Investment Team Voices Home Page

Investment Team Voices Home Page

Global Market Update: A Progress Report on the 3 Rs

Todd Speed, CFA

Global markets and investors came into 2022 with a large to-do list. My shorthand was to describe 2022 as the year of the “3 R’s.” Specifically, this year would require a balancing act based on three principal dynamics: the reopening of economies, the recalibration of interest rates, and the revaluation of asset prices.

As we move toward the midyear and in the spirit of the school year ending, it is time to provide a “progress report” on the 3 Rs.

Reopening global economies

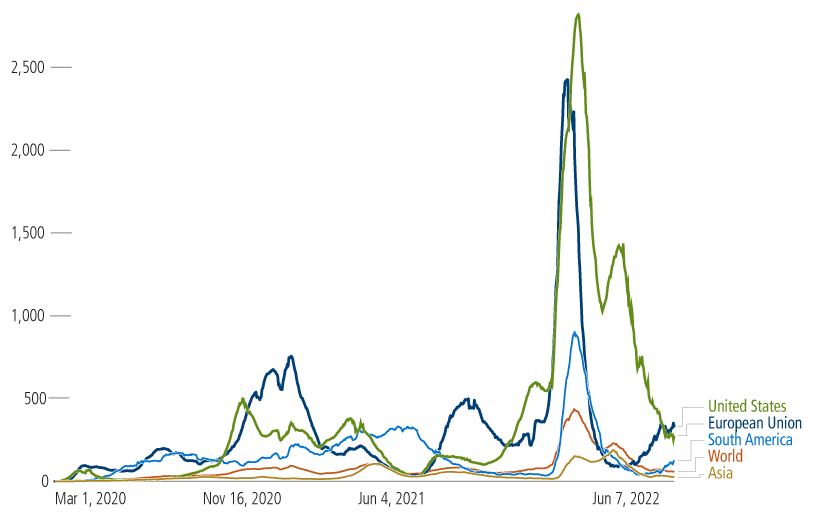

Two-plus years into the pandemic, nobody wants to hear the word Covid anymore. Despite this weariness, the decline in case curves globally and the vigorous reopening of economies remains critical to reigniting global growth.

Progress report. Covid-19 case waves significantly improved in April and May across most global regions. The treatment and outcomes have been far more favorable, supported by the global health care community’s efforts. Most important, China’s strict “zero Covid” approach is adjusting, with some easing in lockdowns over the past couple weeks. Transport ridership is up, port and factory activity are increasing, and consumers can now order a cold brew at Starbucks in Shanghai. Things are getting better not worse.

New Covid-19 cases per million people, 7-day rolling average

Source: Our world in data.org, June 2022*

Recalibrating interest rates

Two years of a pandemic-driven shutdown and stimulus-fueled recovery left us with an enormous global challenge: nearly every good and service costs more and sometimes a lot more. Consumer and producer price inflation in the range of 8% to 10% or more would have seemed nearly unthinkable five years ago. It is now a well-known reality across many economies fueled by a combination of supply-chain disruption, scarcity, and the war in Ukraine.

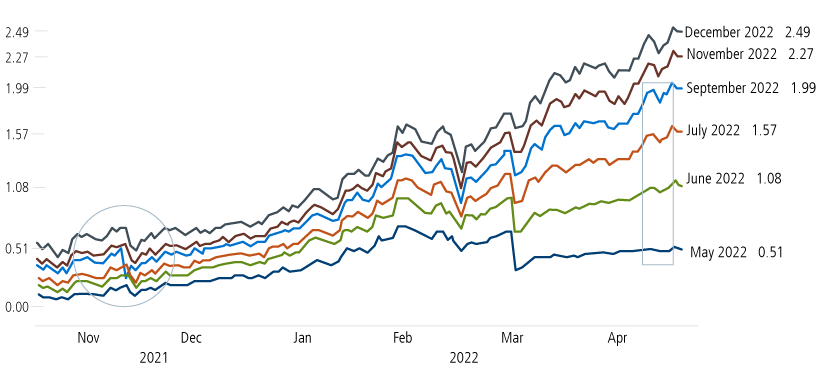

The most pressing single task for this year, and perhaps the most difficult to complete, rests with the Federal Reserve and global central banks—namely, tightening monetary policy and hiking interest rates to stem high inflation pressures and slow demand.

Progress report. The Fed retired the “T-word” on inflation and pivoted to a hawkish stance compared to last fall. So far, the Fed has raised rates a combined 75 basis points, and Chair Powell recently said the Fed needs to see “clear and compelling evidence” that inflation is coming down. Markets expect the Fed to hike rates a half point at the next two meetings, with the European Central Bank also raising rates soon and perhaps exiting zero rates by the third quarter. Recalibrating rates is mechanical but it’s also a behavioral exercise. Global markets sold off 15% to 25% or more this year yet functioned well overall as they digested higher rates and the start of quantitative tightening—and that is impressive progress.

Source: Bloomberg, May 2022.

Revaluating assets

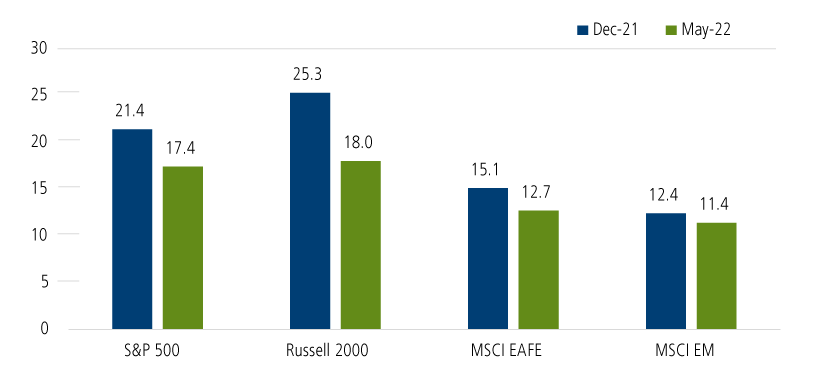

Medicine feels like it is more effective if there’s just a little bad taste. Global markets enjoyed a tremendous rally from the pandemic lows of March 2020; many valuations reached levels well above historic averages; and enthusiasm seemed overdone across a range of public and private assets. Markets needed a bit of bad taste.

Progress report. Revaluation is happening, and it has already been significant. But these transitions take many months to reach their conclusion, and revaluation may have not run its course yet. As shown in Figure 3 below, global equity valuations have declined across regions, with price-to-earnings multiples now closer to the historic average in the United States and even cheaper in foreign developed and emerging markets. As our global team has observed in the past, valuations alone are not a sufficient timing tool for investors, but they can be a key piece of foundation supporting multiyear return opportunities in global stocks. On a forward-looking basis, revaluation means that patient investors are likely in a far better position today than they were in 2019.

Forward P/E multiples (x)

Source: Bloomberg. Past performance is no guarantee of future results. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

Summary

Global markets navigated formidable crosscurrents over the past year—high inflation, supply chain bottlenecks, a hawkish Federal Reserve, and China’s multiple self-inflicted wounds. These known headwinds can become tailwinds as we move through the rest of 2022. Supply chains are normalizing, inflation may have peaked on a year-over-year basis, stock prices and the housing market are reflecting higher rates, and the world is “living with Covid”—going to class, seeing customers and meeting friends for dinner. We may still see volatility spikes and sell-offs ahead, but we have made an awful lot of headway in the 3 Rs and this progress report reflects that.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The S&P 500 Index is considered representative of US large cap stocks; the Russell 2000 Index is considered representative of US small cap stocks; the MSCI EAFE Index measures the performance of developed world equities, excluding US stocks; the MSCI Emerging Markets Index measures the performance of emerging market equities.

*Hannah Ritchie, Edouard Mathieu, Lucas Rodés-Guirao, Cameron Appel, Charlie Giattino, Esteban Ortiz-Ospina, Joe Hasell, Bobbie Macdonald, Diana Beltekian and Max Roser (2020) - "Coronavirus Pandemic (COVID-19)". Published online at OurWorldInData.org. Retrieved from: 'https://ourworldindata.org/coronavirus' [Online Resource]

18966 0622

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.