Investment Team Voices Home Page

Investment Team Voices Home Page

Luxury Stocks: Once a Cyclical Growth Opportunity, Now a Secular One

Jessica Gerberi, CFA

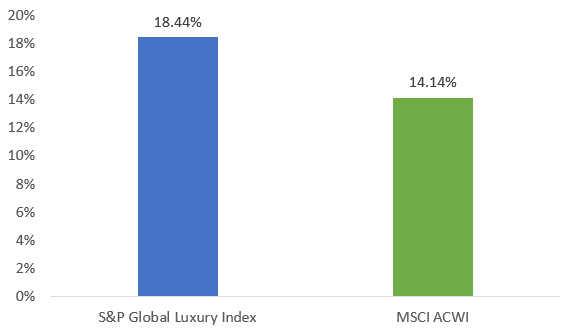

In prior economic cycles, the global luxury industry has shown characteristics of cyclicality. Industry demand tended to ebb and flow with economic conditions and consumer sentiment, similar to other categories of consumer discretionary goods. However, in the past several years, the industry has experienced an unprecedented run, driven by structural growth themes. This has resulted in the S&P Global Luxury Index handily outpacing the MSCI ACWI over the past five years (Figure 1).1

Five years ending January 31, 2021

Past performance is no guarantee of future results. Source: Bloomberg.

Below, we highlight two key themes that have been transformative to the luxury industry during this time. We expect both will continue to shape the industry and support its growth for years to come.

Luxury’s Digital Evolution Is in Full Swing

In the early days of ecommerce, the luxury industry was relatively late to fully embrace selling online, as companies wanted to protect and preserve the high-touch experience and the air of exclusivity and scarcity that can characterize a luxury purchase. From the consumer perspective, luxury buyers may have preferred to see and touch the product in-person prior to purchase, especially given the price premium of luxury goods relative to their more mainstream counterparts.

While we acknowledge the luxury experience can be difficult to replicate online, most luxury brands have come around to embrace ecommerce, albeit to varying degrees. We see this variance both in breadth of merchandise and/or the categories available to purchase on a brand’s own “brand.com” websites. Distribution also varies, with some brands having a greater willingness to work with third-party online distribution partners. Brands’ reluctance to work with third-party distribution stems from, in some cases, a loss of control in how their products are priced, displayed and merchandised online. Further, with most third-party distribution arrangements, the distributor, rather than the brand, owns the relationship with the customer. This understandably is a hurdle for luxury brands where cultivating a relationship directly with their customers is of utmost importance. That said, the customer value proposition of (and web traffic to) these third-party distributors is in some cases too compelling for luxury companies, and us as investors, to ignore.

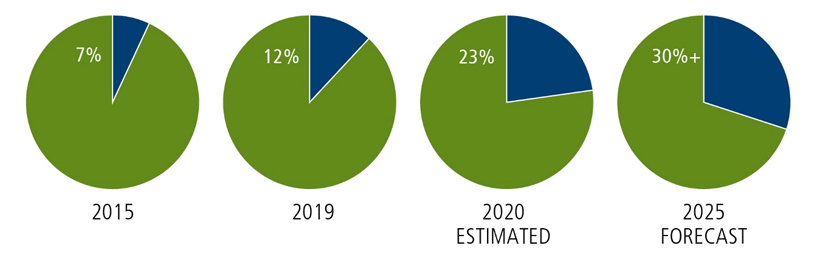

According to a recent study by Bain & Company,2 the total global luxury industry contracted in 2020 due to the pandemic. However, global online luxury sales grew almost 50% (to €49 billion in 2020 from €33 billion in 2019). Online sales penetration rose to 23%, nearly doubling from 12% in 2019. The element of the luxury experience and, in some cases, limited online assortments, may preclude luxury online penetration from ever reaching levels of other consumer discretionary categories like apparel. However, we believe it is absolutely crucial for luxury companies to prioritize and continually improve their digital capabilities as well as offer consumers a holistic, engaging, and seamless experience between online and offline, partnering with select distributors where it makes sense to do so. This was especially apparent during 2020 as online growth helped to offset lost sales from physical store closures. We believe the companies that can most effectively navigate the accelerating momentum and dynamic landscape of digital and online luxury will be well positioned to gain share of the consumer’s wallet.

Source: Infographic: Pandemic Spurs a Transformation of the Luxury Market, Bain & Company.

All Eyes on the Chinese Consumer

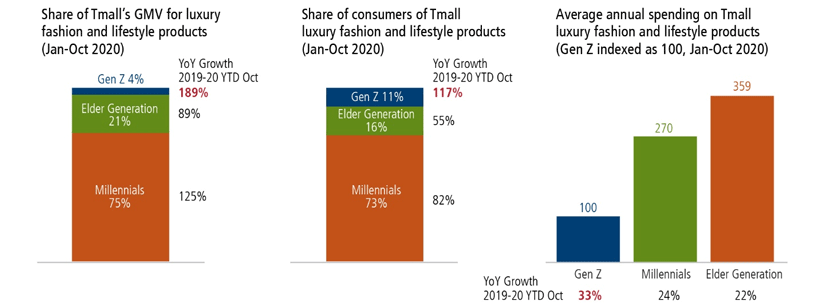

Another immense opportunity for luxury companies lies in their ability to cater to the Chinese consumer, specifically the Chinese millennial. According to a recent study by Bain & Company and Tmall’s Luxury Division,3 millennials represent more than 70% of Tmall’s luxury fashion and lifestyle market, with the younger “Gen Z” cohort following quickly in their footsteps. (Tmall is the most visited B2C online retail website in China.) Another Bain and Altagamma study4 predicts that by 2025, Chinese consumers will account for 50% of the global personal luxury goods industry (up from 35% in 2019) and millennials and Gen Z consumers globally will account for 60% of the industry by 2025 (up from 39% in 2019). Therefore, it is imperative for luxury brands and distributors to effectively cater to the Chinese market. Of course, luxury companies have their work cut out for them in this regard. Not only is China a very large country as measured by population, with 1.4 billion inhabitants, but this consumer base is by no means a monolith. Therefore, brands must have a deep understanding of behaviors and preferences among different cohorts of Chinese consumers as they develop their products, local assortments, physical stores, digital strategies, and marketing campaigns (including influencers with whom they partner)—all the while preserving their own unique brand heritage and DNA. We believe companies and brands that can successfully strike this balance will resonate with the diverse, sophisticated, and discerning Chinese consumer base.

Source: Bain & Company and Tmall Luxury Division, “China’s Unstoppable 2020 Luxury Market.” Using Tmall, Bain analysis.

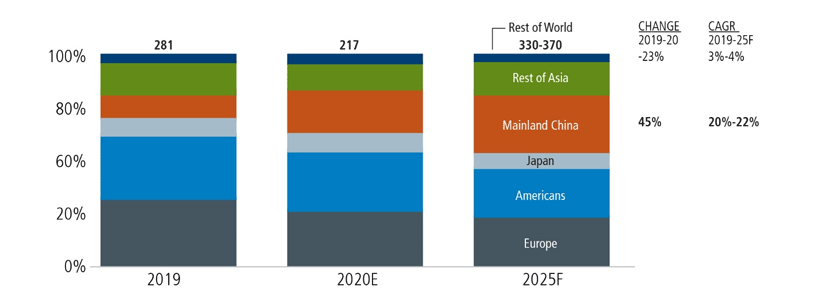

Another dynamic we are closely watching as it relates to the Chinese consumers’ luxury consumption is the change in geographical spending patterns due to the pandemic. During 2020, with the pause in international travel, Chinese consumers repatriated their luxury spending to China at an unprecedented rate as they were no longer able to take international shopping vacations. Although the overall luxury market declined in 2020, including for the Chinese consumer cohort, Bain estimates5 mainland China’s luxury goods market achieved almost 50% growth in 2020, doubling its overall share of global luxury spending to 20% vs. the year prior. We expect this repatriated spending trend to moderate as international travel resumes. However, we do believe mainland China will continue to take share near-term as this resumption of international travel to previous levels could take several years. Further, this trend will be supported by the narrowing price gap between luxury goods in mainland China relative to other geographies, giving consumers less of a financial incentive to buy goods abroad. Finally, the Chinese government’s supportive policies encouraging local spending will continue to underpin domestic spending on luxury.

Regional share of personal luxury goods market (%, € billion)

Source: Bain & Company and Tmall Luxury Division, “China’s Unstoppable 2020 Luxury Market.” Mainland China 2019–20 growth rate 45% is in current exchange rate, sourced to Bain-Altagamma 2020 Worldwide Luxury Market Monitor; Bain analysis.

This has far-reaching implications for both luxury brands as well as for luxury distribution. For the brands, the repatriation trends present new strategic and logistical challenges in terms of having the optimal balance of categories and assortments in their networks of Chinese stores or allocated to their distributor partners. Further, brands must closely monitor the evolution of international travel recovery and adjust inventories accordingly to ensure they have the right volume of goods in the right countries and store locations. On the distribution side, the repatriation trend will fuel growth for online luxury marketplaces that can source products through a global network of brands and sellers. Another area of growth we are seeing is Chinese luxury consumers flocking to Hainan Island, the only duty-free shopping destination considered to be part of mainland China, even though technically, it’s an island. As mentioned above, favorable policies should help to continue driving this growth. The Chinese government has recently taken measures to support growth in the domestic duty-free industry, including granting new licenses and paving the way for more “downtown” duty-free locations for inbound mainland residents. Additionally, according to Bain,6 prices in Hainan for fashion and lifestyle goods can be 10% to 25% cheaper relative to similar goods on the mainland.

In summary, we see the luxury industry as exciting and dynamic with a long runway of growth ahead. While there are many interesting themes supporting this positive outlook, two of the most meaningful to driving industry growth in our view are: (1) the continued digital shift embraced by luxury companies and consumers; and (2) the dynamism of Chinese consumers’ preferences and tastes for luxury brands and the ways in which they want to purchase and consume these goods. We believe luxury companies, brands and distributors that can successfully execute on these themes will present attractive investment opportunities.

1 Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P Global Luxury Index is comprised of 80 of the largest publicly-traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements. The MSCI ACWI Index includes large and mid cap securities across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries*. All securities in the index are classified in the Consumer Discretionary sector as per the Global Industry Classification Standard (GICS®).

2 Bain & Company, “Covid-19 crisis pushes luxury to sharpest fall ever but catalyses industry’s ability to transform,” November 20, 2020

3 Bain & Company and Tmall Luxury Division, “China’s Unstoppable 2020 Luxury Market”

4 Bain & Company, Fondazione Altagamma “Bain & Company Luxury Study 2020 Spring Update”

5,6 Bain & Company and Tmall Luxury Division, “China’s Unstoppable 2020 Luxury Market”

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18868 0221O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.