Investment Team Voices Home Page

Investment Team Voices Home Page

Strengthening Tailwinds for High Yield Bonds

Matt Freund, CFA, and Christian Brobst

For investors seeking income, appreciation, or diversification benefits, fixed income strategies are core components of a well-rounded asset allocation. However, just like the stock market, the bond market is diverse—for this reason, it makes more sense to think of it as a “market of bonds” rather than a “bond market.” At any point in time, some areas are more attractive and some areas are less so. For example, many investors recognize that long-dated Treasury bonds represent outsized risk in a low interest rate environment with building inflation pressures. This makes sense to us, given our expectation that the Fed is likely to maintain an extremely accommodative stance and hold short-term interest rates at near-zero for the foreseeable future. In this environment, we expect the yield curve to steepen (long rates to go up more than short rates) and long-dated Treasury bonds to fall in price.

Still, there are attractive opportunities in the market of bonds. In particular, we are optimistic about the high yield market—and believe that the opportunities can be maximized with active, risk-conscious security selection.

-

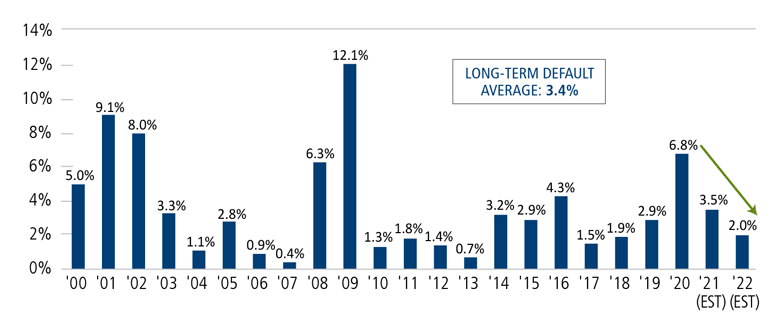

High yield default rates are falling. During 2020, the Fed and the government stepped in with aggressive measures designed to help businesses stay afloat. Given the depth of the economic crisis, it’s understandable that not all companies could endure a protracted solvency phase, which we see in the higher-than-average defaults in 2020. However, with economic activity resuming, defaults are on the downswing, and we expect this to continue against an improving macroeconomic backdrop. As recently as six months ago, we were concerned that defaults could potentially reach all-time highs as a result of the pandemic. However, while we expect defaults to continue to trickle in through 2021, and as the high number of defaults from March, April and May of 2020 roll off, the trailing 12-month default levels should return closer to long-term averages of 3-3.5%.

Figure 1. High yield default rates have likely peaked and are on the way back to longer-term averages

High yield default rate (%), par weighted

Source: J.P. Morgan Default Monitor, February 1, 2021

-

The technical backdrop is supportive. Liquidity conditions continue to provide ample opportunity for high yield issuers to come to market, and we expect ongoing fiscal and monetary support will sustain these conditions for the foreseeable future. Additionally, in 2020, the high yield market grew as investment grade credits saw their credit status downgraded to below-investment-grade ratings. With more companies finding their footing since the height of the crisis, we are seeing significantly less “fallen angel” activity in 2021. In addition, many issuers have improved to the point that upgrades to investment grade might begin in the second half of the year.

-

There are many pockets of value in the high yield market. The high yield market is more idiosyncratic than most—which makes it an excellent hunting ground for an experienced and diligent investment manager. Our high yield approach focuses on bottom-up fundamental security selection and being well compensated for risks undertaken.

The energy sector is one of our favorite hunting grounds right now. The sector was pummeled in 2020 as oil prices collapsed, but to us the environment reminds us of the saying, “don’t throw the baby out with the bathwater.” Our team has found a number of issuers that are misunderstood by the market at large, where we see the potential for good upside compensation. We’re finding a compelling set of bottom-up opportunities in the financials sector, as well.

-

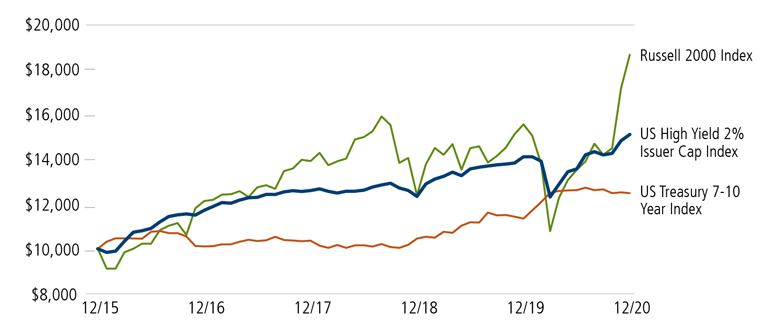

High yield is a hybrid asset class, exhibiting characteristics of high quality bonds and small cap equities. Small cap stocks are capturing a good deal of investor attention following their surging performance in 2020 and into 2021. It’s likely that far fewer investors are aware of the historic similarities in the performance cycle of high yield bonds and small cap stocks. High yield bonds have provided an attractive middle ground between high quality bonds and small cap stocks, as shown below—with less exposure to interest rates than Treasuries and less downside than small caps.

Figure 2. High yield has historically exhibited characteristics of small cap equities and high quality bonds

Growth of $10,000, 5 years ending December 31, 2020

Past performance is no guarantee of future results. Source: Morningstar. High yield and Treasury indexes are Bloomberg Barclays US Corporate High Yield 2% Issuer Cap Index and Bloomberg Barclays Treasury 7-10 Year Index.

Conclusion

We believe there are many reasons to be optimistic about the high yield asset class, as declining defaults, favorable liquidity conditions, and supportive technicals provide powerful tailwinds. However, a bond-by-bond approach is essential for capitalizing on these opportunities. Guided by a focus on being well compensated for the risks we undertake, we are well positioned to identify the most compelling pockets of value in this idiosyncratic asset class.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

High yield securities entail increased credit and liquidity risks compared to investment grade bonds.

Asset allocation and diversification do not guarantee a profit or protect against a loss.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The Russell 2000 Index measures US small cap stock performance. The Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index measures the performance of high yield corporate bonds with a maximum allocation of 2% to any one issuer. The Bloomberg Barclays US Treasury: 7-10 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 7-9.9999 years to maturity.

18872 O321 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.