Investment Team Voices Home Page

Investment Team Voices Home Page

Yield Opportunities in Convertible Bonds

Key points:

- The double-digit declines in equity and credit markets in 2022 set the stage for compelling opportunities in convertible securities.

- We see attractive yield potential in select convertibles trading below par (“busted” convertibles).

- We expect issuance to pick up and new issues offer many structures favorable to investors, including higher coupons and lower conversion premiums.

How have rising interest rates and recent market conditions affected convertibles? This is a question we’ve been asked a lot lately, and we’ll answer it here as we highlight the current opportunities we see in convertibles, including their yield potential.

In 2022, both equity and credit markets saw double-digit declines. This was an extremely rare event—that hasn’t occurred since 1926. As a convertible bond has both a credit and equity component, the simultaneous pullback in both markets created an environment that caused the convertible market to struggle. However, these unusual conditions set the stage for an attractive forward-looking opportunity.

Opportunity in convertible bonds with yield to maturity

Following 2022’s stock and bond market declines, a significant portion of the convertible market currently trades below par. According to ICE BofA, convertibles trading below par represent 49.7% of the ICE BofA Global Convertible Index as of April 30, 2023. These busted convertibles have an average yield to maturity of 7.2% and a weighted average time to maturity of 3.7 years. With only a short time until their “put at par,” these busted convertibles also have an out-of-the-money call option attached to them, providing over three years on average for the stock to advance towards the embedded convertible option’s strike price and add value.

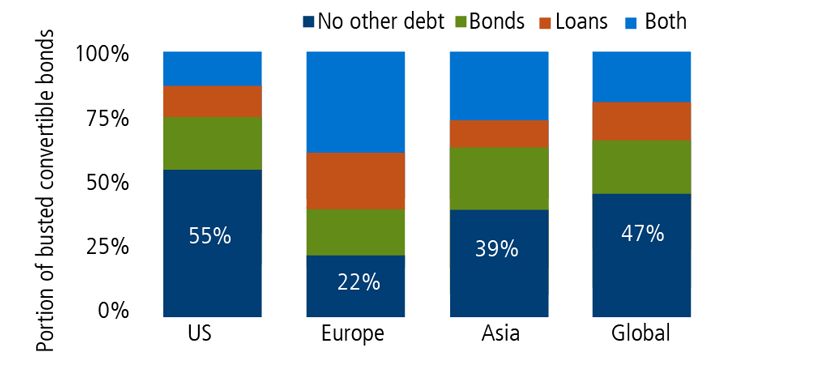

Additionally, as shown in the chart below, for over half of these “busted” convertibles in the US and nearly half globally, convertible debt represented the only debt in their issuers’ capital structure.

Balance sheet summary of global “busted” convertible issuers

Source: ICE BofA Global Research, ICE Data Indices, LLC. Bloomberg, Data as of 11/14/22.

Many busted convertibles don’t have busted balance sheets, but some may be under pressure. We believe active management is essential to assessing the opportunity set in busted convertibles. Although historically convertibles have displayed much lower default rates than traditional corporate high yield bonds, default rates have begun to increase, including in the convertible market. As always, effective portfolio management must consider the attractive yield “to” maturity against the potential backdrop of yield “if” maturity. At Calamos, we employ strenuous proprietary credit analysis to avoid convertibles with a high probability of default. Our process is designed to ensure that investors are adequately compensated for credit risk taken.

Opportunities in new convertible issues

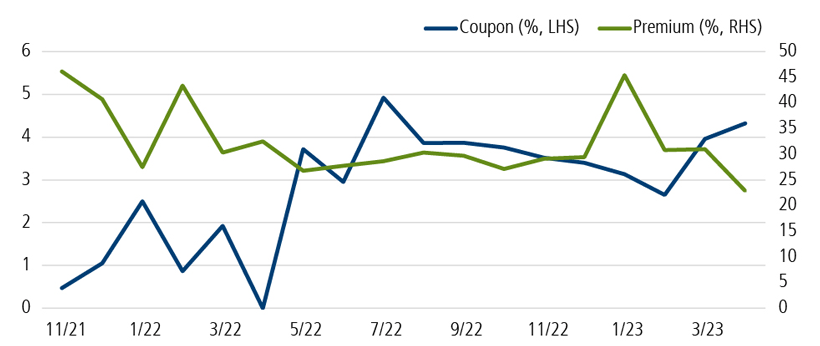

In addition to the opportunities in convertible bonds trading below par, the new higher interest rate environment has led to improved terms in the convertible market. At this time last year, the coupon of a new convertible issue was nearly 0% and the average conversion premium was nearly 35%. This meant that an investor in a new convertible was paid very little or nothing to wait for the underlying stock to appreciate 35% before the conversion option would move into the money. More recently, terms have improved as interest rates have moved higher. The typical coupon on convertibles now exceeds 4% with a conversion premium below 25%.

US convertible issuance trends: Higher coupons, lower premiums

Source: ICE BofA Global Research.

Convertibles are typically issued with an average of five years until maturity, leading to the expectation that roughly 20% of the convertible market matures each year. Although it will take time for the new higher-coupon convertibles to replace the lower-coupon convertibles that preceded them, the current cash yield of the convertible market should rise as new higher-coupon convertibles replace maturing lower-coupon bonds.

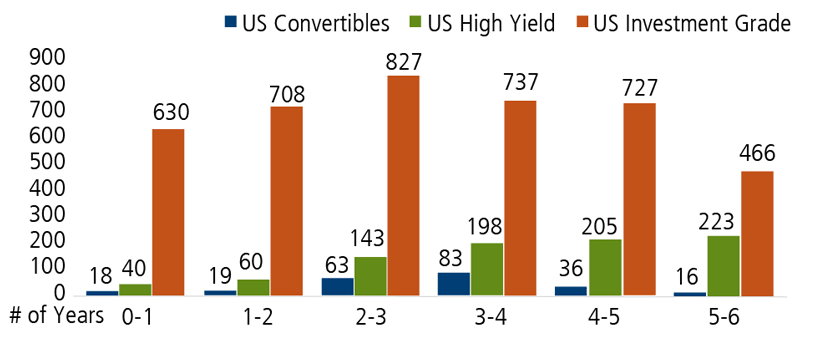

We expect new convertible issuance to accelerate as existing straight (nonconvertible) bonds move closer to reaching maturity. As shown in the chart below, $1.3 trillion in investment-grade straight debt is expected to mature within the next two years. When rates were near zero, investment-grade issuers could issue straight paper at very low rates without needing to include a conversion option to find attractive yield pricing. Today’s higher interest rates will require maturing straight debt to be refinanced at a higher prevailing interest rate. Because a convertible issuer may benefit from issuing a bond with a lower coupon in exchange for including a conversion feature, we expect the higher cost of straight bond refinancing to lead many straight bond issuers to consider convertibles as a means of maintaining a lower cost of capital. Indeed, so far in 2023, we have seen a significant increase in convertibles issued by investment-grade companies. Seven convertible issues worth approximately $7.5 billion have been brought to market, representing nearly one-third of new convertibles issued through April 30, 2023.

The significant maturity wall in corporate credit means issuers will have to return to the capital markets to refinance

Source: Bloomberg, Barclays Research.

Conclusion

We believe the global convertible market offers attractive opportunities for investors. With roughly half of convertible issues consisting of bonds trading below par, their low duration and short time to maturity provide an enticing yield to maturity and also include a conversion option that can rise in value should the convertible issuer’s equity prospects improve. Additionally, the accelerating new issue market with higher coupon yields and lower conversion premiums should also expand the convertible market’s investment opportunity set, which will lead to a higher overall credit quality as well as sector breadth. As investors have viewed traditional straight bonds as more attractive given higher coupons and yields, the convertible market is also deriving similar benefits and should potentially ride higher.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Convertibles entail default risk and interest rate risk.

Moneyness refers to the intrinsic value of an option in its present state. It is a description of a derivative relating the price of its underlying asset to its strike price. A call or put option is out of the money when it is a call option with a strike price that is higher than the market price of the underlying asset, or a put option with a strike price that is lower than the market price of the underlying asset. A call or put option is in the money when it is a call option with a strike price that is lower than the market price of the underlying asset, or a put option with a strike price that is higher than the market price of the underlying asset.

Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

19080 0523

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.