upside potential, their downside protection level, and their investment timeframe, at all times.

Why hasn’t this product existed before?

While Calamos Structured ETFs are new to the marketplace, it is worth noting that the “capital protected” investment structure has existed for several decades, often in the form of bank products, like CDs and structured products, or through equity-linked insurance products. What’s changed? The investment structure and the ETF ecosystem.

Advancements in the ETF ecosystem and Calamos ingenuity has allowed us to construct and deliver these similar outcomes, now inside the transparent, cost-effective, liquid and tax-efficient ETF vehicle. These factors, in combination with current interest rate dynamics, makes this an opportune time to bring Structured Protection ETFs to market.

How does Calamos do it? Structuring 100% protection inside an ETF.

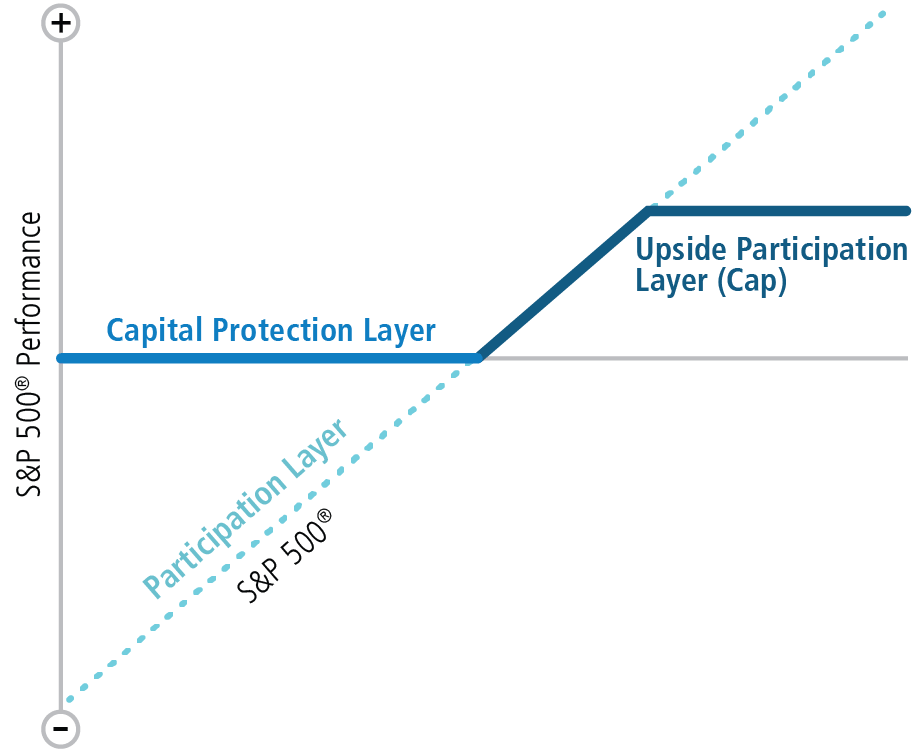

Each Calamos Structured Protection ETF is typically made up of three “layers” of options positions that work together to build the ETF’s respective target outcome. Calamos taps into its four-decades long options expertise in options-based strategies to accomplish this. Each layer is constructed with varying strike prices (the price at which the option purchaser may buy or sell the security), the same expiration date (approximately one-year), and the same style (European style options).

-

The First Layer: Participation

Generates full exposure to price return of an index

For this layer, we’ll use the price return of the S&P 500 as our example. The blue dotted line represents the first layer, which involves purchasing a 1-year near zero-strike call on the S&P 500, meaning options with an exercise price of zero or very close to zero, at a predetermined strike price. This achieves full exposure to the price return of the S&P 500. This is the most expensive layer in the construction process, costing around 98% of portfolio’s value—one of the reasons many option investors choose not to utilize this approach themselves.

-

The Second Layer: Protection

Generates 100% downside protection over the outcome period

The light blue line represents the second layer, which involves purchasing an at-the-money (ATM) put option. An ATM put option occurs when the strike price is very close to the current market price of the underlying security. As a result, if the price return of the S&P 500 is down at the end of the outcome period, the put option will have appreciated by the amount the S&P 500 is down, providing 100% downside protection (before fees and expenses). The cost of this capital protection layer today is around 4% of portfolio value.

Those who have done the arithmetic up to this point will conclude, “I’ve overspent. I started with 100% and spent 102% of my portfolio value! (98% + 4% = 102%)." This is where the third layer comes into play…

-

The Third Layer: Upside Participation

Determines the upside cap

The dark blue line illustrates the third and final upside participation layer, which involves selling an out-of-the-money (OTM) call at a level that will generate the premium needed to bring the portfolio value back to 100%. An OTM call occurs when an option has not reached its strike price. Let’s use 2%, as our example. The strike price of the OTM call ultimately establishes the upside cap.

Said another way, the upside participation layer acts as a credit to the portfolio value, equal to the price that would make the total options package “no-cost” (or fully financed). In this example, the sold call would generate proceeds of 2%, making the total package equal to 100% (98% + 4% - 2%).

Why the ETF structure?

Advances in the ETF ecosystem enabled Calamos to use its four-decades of options investing expertise to construct the 100% downside protected profile. When combined with the several potential benefits gained from the ETF structure, it delivers a compelling value proposition for investors to consider:

- Tax-Efficiency: Calamos Structured Protection ETFs seek tax-deferred growth, and do not anticipate distributing any gains along the way. Investors who hold the ETFs longer than one year are subject to long-term capital gains taxes

(up to 20%). This is more tax-advantageous than other types of 100% downside protection products, which are often subject to ordinary income tax (up to 37%) and may also be subject to phantom income tax along the way. - Liquidity: ETFs are among the most liquid investment vehicles because they are traded throughout the day on an exchange, rather than at the end of the day, or at the discretion of the issuing institution as in the case of structured notes. Additionally, the options underlying the Structured Protection ETFs are derived from some of the largest and most recognized liquidity pools in the world (e.g., S&P 500, Nasdaq 100 and Russell 2000).

- Cost-Efficient: Structured Protection ETFs are cost effective relative to other types of 100% downside protection products, which often have opaque and high upfront fees. The ETF structure provides clear and transparent pricing. All Calamos Structured Protection ETFs have an annual expense ratio of 0.69%, as of the prospectus dated May 1, 2024.

- Increased Transparency: ETFs are by nature transparent vehicles. Investors can always know the holdings of an ETF.

- Accessibility: ETFs do not have investment minimums and are generally easier to trade and incorporate into a portfolio.

- No Counterparty Credit Risk: The options held by the ETFs are centrally cleared by the Options Clearing Corporation (OCC) and are not subject to counterparty risk.

Why learn more about Calamos Structured Protection ETFs?

The planned suite of 12 Structured Protection ETFs enables investors to unlock the growth potential of some of the largest and more recognized benchmarks—S&P 500®, Nasdaq-100®, and Russell 2000® benchmarks—while protecting against 100% of loss over one-year outcome periods. Investors who have predominately used other capital protected structures like money market funds, CDs, short-term bonds, and structured notes, may find that the Calamos Structured Protection ETFs offer a compelling alternative to consider.

Learn more about Calamos Structured Protection ETFs and subscribe to the Weekly Rate Sheet. To speak to your Calamos Investment Consultant contact us at 866-363-9219 or caminfo@calamos.com.

The information in each fund's prospectus and statement of additional information) is not complete and may be changed. We may not sell the securities of any fund until such fund's registration statement filed with the Securities and Exchange Commission is effective. Each fund's prospectus and statement of additional information is not an offer to sell such fund's securities and is not soliciting an offer to buy such fund's securities in any state where the offer or sale is not permitted.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Calamos Investments LLC, referred to herein Calamos is a financial services company offering such services through its subsidiaries: Calamos Advisors LLC, Calamos Wealth Management LLC, Calamos Investments LLP, and Calamos Financial Services LLC.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Investing involves risks. Loss of principal is possible. The Fund(s) face numerous market trading risks, including authorized participation concentration risk, cap change risk, capital protection risk, capped upside risk, cash holdings risk, clearing member default risk, correlation risk, derivatives risk, equity securities risk, investment timing risk, large-capitalization investing risk, liquidity risk, market maker risk, market risk, non-diversification risk, options risk, premium-discount risk, secondary market trading risk, sector risk, tax risk, trading issues risk, underlying ETF risk and valuation risk. For a detailed list of fund risks see the prospectus.

There are no assurances the Fund(s) will be successful in providing the sought-after protection. The outcomes that the Fund(s) seeks to provide may only be realized if you are holding shares on the first day of the outcome period and continue to hold them on the last day of the outcome period, approximately one year. There is no guarantee that the outcomes for an outcome period will be realized or that the Fund(s) will achieve its investment objective. If the outcome period has begun and the underlying ETF has increased in value, any appreciation of the Fund(s) by virtue of increases in the underlying ETF since the commencement of the outcome period will not be protected by the sought-after protection, and an investor could experience losses until the underlying ETF returns to the original price at the commencement of the outcome period. Fund shareholders are subject to an upside return cap (the "Cap") that represents the maximum percentage return an investor can achieve from an investment in the fund(s) for the outcome period, before fees and expenses. If the outcome period has begun and the Fund(s) have increased in value to a level near to the Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one outcome period to the next. The Cap, and the Fund(s) position relative to it, should be considered before investing in the Fund(s). The Fund(s) website, www.calamos.com, provides important Fund information as well as information relating to the potential outcomes of an investment in the Fund(s) on a daily basis.

The Fund(s) are designed to provide point-to-point exposure to the price return of the reference asset via a basket of Flex Options. As a result, the ETFs are not expected to move directly in line with the reference asset during the interim period. Investors purchasing shares after an outcome period has begun may experience very different results than fund's investment objective. Initial outcome periods are approximately 1-year beginning on the fund's inception date. Following the initial outcome period, each subsequent outcome period will begin on the first day of the month the fund was incepted. After the conclusion of an outcome period, another will begin.

FLEX Options Risk The Fund(s) will utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (OCC). In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund(s) could suffer significant losses. Additionally, FLEX Options may be less liquid than standard options. In a less liquid market for the FLEX Options, the Fund(s) may have difficulty closing out certain FLEX Options positions at desired times and prices. The values of FLEX Options do not increase or decrease at the same rate as the reference asset and may vary due to factors other than the price of reference asset. Shares are bought and sold at market price, not net asset value (NAV), and are not individually redeemable from the fund. NAV represents the value of each share's portion of the fund's underlying assets and cash at the end of the trading day. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where fund shares are listed.

100% capital protection is over a one-year period before fees and expenses. All caps are pre-determined.

Nasdaq®, Nasdaq-100®, Nasdaq-100 Index® and Nasdaq-100 Top 30 Hybrid Income Index® are registered trademarks of Nasdaq, Inc.

(which with its affiliates is referred to as the “Corporations”) and are licensed for use by Calamos Advisors LLC. The Fund has not been passed on by

the Corporations as to their legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

Strategy – “Capital Protection” represents the downside protection target equal to 100% of losses (before fees and expenses) of the Underlying ETF, over the Outcome Period. There is no guarantee the Fund will be successful in providing the sought-after downside protection.

Reference Asset – Each Underlying ETF seeks to produce

pre-determined investment outcomes based upon the price performance of an underlying reference asset. S&P 500 is represented by the SPDR® S&P 500® ETF Trust. Nasdaq-100® is represented by the Invesco QQQ Trust, Series 1. Russell 2000® is represented by iShares Russell 2000 ETF (IWM).

Roll Month – Starting month of each Outcome Period.

Cap Rate – Maximum percentage return an investor can achieve from an investment in the Fund if held over the Outcome Period. Cap range depicted is the high and low cap rate over the past 15 trading days. Actual cap delivered by the Fund may be different.

Protection Level – Amount of protection the Fund is designed to achieve over the Days Remaining.

Downside Before Protection – Amount of downside risk the Underlying ETF is exposed to before the capital protection begins. This occurs when the ETF price has appreciated from its starting level.

Outcome Period – The defined length of time over which the outcomes are sought.

Days Remaining – Number of days remaining in the Outcome Period.

Calamos Financial Services LLC, Distributor

© 2024 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

900176 0524

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.