CMNIX: A Compelling Alternative to Fixed Income—Hear the Replay from Co-CIO Eli Pars' Webcast

In his recent webcast, Co-CIO Eli Pars provided a 30-minute primer on how Calamos Market Neutral Income Fund (CMNIX) provides a time-tested diversifier for a fixed income allocation. Historically, it has delivered workhorse performance and done so with less risk.

Pars explains how the fund’s unique structure that utilizes arbitrage strategies (mostly convertible arbitrage) and a hedged equity strategy allows the fund to operate independently of the bond market and its susceptibilities. He elaborates on three market scenarios where the fund has set itself apart from traditional fixed income.

1. The fund has not been at the mercy of interest rate moves like traditional bonds.

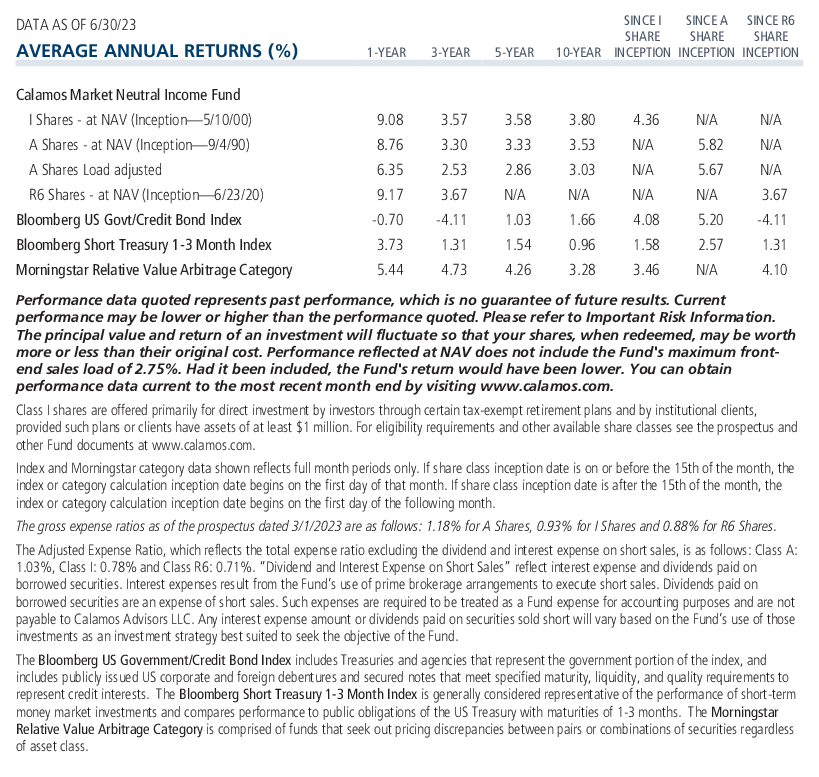

“We’re ahead of the bond market: year to date, 1-year, 3-year, 5-year, 10-year, 20-year,” Pars reports. “We don’t have a lot of interest rate risk or opportunity. We just get results a different way.”

Although the prices of traditional bonds generally get knocked down during a rising interest rate environment, Pars remarks that the fund’s convertible arbitrage strategy may benefit during rising rates from “the rebate we receive on short positions. We short a company stock against its convertible bond to create a neutral hedge. We get paid fed funds minus a fee that adjusts literally overnight when the fed changes rates.”

And higher rates are helping convertible issuance. Pars team believes the pace will accelerate as companies increasingly recognize the benefits of issuing lower-coupon convertibles rather than traditional bonds in an environment of higher interest rates. Issuing a convertible and “lowering your rate by 300 or 400 basis points in exchange for the conversion option is a much more compelling story,” Pars affirms. “We’re also seeing some investment-grade issuance this year.”

Higher rates, of course, also affect the other side of the book in hedged equity. “It’s really just basic options calculations,” Pars explains. “Higher rates mean higher call prices and lower put prices. For a strategy like ours that sells calls and uses some of the money to buy puts, it can generate more income for us—the standstill yield that we get out of the option book allows us to seek better participation rates to the upside and the downside.”

Hear David O’Donohue, SVP and Co-Portfolio Manager, discuss why he believes rising interest rates present opportunities for hedged equity strategies.

2. From a credit perspective, Pars believes the fund’s convertible arbitrage component stacks up better from a risk-management standpoint.

“Last year, the convertible market was 85% non-investment-grade (either below investment grade or not rated at all). Some people would expect that the default experience would be similar to high yield.” Pars remarks, “Actually, convertible defaults are lower than high yield for every year since Barclays has kept records.”

3. The fund has done well in varying volatility environments.

“The VIX and short-dated options seem to be at somewhat low levels,” says Pars. “Real volatility is pretty anemic too.” He explains that the S&P 500 Index is up about 18% year to date, and the equal-weighted S&P 500 Index is up about 5%, with cash up 4%. “So, you’ve seen this grind up in a handful of high-flying stocks that hasn’t really translated into volatility at the index level.”

Pars continues, “We’ve done well in convertible arbitrage this year and some of that is realizing volatility and trading our hedges around. The beauty of convertible arbitrage is you are long volatility. The stock goes up, you sell the stock to get your hedge in balance. The stock goes down, you buy it back, so you’re naturally buying low and selling high. As long as there are no existential credits issues, it’s a good environment.”

Pars concludes by saying that including the fund as part of your fixed income allocation gives investors more opportunities to do interesting things now in this environment than they did two or three years ago.

To find out more on how CMNIX’s active strategy can serve as a foundational component s in a fixed-income allocation, listen to the full replay and Q&A with Eli Pars, CFA, here.

To learn about the fund’s resiliency and consistency through multiple market challenges, see No Matter What: CMNIX.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

822177 0923

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.