Investment Team Voices Home Page

Investment Team Voices Home Page

Risk Management Will Matter More in 2024

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

Summary Points:

- We do not believe lower-quality companies will be rewarded to the extent they were over the past decade.

- Looking forward, we expect the market to increasingly reward reasonably valued stocks of high-quality, fundamentally strong growth companies.

- The global focus on sustainability will increasingly drive opportunities for innovative companies across industries and geographies and create risks for those businesses that cannot evolve.

After taking a breather in the third quarter, equities resumed their climb in the fourth to close out the year on a strong note. The powerful rally in the final quarter of the year was propelled by the expectation of interest rate cuts in 2024. Traders bet that central banks will cut interest rates sooner rather than later, with contrarian views centered on the magnitude of the easing and the timing. Ten of the 11 economic sectors within the S&P 500 Index appreciated both in the fourth quarter and for the full year. Generative AI and GLP-1s weight-loss drugs were the dominant themes, and stocks associated with them were among the best performing globally.

The Federal Reserve may be done with rates hikes, but higher rates may not be done with us. The impact of higher rates has only begun to take hold. It can take up to 24 months for a change in interest rates to be fully reflected in the economy. Consumers and businesses are beginning to feel the pinch of higher rates. Whether the US economy and corporate earnings can withstand the lagged effects of monetary tightening next year is unclear. As always, we shall see.

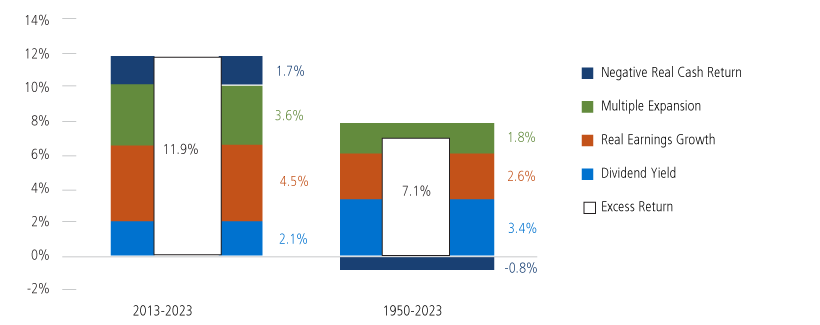

The worst decisions are made during the best of times. We’ve seen a secular bull market over the past decade when investors often made more by dipping further down in quality. Can this continue? The chart below suggests it is unlikely. Cash returns will probably not be negative as they were for the past 10 years, and dividends tend to stay steady. So, if returns are to stay at the current level, it will take even more multiple expansion and even faster earnings growth. Going forward, good risk management is likely to be better compensated than brazen risk taking. Because the past 10 years are unlikely to be repeated, we believe diversification will pay off as investors return their focus to fundamentals and valuations.

US Equity Return Decomposition, January 1, 1950, to June 30, 2023

Past performance is no guarantee of future results. Source: AQR, Robert Shiller’s Data Library, US equities are represented by the S&P 500 Index and cash is represented by 3-month Treasury Bills. All returns are gross of fees.

We position Calamos Antetokounmpo Sustainable Equities Fund (SROIX) to provide a core allocation to quality growth companies that can thrive as the global economy evolves. Even if we cannot predict with certainty how economic and market conditions will unfold in 2024, we believe investors will be best served over the long term by a diversified portfolio of industry leaders with strong operating fundamentals and reasonable valuations. We view this as the optimal formula to attain desirable risk-adjusted returns over time. Accordingly, we are committed to managing SROIX with a time-tested integrated approach that uses traditional financial data and alternative data to make better investment decisions.

Sustainable criteria are one key set of this alternative data. Investors should take the resolution of COP28 as a clear indication of how important sustainability has become and how important it will be going forward. Declarations and pledges by 130 countries to double energy efficiency by 2030 are deliberate and present investment risks for some companies and industries but exciting opportunities for others. SROIX includes a broad array of quality growth companies that are at the forefront of innovation. Regardless of whether countries can meet their Paris Climate goals, we believe companies purposefully moving to become more resource- and energy-efficient in their operations, products, and services are positioned to win.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s)will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo. Giannis Sina Ugo Antetokounmpo is the majority shareholder of Original C, with a 68% ownership interest.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

The Adviser is jointly owned and controlled by Calamos Advisors LLC and, indirectly, by Mr. Antetokounmpo, a well-known professional athlete. Unanticipated events, including, without limitation, death, adverse reputational events or business disputes, could result in Mr. Antetokounmpo no longer being associated or involved with the Adviser. Any such event could adversely impact the Fund and result in shareholders experiencing substantial losses.

024001e 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.