Our Funds

Invest for a Brighter Future

Seeking a better way to invest

We invest in high-quality companies that have strong financial metrics and seek to address risks related to governance, ecological impact and human development.

Authentic heritage

The Fund is managed by a team that established and maintains one of the longest running ESG processes in the United States, consistently applied for more than 25 years.

Seeking positive long-term societal and investment returns

We invest in companies that are realizing positive social and environmental benefits across market cycles. Also, SROI is part of a broader partnership that has committed to donating a portion of its profits to charity.

Time-tested Sustainable Investment Experience

- Our team has been at the forefront of sustainable investing since 1997

- Reflecting their commitment to providing a better way to invest and manage risk, our team launched one of the first fossil-fuel-free funds in the United States

- We believe our proprietary research platform gives us a competitive edge by delivering insights above and beyond off-the-shelf ESG research

Beth Williamson

VP, Head of Sustainable Equity Research and Associate Portfolio Manager

19 years of experience

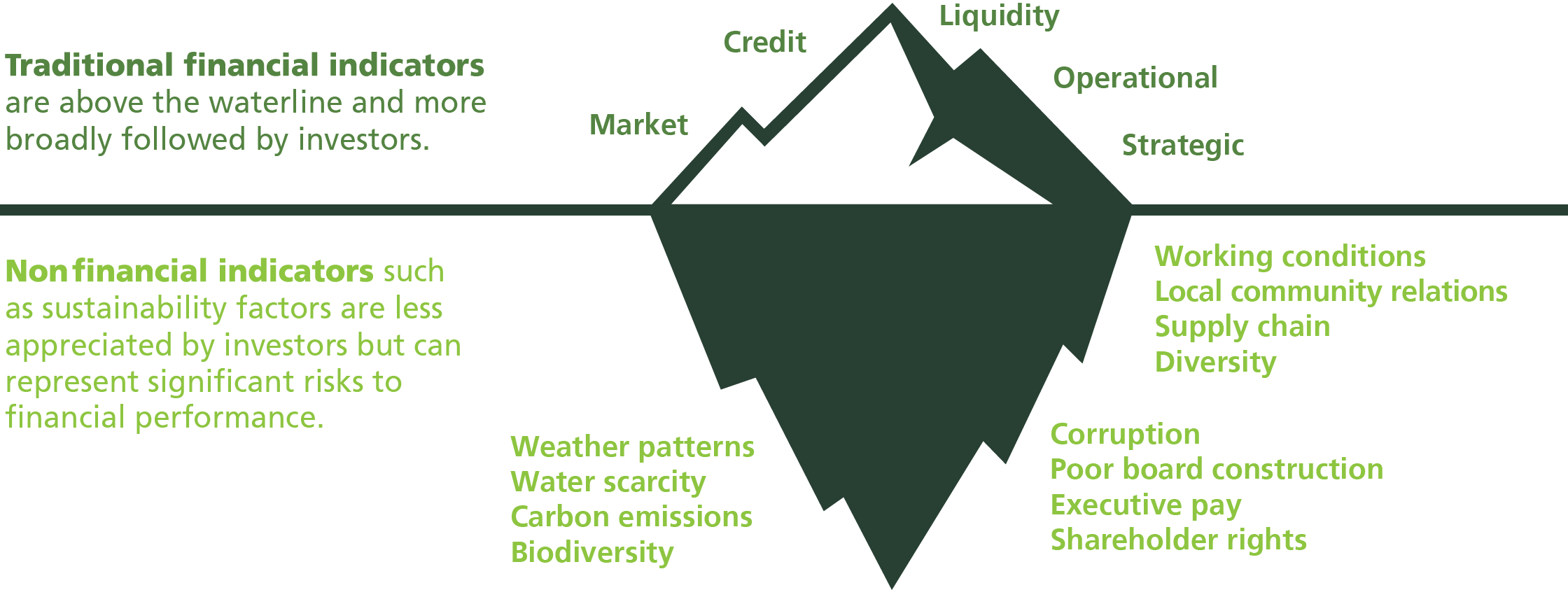

Our Approach Considers Risks Above and Below the “waterline”

SROI's inclusive research dives deep and encompasses traditional financial indicators and less-followed sustainability risks hiding below the waterline. We believe our process provides key advantages for identifying quality companies and avoiding risks that many nonsustainable strategies overlook.

A Joint Partnership

SROI is advised by Calamos Antetokounmpo Asset Management LLC (CGAM), a 50%/50% joint venture between Calamos Investments and Giannis Antetokounmpo. The structure is symbolic of their commitment—two powerhouses joined as one team to deliver positive societal return. The partnership marks the first time an asset manager and professional athlete team together as co-owners.

SROI: Helping to Fund Societal Returns

SROI is part of a broader partnership between Calamos and Antetokounmpo, who together have committed to donating a portion of the partnership’s profits to charity.

How Can You Invest In SROI?

SROI can be purchased through your trusted investment professional or at most online brokerages.

Fund Facts

| Ticker | SROI |

|---|---|

| ETF Structure | Active |

| Exchange | NYSE ARCA |

| Investment Objective | Long-term capital appreciation |

| Investment Strategy | The Fund employs an integrated, fundamental and proprietary sustainable process to evaluate and select what we deem are the highest-quality growth opportunities throughout global developed and emerging markets and across market capitalizations. |

| Portfolio Fit | The Fund can serve as an equity allocation for investors seeking above-average returns with potentially lower volatility from a portfolio of high-quality companies offering enhanced prospects for growth. |

| Expense Ratio | 0.95% as of the prospectus dated 1/27/2023 |

| Benchmark | MSCI ACWI (net) |

Sustainable Equities Capabilities

The shared values between Calamos Investments and Giannis Antetokounmpo forge the foundation for a great partnership. Together, we are creating a sustainable fund and will seek to generate investment and societal returns. Our aim is to inspire, drive greatness, and contribute to a world of well-being and prosperity for all.