Balanced Convertibles Can Offer Asymmetric Risk/Reward

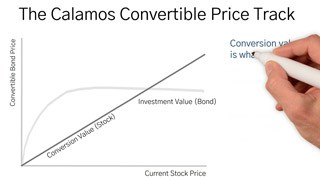

April 16, 2019Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager, provides an overview of the convertibles market, noting “opportunities to give us the asymmetric risk/reward profile that we think is the sweet spot of convertible investing.”

Video recorded 03/21/19.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Active management does not guarantee investment returns or eliminate the risk of loss. It should not be assumed that any securities mentioned in this recording will be profitable or experience equal performance in the future.

© 2019 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

801529 0419

Media Appearances

Active Management Reacts to Changing Risk Profile

April 16, 2019

In a strong equity market, some convertibles can have a high degree of participation, but can also leave clients exposed to downside risk. Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager, explains how active management helps “create a portfolio that has the optimal risk/reward throughout the full market cycles.”

Convertibles Have Provided Equity-Like Returns, Less Volatility

April 16, 2019

Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager, points out that convertibles have historically produced positive total returns during rising rate environments that traditional fixed income has struggled with.

Tapping Tech's Growth Potential While Limiting Downside Risk

April 16, 2019

Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager, observes that technology companies are typically growth companies, often with healthy valuations. An investor in a tech company’s convertible expects to participate in the upside when anticipated growth materializes, while seeking to avoid much of the downside if it does not.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.