Investment Team Voices Home Page

Investment Team Voices Home Page

Quality for Uncertain Times

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

- As markets adjust to higher rates and assets begin to reprice, downside volatility does not come as a surprise.

- Many companies’ deteriorating corporate earnings only reaffirms our conviction in our portfolio of what we believe are high-quality stocks.

- Despite the political debate over ESG, we believe both sides can agree with our philosophy of analyzing material nonfinancial information in pursuit of superior financial returns.

With bank failures adding another variable to an already complex economic equation, policymakers worldwide continue to walk a tightrope in 2023. Strong equity returns in the early part of Q1 seemed to indicate that investors were convinced, or were convincing themselves, inflation had peaked, interest rates would be coming down sooner than expected, and that corporate earnings would show good growth. The sudden, unexpected wobble of faith in the financial system proved sentiment can change quickly.

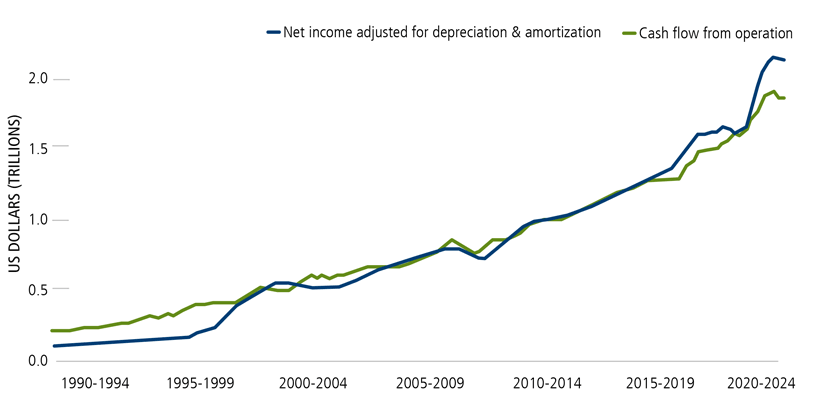

Looking back, the unprecedented liquidity and continued suppression of interest rates since the Great Financial Crisis fueled a boom in many asset classes. As a result, it is not surprising that we are seeing some downside volatility as markets adjust to higher rates and assets begin to reprice. The rest of the year could give rise to more unpleasant surprises based on charts like the one below:

Corporate America’s Earnings Quality Worsens

Source: Bloomberg

The chart shows earnings quality (net income) worsening while the number of firms operating at a loss (cash flow) nears a record high. These conditions bolster our conviction in our high-quality approach—seeking companies that can withstand high inflation, rising rates and slowing growth better than their peers.

Meanwhile, the ESG political debate raged on in Q1 with both sides claiming the moral high ground. However, when cutting through the rhetoric, there is actually little difference between the “Biden Rule” and the “Trump Rule” concerning ESG as highlighted by the Harvard Law School Forum on Corporate Governance:

“Neither final rule singled out ESG investing for favored or disfavored treatment. The final Trump Rule did not use the term ‘ESG.’ The regulatory text of the final Biden Rule refers once to ESG investing, but only to state that ESG factors ‘may’ be ‘relevant to a risk and return analysis,’ depending ‘on the individual facts and circumstances.’ This statement is true for all investment factors, ESG or otherwise.”

It would seem that our philosophy of analyzing material nonfinancial information in pursuit of superior financial returns is something both sides can agree on.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s)will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Antetokounmpo Global Sustainable Equities ETF include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The Fund’s ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund’s exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund— positively or negatively—depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.